Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageGet ahead of the changes and help your practice and clients to stay compliant with QuickBooks. We're one of the few software providers recognised by HMRC as part of their Making Tax Digital for Income Tax Self Assessment testing phase.

Claim your exclusive early access to QuickBooks' NEW MTD for Income Tax functionality by joining our testing phase today. Act fast–places are limited.

Why should I join the testing phase?

If you have clients who are self-employed or landlords with a gross annual income over £50,000 from these sources, they will be legally required to start keeping digital records and send quarterly updates of income and expenditure to HMRC using compatible software from April 2026. This requirement will extend to those with a gross annual income over £30,000 from these sources from April 2027.

Get the MTD for Income Tax support you've been missing:

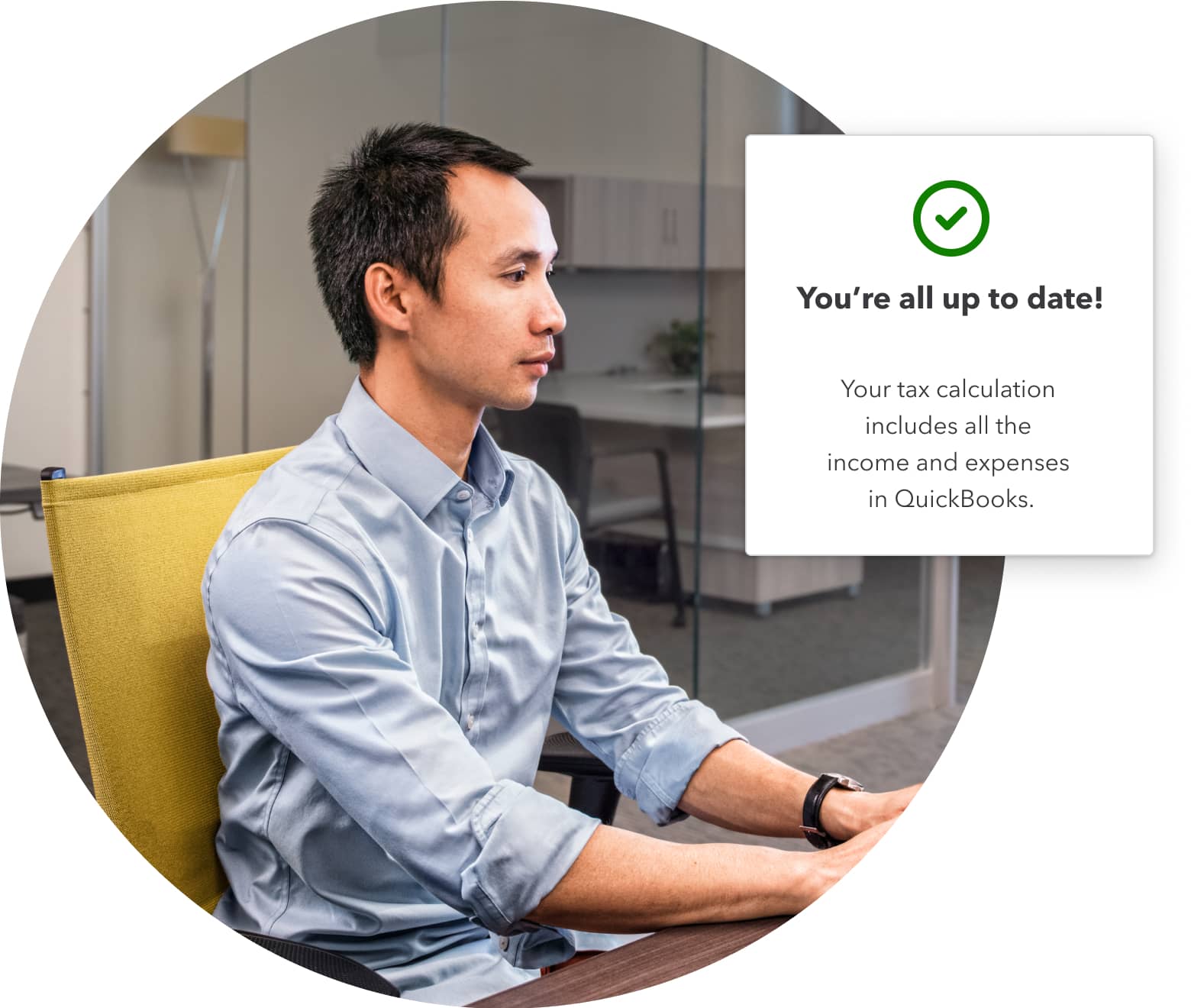

Be ready for April 2026 by being among the first to try these new MTD for Income Tax specific features, available exclusively in this testing phase:

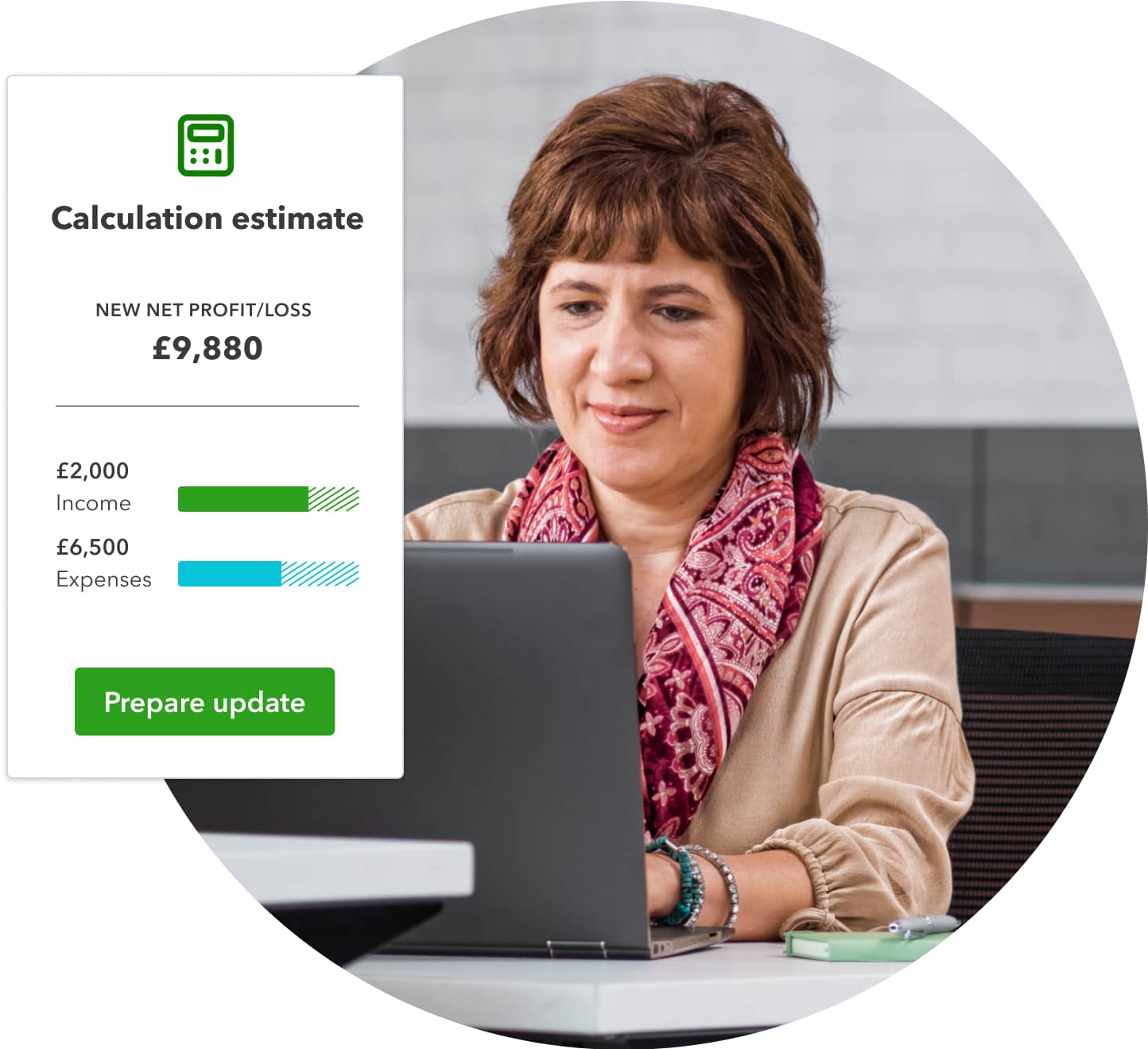

Select quarterly or annual accounting periods

Send quarterly updates

Download CSVs with quarterly information

Retrieve calculations from HMRC

View historical calculations

View tax timelines

Complete final declaration

Which QuickBooks plans are supported?

Save up to 60% on QuickBooks Online when you manage the subscription billing for your clients. Need help choosing? Talk to us on 0808 258 3854.

Simple Start

For small business clients who require invoicing, estimate and receipt capture tools.

Essentials

For small business clients who need all the functionality of Simple Start and who work with suppliers.

Plus

For small business clients who need all the functionality of Essentials and manage projects and stock.

Advanced

For small and medium business clients needing automatic data backup, custom permissions, bespoke reporting and insights.

a

Signing up for the MTD for Income Tax testing phase is easy:

1. Fill in the form

2. We'll be in touch

A member of the QuickBooks team will get in touch with you to walk you through the process

3. Onboard your clients

Once we've been in touch with you, you'll be all set to onboard your clients via the self service Income Tax testing phase portal. Just remember to select QuickBooks as your chosen solution.

Don't miss out. Joining the MTD for Income Tax testing phase can help you:

Get ahead

Taking part means you’ll have early access to MTD-compatible software to keep digital records and submit quarterly updates. You’ll be up to speed on all of the MTD changes before they become mandatory.

Build a better solution with us

You’ll be fully engaged in the development of our MTD for Income Tax solution from day one. Your feedback will help us shape a product that’s right for you, and practices like yours.

Shape the proposition for accountants, bookkeepers & clients

Our product teams will co-create the features and design of our next-gen MTD service with you.

Improve the Income Tax support we offer

Your participation will help pioneer the way everyone adapts to the new changes and ways of managing their taxes.

They've already joined the MTD for Income Tax testing phase with QuickBooks

They've already joined the MTD for Income Tax testing phase with QuickBooks

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.