A housing benefit is part of fringe-type benefits, learnhorse. I can help you generate and add this to your employee's paycheck.

Beforehand, it's essential to know that determining if a benefit is taxable or not would depend on the tax policy of where your business operates. To learn more, please check this link: Employer's Tax Guide to Fringe Benefits.

To start creating and applying a payroll item for the lodging benefit, please refer to the procedures below:

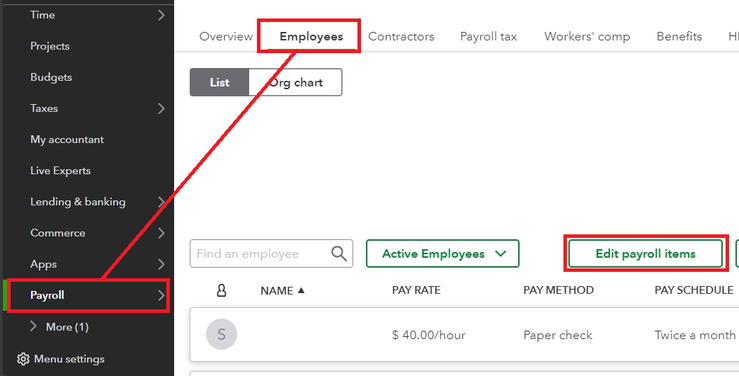

If you're using QuickBooks Online (QBO):

- Go to the Payroll menu, then Employees.

- Click the Edit payroll items button.

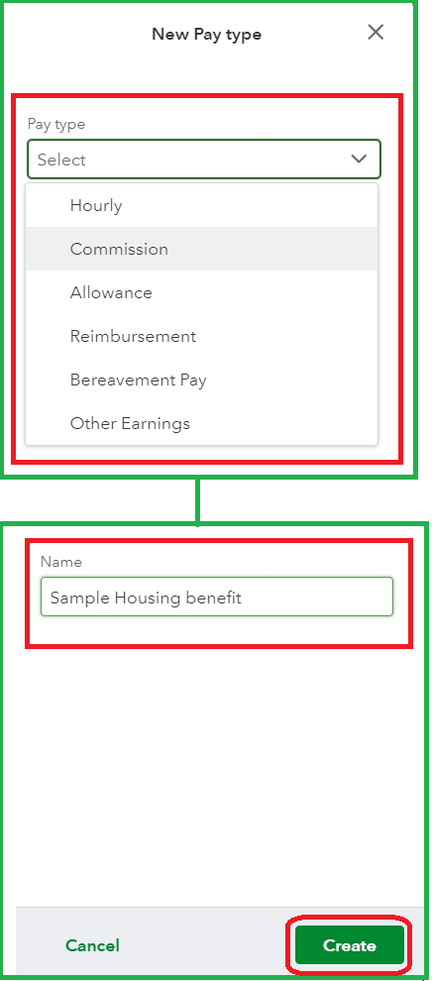

- Select the New payroll item option, then Pay type.

- Choose the accurate Pay type from the dropdown list.

- Enter Housing Benefit or Lodging Benefit as the item's Name. Then, hit Create.

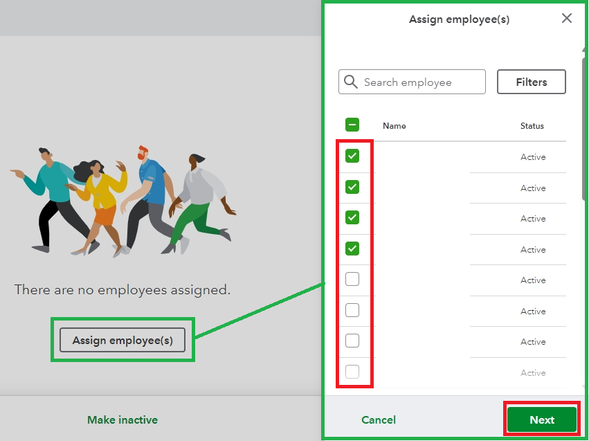

- Tap the Assign employee(s) button and tick the Checkbox for the workers included in this benefit. Then, Next.

- Input the Recurring amount and hit Save.

- Once prompted, hit Done.

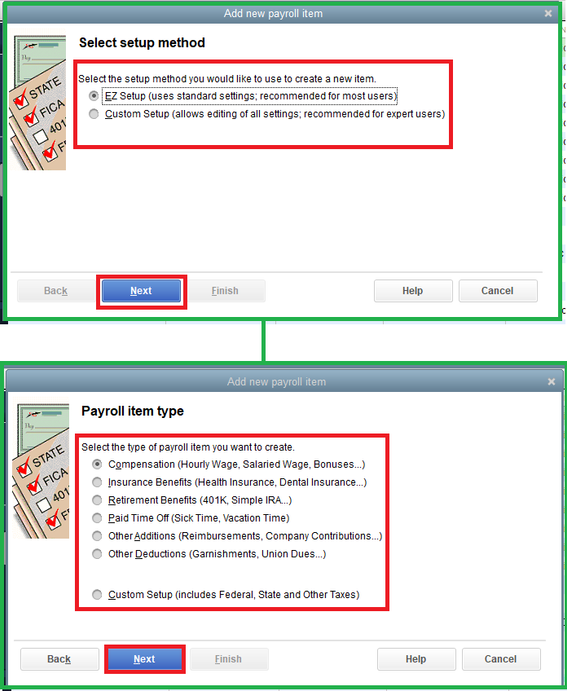

However, if you're using QuickBooks Desktop (QBDT), follow these steps:

- Go to List, then Payroll Item List.

- Click the Payroll Item dropdown from the bottom left corner of the page. Then, select New.

- Select your preferred setup method and then Next.

- Choose the appropriate Payroll item type. Then, Next.

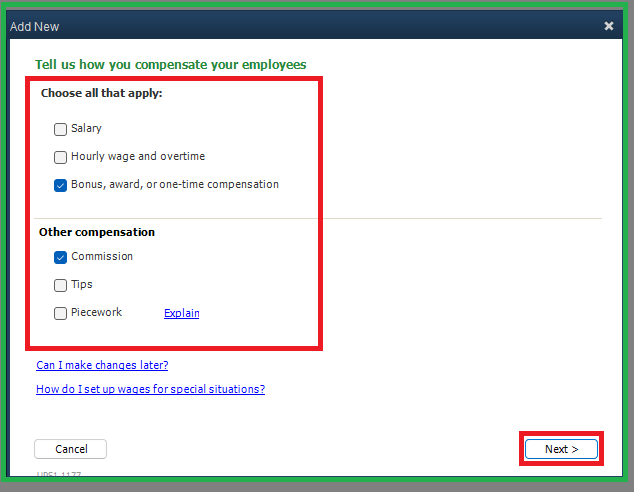

- Pick the option that aligns with how you compensate your employees and then Next >.

- Finish the setup and double-click the previously created item.

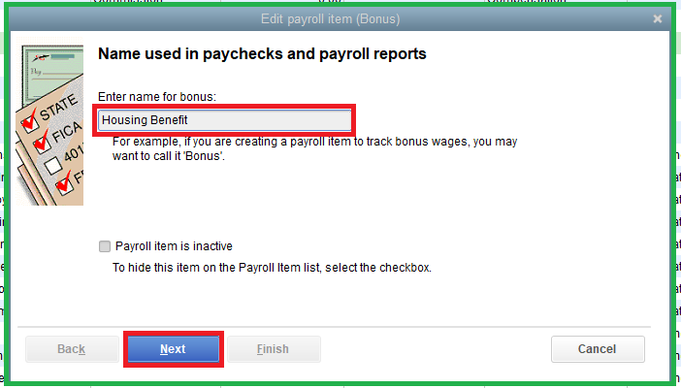

- Enter a name, then Next.

- Continue the item's step.

- Once done, tick Finish.

After that, let's apply the payroll item to your employee(s):

- Go to Employees, then Employee Center.

- Double-click the employee and go to the Payroll Info tab.

- Add the previously created Housing/Lodging Benefit from the Item Name dropdown of the Earnings section.

- Enter the Rate/Amount.

- Once done, hit OK.

For more information on handling housing and other benefits in QuickBooks, you can access this resource: Add fringe benefits to paychecks. I'd also recommend seeking assistance from an accounting professional to ensure the item and its associated transactions are tracked accurately in the program.

I'm also attaching this article to guide you once you're ready to pay your employees: Create and run your payroll.

If you have more questions about managing your employee's benefits, tag me on this thread. I'll ensure to provide speedy assistance.