Hi there, Cheri.

Welcome to the QuickBooks Community page! I see you're facing issues with duplicate payroll checks for two employees, which are affecting their wages and taxes. Let me guide you through the process of reversing this.

Reversing a duplicate direct deposit paycheck must undergo a reversal request since the money has already been sent to your employee. If the duplicate is for a paper check and you haven't paid the employee twice, you can delete it.

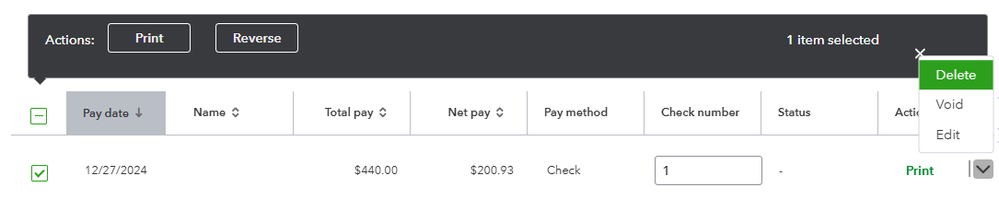

Here's how to delete or void the duplicate paycheck:

- On the left menu, hover to Payroll and select Employees.

- Choose the affected employee's name and navigate to their Paycheck list.

- Locate the duplicate check (the one without a check number) and click the dropdown arrow in the Action column.

- Select Delete or Void, then confirm the action. This will remove the duplicate payment and adjust the tax amounts accordingly.

Afterward, check your payroll totals by going to Reports and running the Payroll Summary report to ensure everything reflects correctly.

If you're using direct deposit, you can also learn how to handle a direct deposit paycheck your employee didn't receive.

Feel free to leave a reply if you have additional concerns with your payroll forms in QuickBooks Online Payroll. I'd be glad to assist you.