There are several reasons why your Sales Tax Liability entries increase in unusual value or period, marmathsen. I'm here to discuss them below and provide fixes for this matter.

In Cash-based (Cash Basis) accounting, your sales tax liability should increase only when a payment is received. In this case, let's double-check if you've selected the correct sales tax setup. It could be the factor that causes you to see incorrect data in a given period.

Here's how:

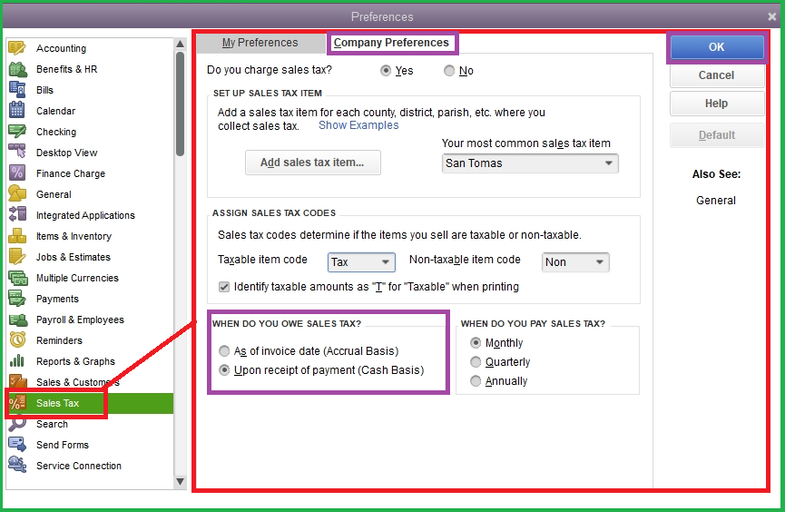

- Go to the Edit menu, then Preferences.

- Hover to the Sales Tax tab, then select Company Preferences.

- From the When Do You Owe Sales Tax section, ensure the Upon receipt of payment (Cash Basis) option is enabled.

- After that, click OK.

On top of that, your customer's information could also affect how your taxes are calculated when creating an invoice for them. That said, make sure you've applied the accurate customer details and tax setup:

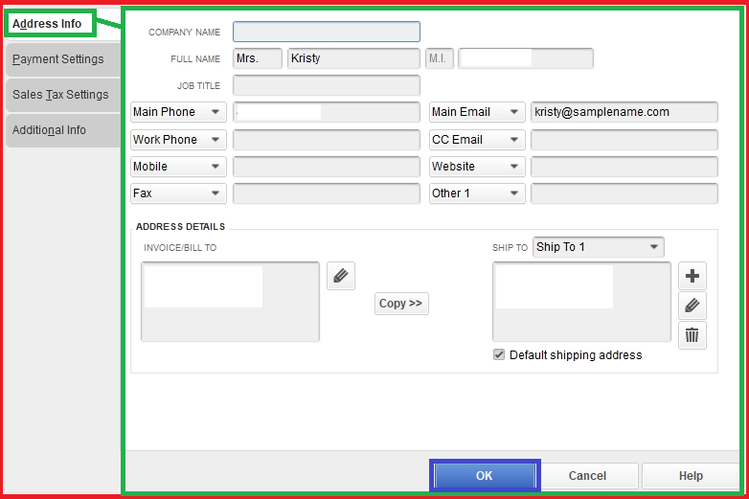

- Go to the Customers menu, then Customer Center.

- Double-click your customer's name from the list (the customer for whom the invoice was generated).

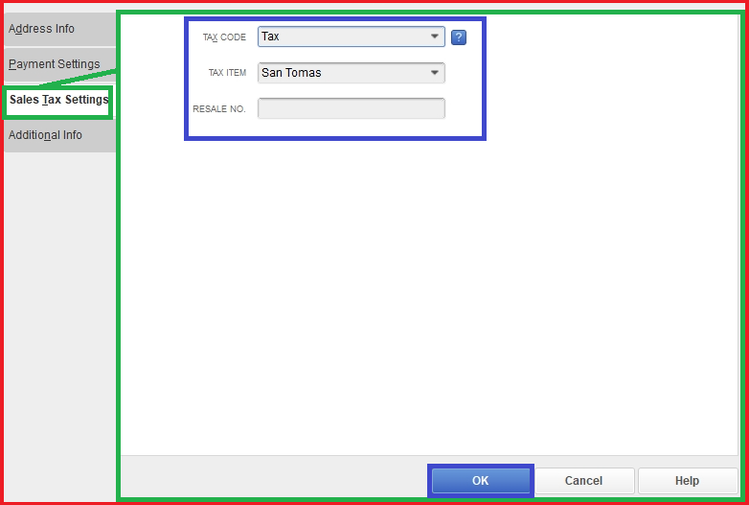

- Ensure that the Address Info and Sales Tax Settings are accurate.

- Once done, hit OK.

After that, I recommend creating a dummy invoice and payment to see if the taxes are showing accurately on the Sales Tax Liability report.

On the other hand, partial payment for completely taxable or non-taxable items or invoices with applied credit could also influence how your tax is shown and dealt with. For a complete reference on managing these scenarios, check out this article: Handle cash basis sales tax.

However, if the issue persists, I recommend Verifying and Rebuilding your data to narrow down the result. The Verify tool locates the issue on a company file, and the Rebuild tool fixes it.

I'm also adding these resources you may find handy when you need to apply for exemptions and refund or manage adjustments to your sales taxes:

Our doors are always open to help you with your taxes in QuickBooks. Just hit the Reply button, and we'll get back to you promptly.