Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

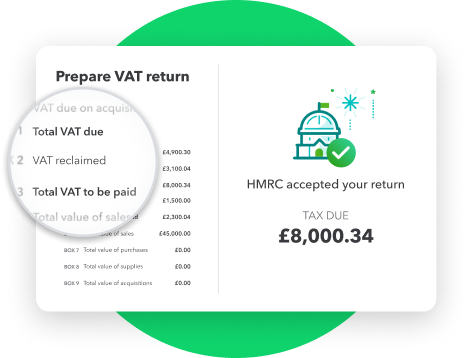

Contact support Visit support pageQuickBooks’ bridging software makes it easy for spreadsheet users to comply with HMRC’s new Making Tax Digital rules. It also works for businesses with complex VAT. Whether you're a small business or an accountant, QuickBooks is designed to make MTD bridging easier.

Join over 6.5 million subscribers worldwide

Our range of simple, smart accounting software solutions can help you take your business to the next level. Once you've chosen your plan, there's no hidden fees or charges.

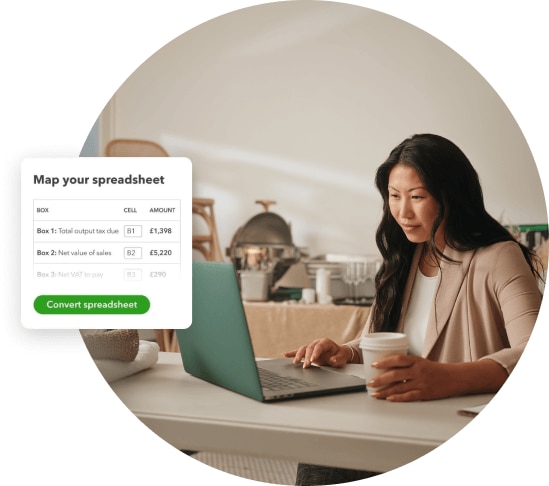

Simple VAT submission from a spreadsheet

It’s easy to meet Making Tax Digital requirements for VAT submissions with QuickBooks. Upload your spreadsheet data and use our bridging software to submit directly to HMRC.

Your figures, your way

Not ready to ditch the spreadsheets? No worries–QuickBooks can work with your existing data.

Ready when you are

Take your time discovering all the benefits of QuickBooks, without stressing about your VAT deadlines.

Suits every scheme

It doesn’t matter what VAT scheme you’re on–QuickBooks bridging software can help you stay compliant.

Bridging software for accountants

QuickBooks’ MTD bridging software helps accountants prepare their clients for Making Tax Digital, without changing the way they manage their VAT. You can get started in 3 simple steps.

- Register your clients for VAT with HMRC.

- Upload your clients' VAT digital records in QuickBooks, highlighting the 9-box summary needed for HMRC.

- Submit VAT returns to HMRC.

Our flexible solution creates the final digital link between your clients' spreadsheets and HMRC.

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.