We completely understand how concerning and unexpected it must be to see your employees, who typically receive direct deposits, receiving checks instead. Let me help you figure out why this happened and guide you on how to fix it, Miles.

QuickBooks Online Payroll relies on the payment method set up for each employee in their profile to process pay correctly.

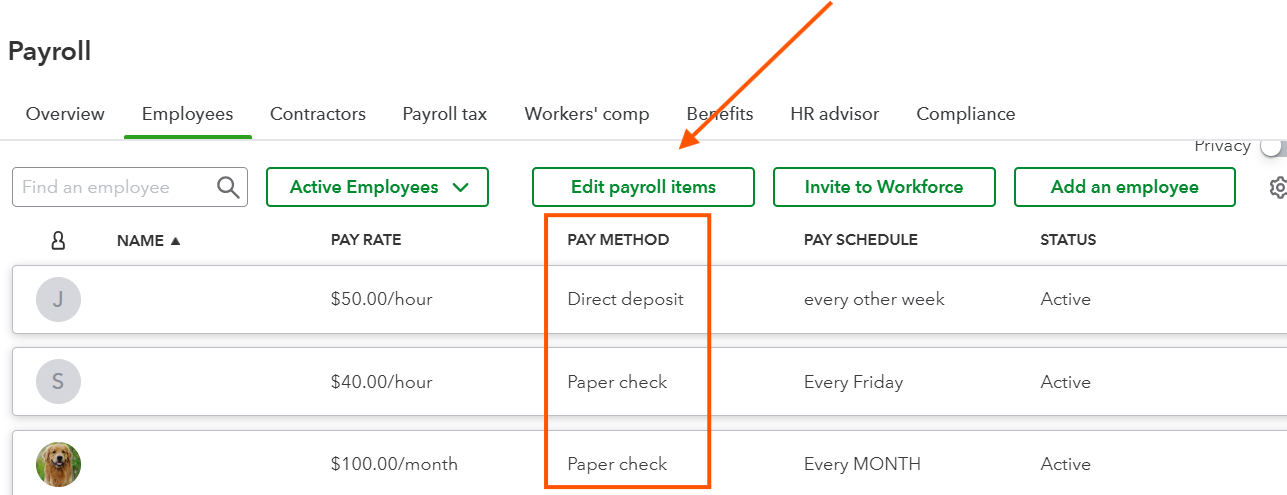

After setting up an employee for direct deposit, payroll will automatically use that method when processed. However, it’s important to double-check that the payment method hasn’t been accidentally switched to paper checks.

To ensure your employees are paid accurately in the future, I recommend checking and confirming their payment methods in QuickBooks Online Payroll.

Here's how:

- Navigate to the My Apps menu and select Payroll.

- Click Employees to locate the employee whose payment method you need to check or update.

- Select the employee’s name to view their profile.

- Scroll down to Payment Method to review whether it’s set to Direct Deposit or Paper Check.

If it's incorrectly set to Paper Check, you can change it to Direct Deposit, ensuring payroll will use direct deposit automatically for the next pay period.

However, if you need to edit your employees' payroll for this pay period, we recommend contacting our Payroll Support Team. They have the necessary tools to identify any potential issues, such as bank holds or other factors, that could cause QuickBooks to issue a paper check instead.

If you have any questions or concerns, feel free to reply below. We’re happy to assist you.