To create journal adjustments, just click on the Adjusting Entry box in the Make General Journal Entries section, Joy. I'll guide you through the process.

It’s best to use journal entries in QuickBooks only when needed. It is set up to work best with functions like enter bills and make deposits. Although some information from journal entries can show up in reports, it might not include everything, which can lead to missing details.

For the most clear and complete reports, use the specific tools provided for each transaction. It's advisable to consult your accountant during this process to ensure everything is correct.

Here's how to adjust:

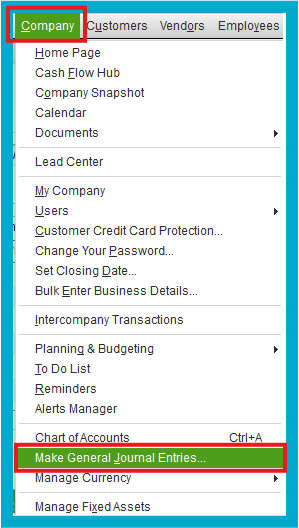

- Go to the Company menu and choose Make General Journal Entries.

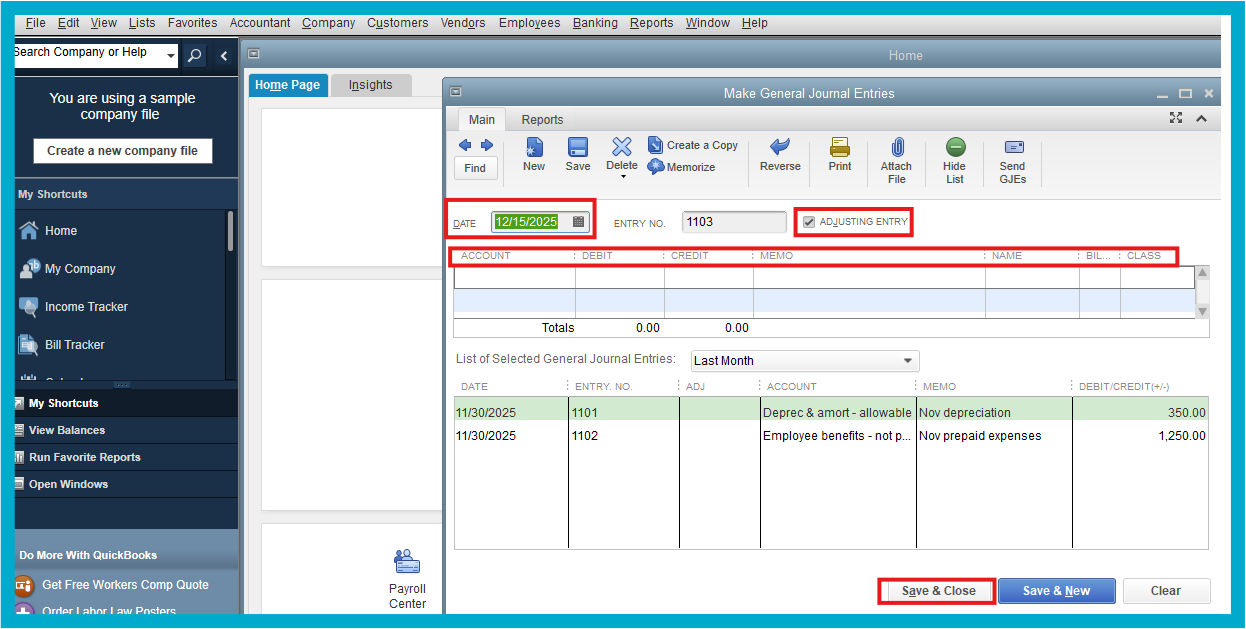

- Change the date if necessary.

- Enter the required information, such as the Account, Debit, Credit, and Memo.

- Before saving, check the Adjusting Entry box to mark it as an adjusting journal entry.

- Once done, click Save & Close.

Additionally, I've included this article for your future reference to assist you in creating and customizing an Adjustment Journal Entry report. This will help you monitor and review the details of each adjustment transaction you have made.

Journal entries are crucial for keeping your financial records accurate. If you have any questions about making journal adjustments, please feel free to reply to this thread.