I know a way to rectify the accumulated sales tax issues and ensure your balance sheet accurately reflects the financial position of your current corporation, @kkress.

Accumulated sales tax can be associated with your previous corporation on your balance sheet due to the following situations:

- Downloaded transactions from the Bank transactions page have been categorized with sales tax linked to the previous corporation.

- During transaction creation, sales tax was associated with the previous corporation.

If you fall under the first scenario, you'll want to Undo the downloaded transaction and recategorize it to associate it with the new corporation.

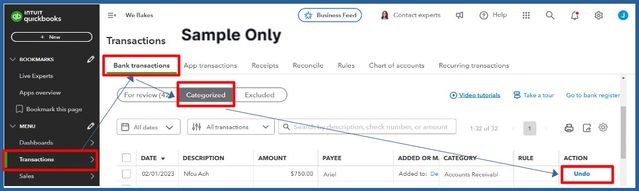

- Navigate to Transactions, then Bank transactions.

- Select the Categorized tab.

- Search for the transaction, then click Undo in the ACTIONS tab.

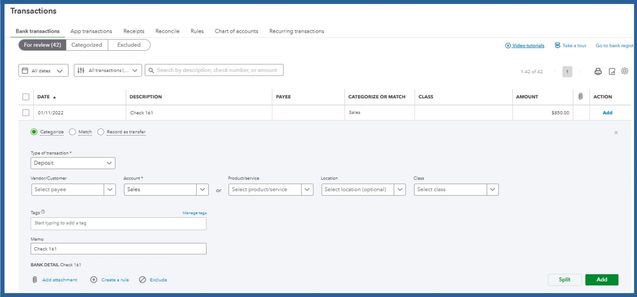

- Go back to the For review tab and click on the transaction.

- In the Account field, categorize it to the current Corp before you Add.

In the second scenario, consider manually editing each transaction to reassess and reassociate the sales tax to the new corporation's settings.

It’s advisable to consult with your accountant to ensure this Journal Entry (JE) is handled correctly and in compliance with accounting standards.

Also, I'll be adding these links to know how the tax rate is calculated and get a detailed look at the taxes you owe in QuickBooks:

It would always be my pleasure to assist you, whether it's regarding sales tax, rates, or any other QuickBooks-related concerns. I'm always here to lend a helping hand. Take care.