To change the check number, @Bethany1000, we'll have to delete the payment and recreate it using the correct details. I'll guide you through the process on how to do it.

There are two ways to change the check number. The first option is to delete the payment from the Payroll tax payments page, then recreate it using the correct check number. The second one is to delete it in the Bank Register, then recreate it. I'll provide the steps below:

In the Payroll tax payments page:

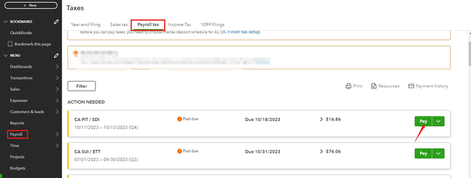

- Select the Payroll menu and proceed to the Payroll tax section.

- On the same page, select Payment history.

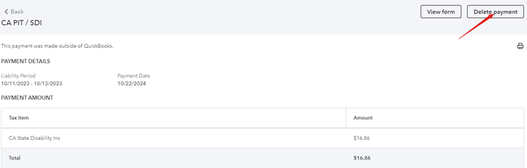

- Locate the payment on the Payroll tax payments page, then click it.

- In the Tax payment details, click Delete payment.

- You'll see a notification asking if you'd like to delete the payment. Just click Yes, delete.

To recreate it, here's how:

- Go back to the Payroll tax page locate the payment.

- Recreate it by clicking Pay.

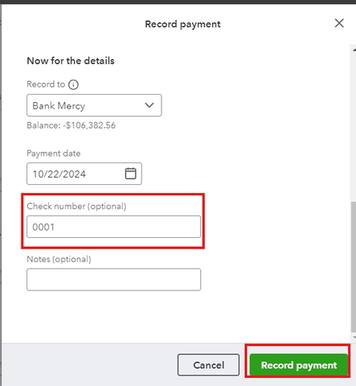

- Edit the check number.

- Once done, select Record payment. Then, Done.

In the Bank Register:

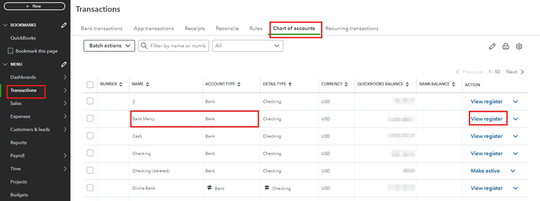

- Go to the Transactions menu and proceed to the Chart of accounts section.

- Select the bank account associated to your quarterly tax payment and click on View register.

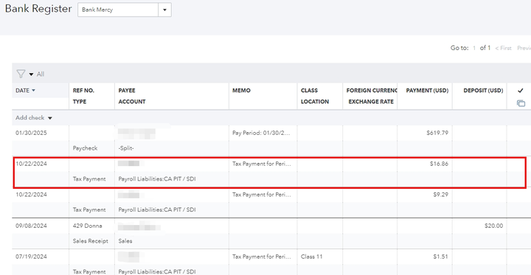

- In the Bank Register, click the transaction and select Edit to view the payment details.

- Click the Delete payment button.

After that, the payment will be reflected under the ACTION NEEDED section on the Payroll tax page. Follow the steps above for recreating the transaction.

Also, I'm including this article to help ensure that your financial records are accurate and up-to-date, preparing you for tax season to avoid penalties: Tips for year-end reconciliation in QuickBooks Online.

Please fill me in if any questions pops up in your head about correcting your quarterly tax payment check number. I'm always here to help. Have a great day!