Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

The answer to this question depends on whether you are keeping your books on the cash basis or the accrual basis. If you are using GAAP (generally accepted accounting procedure - which is required for public companies), you are using the accrual basis. Many small private businesses however, do use the cash basis for their books, and federal income tax is calculated on the cash basis. On the accrual basis, you record a liability and an expense when you collect the sales tax from your customers. Quickbooks does this for you when you set up sales tax in Quickbooks Online and record it on invoices, or use the invoice sales tax feature in Quickbooks Desktop. (The accrual basis records expenses when incurred, not when paid: so on your invoice Quickbooks adds this for you: debit expense, credit liability.) Then the liability for the sales tax is reduced when the sales tax is paid. (Debit liability, credit checking.) The expense or check would be recorded as paid from account checking, account paid would be your sales tax liability account. (Example: Accounts Payable - Vendor Department of Revenue).

If you are not recording sales tax on your invoices or sales receipts, then you likely are using the cash basis for sales tax . In this case, the expense would be recorded when the sales tax is paid: Debit sales tax paid expense, credit checking. Quickbooks Online does this for you when you enter an expense the usual way: +, Expense, pay from account checking, down below the account would be the sales tax expense.

There are problems with lprincecpa's answer. In many states and local jurisdictions, what is known as a sales tax is actually a transaction privilege tax levied on the seller . . . the seller is not just collecting an amount from the buyer and then remitting it to the government agency(ies). In these cases, the liability belongs to the seller and the expense is a seller's expense. If the amount is included in the selling price (the amount received), then, for tax purposes, it can also be deducted on the business return.

In these cases, the seller should be recording the tax expense on either the accrual (time of sale) or cash basis (time of payment). QB can be configured for either case based on how the seller keeps its books.

Thank you for this. We are in Hawaii and the tax is a privilege tax that can be written off. However, I don't know how to do this in quickbooks. We are cash basis and our sales receipts add in sales tax which get auto added into liabilities. Right now I can only think of balancing this with a journal entry to debit the bank account and credit the liabilities owed. However, How do I go about adding it as an expense without it throwing off everything? I imagine adding it as an expense is how we deduct it at tax time. Or do I handle this deduction outside of quickbooks?

Hi mauifun,

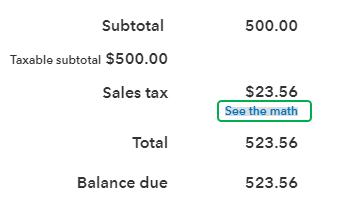

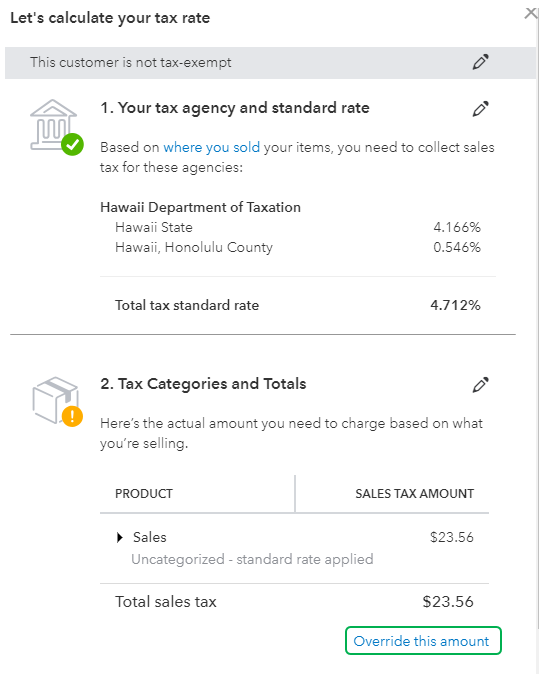

QuickBooks Online (QBO) automatically calculates tax amount based on the state where you have nexus and are registered to collect sales tax, physical address of your business and on the forms, and the product mapping you've associated with the item you're selling.

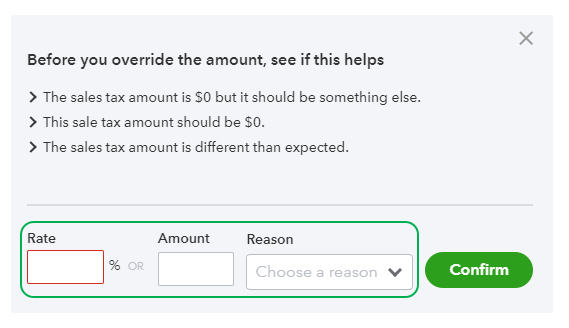

In this case, you can override the sales tax amount on the transaction.

Here's how:

See the Set up and use automated sales tax article for further guidance.

Let me also share this link that will help you in the future: Enter sales tax amount manually.

Please leave a comment below if you have any follow-ups or other questions. I'm here to help. Have a wonderful day.

Aloha, Thank you for the detailed response. I don't think I explained my question correctly. Let me try one more time as I still can't figure out how to match everything using Quickbooks Online.

My sales tax is charged and collecting fine. On my balance sheet the taxes are being added into a liabilities account labeled: "Hawaii Dept of Taxation Payable."

On my banking tab, which I still have to "Match" I show a payment made to the state of Hawaii to pay my Monthly taxes.

My question is,

1. How do I enter this into Quickbooks so that the payment deducts the liabilities owed in the account mentioned above on the balance sheet?

2. Since Hawaii is a privilege tax state I can deduct the taxes paid. How would I also add this as an expense that shows on the P&L?

I found one thread on the internet that mentioned adding the bank item as an expense to a sales tax expense account and then a journal entry to deduct from the liabilities account.

To me this doesn't make sense either because unless they are all matched, QB would essentially be adding this expense twice.

Maybe someone can help clear my confusion up with this. Thank you! Aloha & Mahalo!

I appreciate the complete details about your concern, @mauifun.

There are different scenarios involving sales taxes, and the accounting treatment varies in each scenario. Let me share additional information to ensure you're able to record your sales tax payments accurately.

Also, I'd recommend consulting your accountant so you'll be guided in recording your sales tax payments.

Keep me posted if you have other questions. I'm always here to help.

Thank you Very much for the response. My accountant is busy for a little while and cant assist yet.

I understand what you shared.

I made a payment to the state for sales tax and a it shows in my banking tab. I have a full liabilities account with money owed. How do I reconcile that payment I made so that it withdrawals and reduces the liability account.

Allow me to join the thread and share some ways so you'll be able to reconcile your transactions successfully, @mauifun.

You need to record the sales tax payment manually through the Sales Tax Center in QuickBooks Online (QBO) to reduce your liability account. Once completed, you can then match it to the sales tax payment showing up on the Banking page.

To record a tax payment:

For additional reference about managing sales tax payments, you can check this article: Manage sales tax payments.

To match the payments:

For more insights about downloading, matching, and categorizing your bank transactions, you can read this article: Download, match, and categorize your bank transactions in QuickBooks Online.

After following the steps provided, you'll now be able to reconcile your transaction/s. For the steps, you can follow this article: Reconcile accounts in QuickBooks Online.

You can also check these articles in case you have any other sales tax and banking concerns in the future:

Keep posted if you have any other questions. I'll be right here to help!

Try going into the Taxes tab.

I found I was not processing the sales tax return and payment correctly in QB's since I do the return and payment outside of it.

View your return(s).

Make adjustments if necessary to have the amount match your payment, then click on "File Return".

Once there, choose "File Manually".

At the bottom of that page, you add the payment date, amount, and account. Then process the return.

(I had to back track, pull my files, and do this a couple of times to get current in QB's.)

Now (I hope) QB's will be able to find a match for those funds when they process next time.

As it stands now, the Tax Liability Account shows payments correctly. :)

Of course, I did have to undo and delete the previous payments, that I had put towards the Expense account of "Taxes and Licenses".

Thus, balancing the books.

Hope that makes sense, and it helps!

This information was helpful, thank you. However I do have a question to add onto this. Since the sales tax payment does not show up on the Profit and Loss and I'm assuming there's no way to make it, then I would just need to deduct the sales tax amount from the Net Income to find out my actual profit, correct?

Sales tax is a liability - it is short for sales tax payable, when collected by your business, and paid to a taxing entity. This sales tax money is collected as a debt to the state (usually, or the locality). Debts show up on the balance sheet instead of the profit and loss statement. When it is collected from customers, it is owed to the state. When the business pays the sales tax to the state, it is a payment reducing the debt owed to the state. For tax purposes, this is not treated as taxable income, unless the total money collected is reported on your return, in which case, the sales tax would be deductible. Otherwise, as a general principle, sales tax is neither taxable on the federal return, nor deductible on the federal income tax return. So generally this would NOT show up on the profit and loss statement, but it WOULD show up on the statement of cash flows.

As described above by the Quickbooks team, when sales tax is paid TO another business when you are making a large purchase for your business of a single piece of equipment for instance, that is something that your business will own and use for more than one year, it is an expense to you, and in some cases may be recorded as part of the cost of the asset. (You can also ask your accountant or bookkeeper if you need further explanations about assets).

If you are paying sales tax TO another business for everyday purchases, such as office supplies, for tax purposes this tax can be included in the office supplies expense.

When I charge sales tax on a sales invoice, it posts to sales tax receivable and not the liability account.

How can I correct this?

Hello there, fionahutchinson.

Once you turn on sales tax, QuickBooks creates default taxes to where we post your tax payables and liabilities. I'd like to ask where you see the sales tax posted on a receivable account so I can walk you through the detailed steps on how we can correct it.

Meantime, you 'll want to review the invoices transactions journal to verify if the correct amounts is posted to the correct liability account. Let me show you how:

Once you see the account affected, you can check out your register to see the account and detail type.

Feel free to check out these articles that will help you handle customer transactions and sales taxes:

If there's anything else I can do to help, feel free to post here anytime. Thanks and I hope you have a lovely day.

Aloha Mauifun -

Hope you've gotten an answer elsewhere closer to when you asked the question.

Hawaii's GET is an Excise Tax, not a Sales Tax. Do NOT use the Sales Tax features provided by QuickBooks.

Add an Income/Revenue Account/Category called: GET Collected from Customers, and

also a Product/Service Item for: GET (to be collected from customers) and attach it to the new Income Category.

Add an Expense Account/Category called: GET Expense (to record actual payments to Hawaii Dept of Taxation)

Best wishes

How do I categorize my CA sales tax I paid that's showing in my bank transactions? I use Tax Jar with my website and paid my sales taxes directly through CA's tax website, not through QB. Is Taxes & Licenses the correct category or will that show up as an expense instead of a liability?

SALES TAX FROM INVOICES ARE CREDITED IN OTHER LIABILITIES UNDER SALES TAX PAYABLE BUT THEN WHEN THE BANK STATEMENT SHOWS THE TRANSACTION DEBITED TO DF&A I NOT SURE HOW TO CATEGORIZE IT TO MAKE THE BALANCE OF MY SALES TAX PAYABLE DEBIT IT TO CREATE THE LOWER BALANCE AFTER PAYING IT (QUICKBOOKS ONLINE)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here