Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I’m having a small discrepancy between sales tax due calculated by quick books and sales tax due from my state. Quickbooks is basically saying I owe $3.34 more, however I completely paid the state the right amount. Im trying to make an adjustment to decrease the sales tax by $3.34, but Im not sure which account to select.

Solved! Go to Solution.

Selecting the appropriate account for sales tax adjustment in QuickBooks Online is easy, and I'm here to show you how, @wk249.

When you need to decrease your sales tax due, you'll have to use an income account type for your adjustment. In case you don't have one yet, here's how to set up:

I've attached a screenshot below that shows the last four steps.

After that, you're now set to add an adjustment to your sales tax payment. Please see the screenshot below for your reference.

Also, you can pull up the Sales Tax Liability report. This will help you effectively monitor your sales tax collection and the amount you owe to the tax agencies before filing your returns. To do this, just go to the Sales tax section from the Reports menu's Standard tab.

In case you have other sales tax concerns, just drop your comments below and I'll be glad to help. Take care and stay safe always.

Selecting the appropriate account for sales tax adjustment in QuickBooks Online is easy, and I'm here to show you how, @wk249.

When you need to decrease your sales tax due, you'll have to use an income account type for your adjustment. In case you don't have one yet, here's how to set up:

I've attached a screenshot below that shows the last four steps.

After that, you're now set to add an adjustment to your sales tax payment. Please see the screenshot below for your reference.

Also, you can pull up the Sales Tax Liability report. This will help you effectively monitor your sales tax collection and the amount you owe to the tax agencies before filing your returns. To do this, just go to the Sales tax section from the Reports menu's Standard tab.

In case you have other sales tax concerns, just drop your comments below and I'll be glad to help. Take care and stay safe always.

worked perfectly. thanks.

Where can I find the "add adjustment" to click on to make an adjustment?

It's my pleasure to help you add an adjustment in QuickBooks Online (QBO), @Chicken2024.

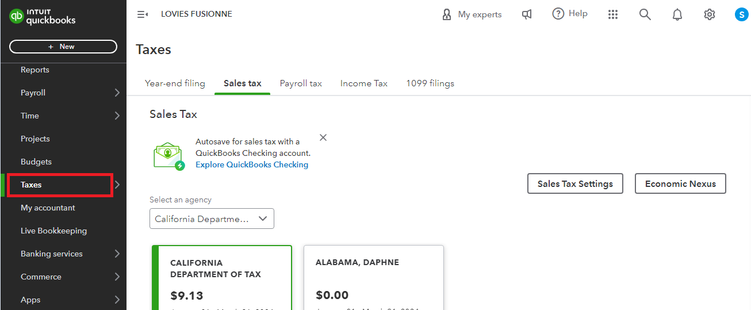

In QBO, the Add an adjustment option can be found in the Taxes menu. I'd be glad to show you how:

4. Under the ACTION column, click View Tax Return.

5. Select Add an adjustment.

6. Choose the reason for the adjustment from the Reason dropdown menu.

7. Add an adjustment date.

8. Pick the account for adjusting sales tax from the Account dropdown menu. Note: (Choose an expense account if you need to increase the tax due. Choose an income account if you need to decrease the tax due).

9. Enter the adjustment amount.

10. Click Add.

Additionally, here's an article that you can browse through for you to be able to track your sales tax accurately: Set up and use automated sales tax in QuickBooks Online (QBO).

Please know that you're always welcome to reach out for further inquiries about managing your sales tax. I'd be glad to assist you 24/7. Stay safe!

There are no options in the reason dropdown. How do I add a reason?

Performing troubleshooting steps can help narrow down the issue of not having a reason in the drop-down when adding a sales tax adjustment, @jdland.

At times, the browser stores frequently accessed data, and unusual behaviors in any online platform, including QuickBooks Online (QBO) can cause a data issue with your browser. Let's access your account using a private browser by following the keyboard shortcut keys below:

If it works, go back to your regular browser and clear its cache to refresh the website's preferences. You can also utilize another supported browser to optimize your QuickBooks experience.

In case you require assistance in filing your sales tax return and recording your sales tax payments, feel free to scan this article for guidance: File your sales tax return and record sales tax payments in QuickBooks Online.

If you've got more concerns about adjusting sales tax, feel free to leave a comment below. We'll keep an eye out for your reply.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here