Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowCan someone explain why the Sales by Product/Service Summary report insists on flagging non-taxable line items as taxable?

I’m talking about items that have never been taxable. Not once. Not in this lifetime, nor in any prior incarnation. Still, the report merrily includes a taxable amount (and once in a while for flavor, it doesn't) and they are included in the taxable totals while the sales tax amount = $0.

This leads to wildly misleading reporting and makes reconciling actual taxable sales a mess. I have to cross-reference multiple reports just to figure out what’s real—because this one apparently lives in a fantasy world where all things are taxable and logic is optional. Then I have to zero out all the taxable amounts where the item is non-taxable.

Is this a bug? A known issue? A design decision by someone who’s never filed a tax return?

P.S. If you’re on the Sales Tax team: please pass this note along to whoever’s doing QA. Assuming QA exists. If not, blink twice and I’ll send help.

It's completely understandable that you might feel frustrated when items appear as taxable even if they're not supposed to be. Let's work through this together, Katniss, and make sure everything is displayed accurately.

The Sales by Product/Service Summary report shows figures for items regardless of their tax status. By clicking on the amount, you can access detailed transaction data to determine whether it is taxable or not.

See the screenshot below:

Once directed to the specific transaction, you can confirm its tax status. I've added these screenshots for your visual guide:

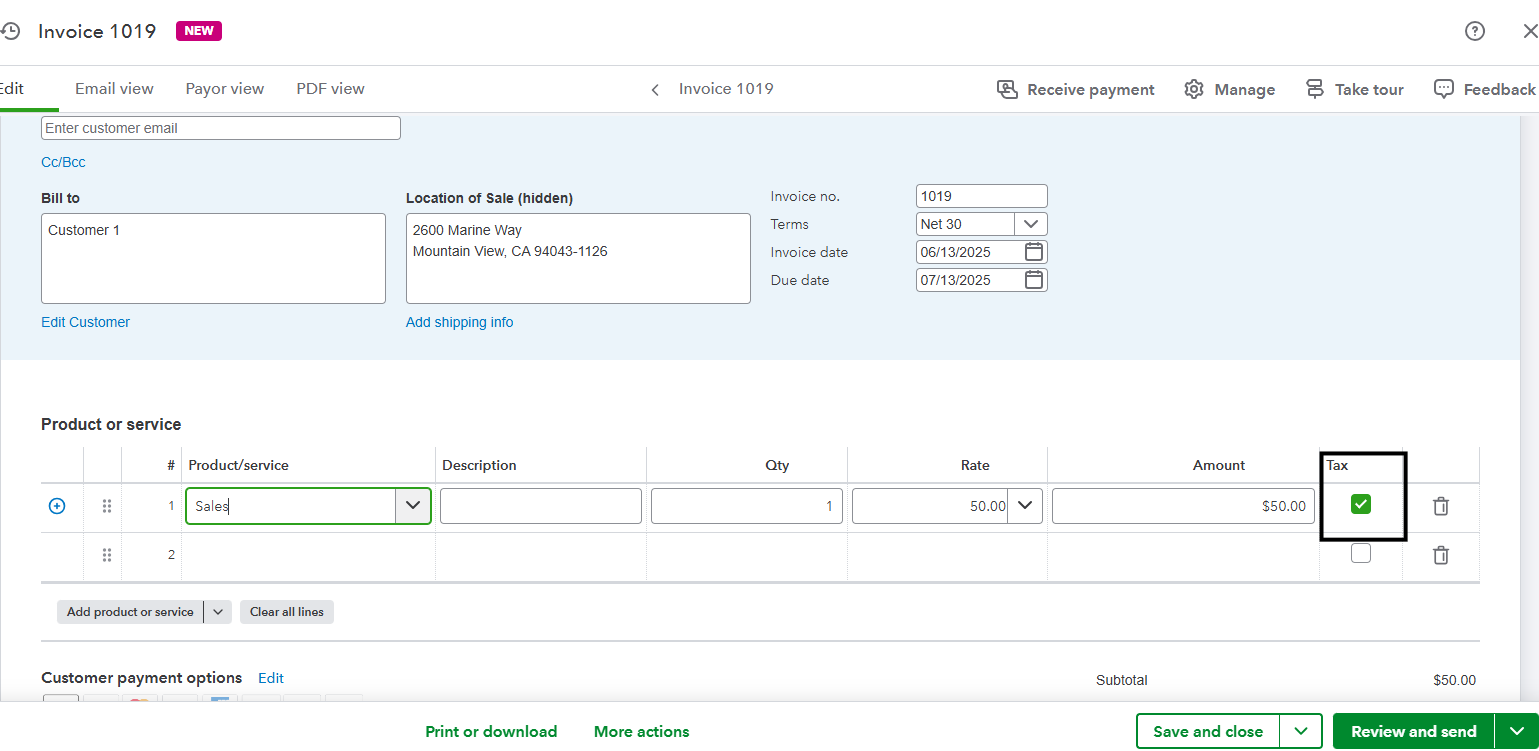

Item that are taxable:

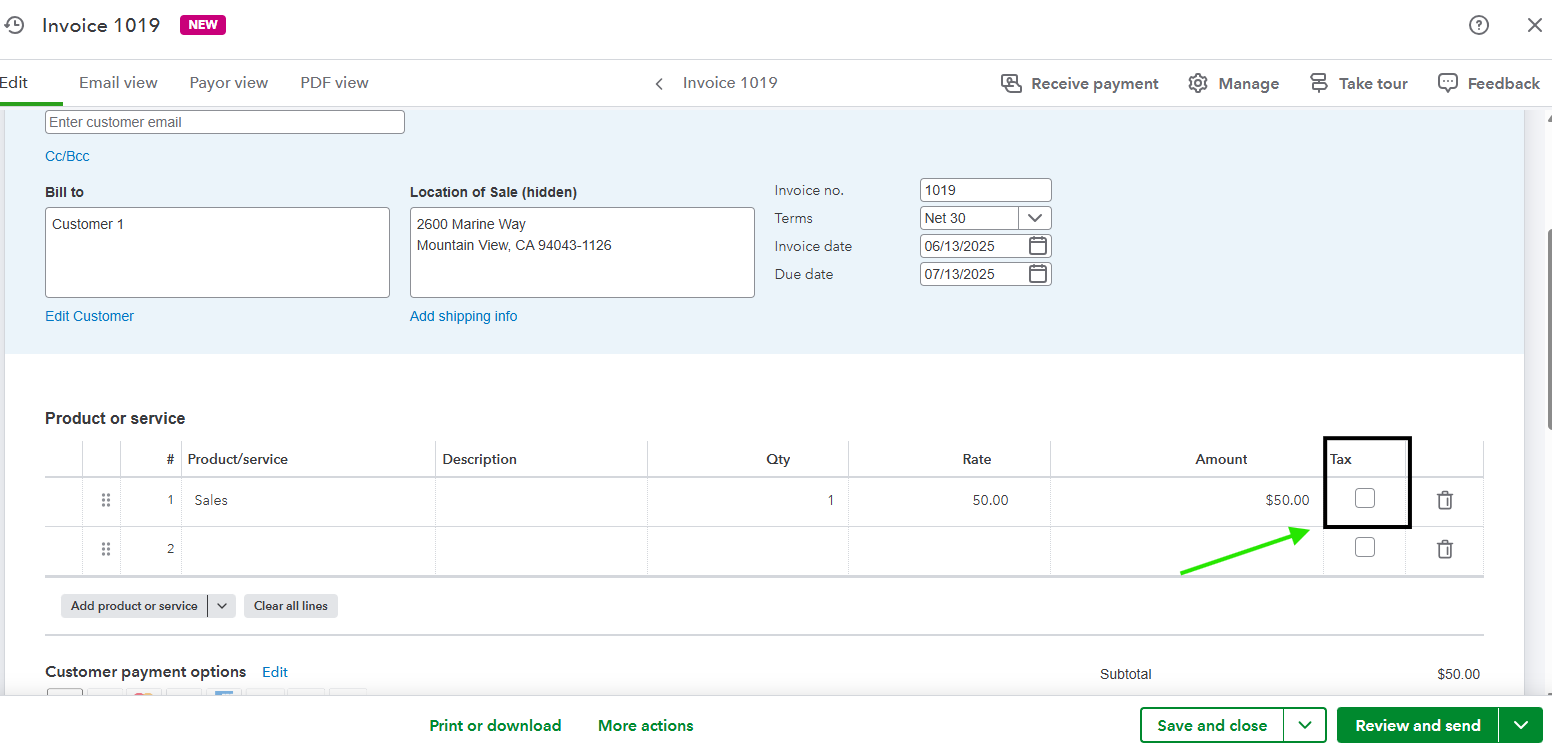

Items that weren't taxed:

Also, you can generate other sales reports such as the Sales by Product/Service Detail report, where you can filter and compare taxable amounts against non-taxable ones.

To know more on how to customize reports, I've added this for you: Customize Reports.

Additionally, you'll want to save the modification of your report for future use, check out this article for more details: Create, Access and Modify Memorized Report.

If you have any further questions or concerns related to taxes, let us know. We're always right here to help you anytime.

Thanks, but I think you may have misunderstood the issue.

This isn’t about how to mark an item as taxable or non-taxable—I’m already doing that correctly. The problem is that the Sales by Product/Service REPORT is incorrectly showing non-taxable items as having a taxable amount in the report totals. These are items that:

Yet, the report still includes them in the “Taxable Amount” column, which is both misleading and incorrect.

This is not a user error. This is a reporting bug. It makes the report useless for reconciling taxable vs. non-taxable sales without exporting to Excel and manually correcting the taxable amount to $0 for all of them.

Please escalate this to someone who understands the backend behavior of this report, because your response completely missed the point.

I appreciate your efforts in trying to clarify your concern, Katniss. I understand that running a sales report is essential for your business. I'll explain why the non-taxable items have a taxable amount when running reports.

The Sales by Product/Service report works as designed, regardless of whether the items are tagged as taxable or non-taxable. It will display an amount in the Taxable Amount column, which reflects only the supposed taxable amount. That is why your sales tax amount appears as $0.

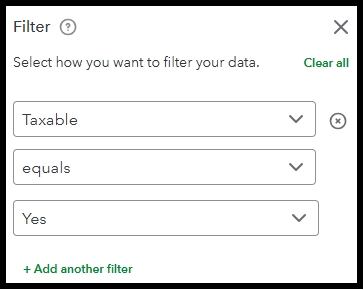

To sort out the problem, you can filter the report, you can refer to these steps:

If you want to customize your reports, read this article. It has helpful information about your business. You can filter the report to show specific accounts or customers. You can also change the layout to make sure the right data is in the right place: Customize reports.

Just leave a comment below if you have further concerns regarding running reports. We'll follow up to assist you. Have a good one!

Thanks for the reply, but this doesn’t address the issue.

The report is incorrectly marking non-taxable items as taxable—randomly. I have multiple instances where the same item, set to non-taxable and unchecked on the invoice, shows:

This is not a filtering issue. It’s a data integrity issue.

Please escalate this to someone who can investigate the backend logic. This isn’t user error. It’s a flaw.

—KatnissBookkeeper

We truly appreciate your patience and cooperation in this thread, Katniss, and for providing details of what's happening on your end.

I recommend contacting our Live Support team. They have the right tools to securely look into your account and identify why non-taxable items are listed as taxable in the Sales by Product/Service Summary report. They'll also be able to advise you on the next steps to resolve this issue.

Here's how you can connect with them:

To find out the best time to call, you can visit this page to check our Support Hours: Get help with QuickBooks products and services.

If you want to access your reports in Excel outside of QuickBooks Online (QBO), you can check this helpful resource for the process: Export your reports to Excel.

Feel free to revisit this thread if you need further assistance. The Community team is always here to help.

Thanks, but I’ve already raised this with Tech Support multiple times, and I’ve also discussed it directly with your Group Product Manager for Sales Tax, who acknowledged the issue and confirmed that this report could and would be fixed several months ago -even as broader system changes were underway for Sales Tax.

This is not a new concern. This is not a user misunderstanding. And this is not something that “Live Support” can resolve with a script and a screen share. I have tried that.

The issue is inconsistent and incorrect population of the Taxable Amount column, which I have repeatedly documented, including showing identical line items with different outcomes on the same report. That should not happen under any circumstances.

If this is not being routed to the reporting team for correction, then please escalate to someone with direct access to them. Otherwise, I’ll assume that feedback—even when clearly validated and acknowledged—is being discarded.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here