How can we help?

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday

Get product support

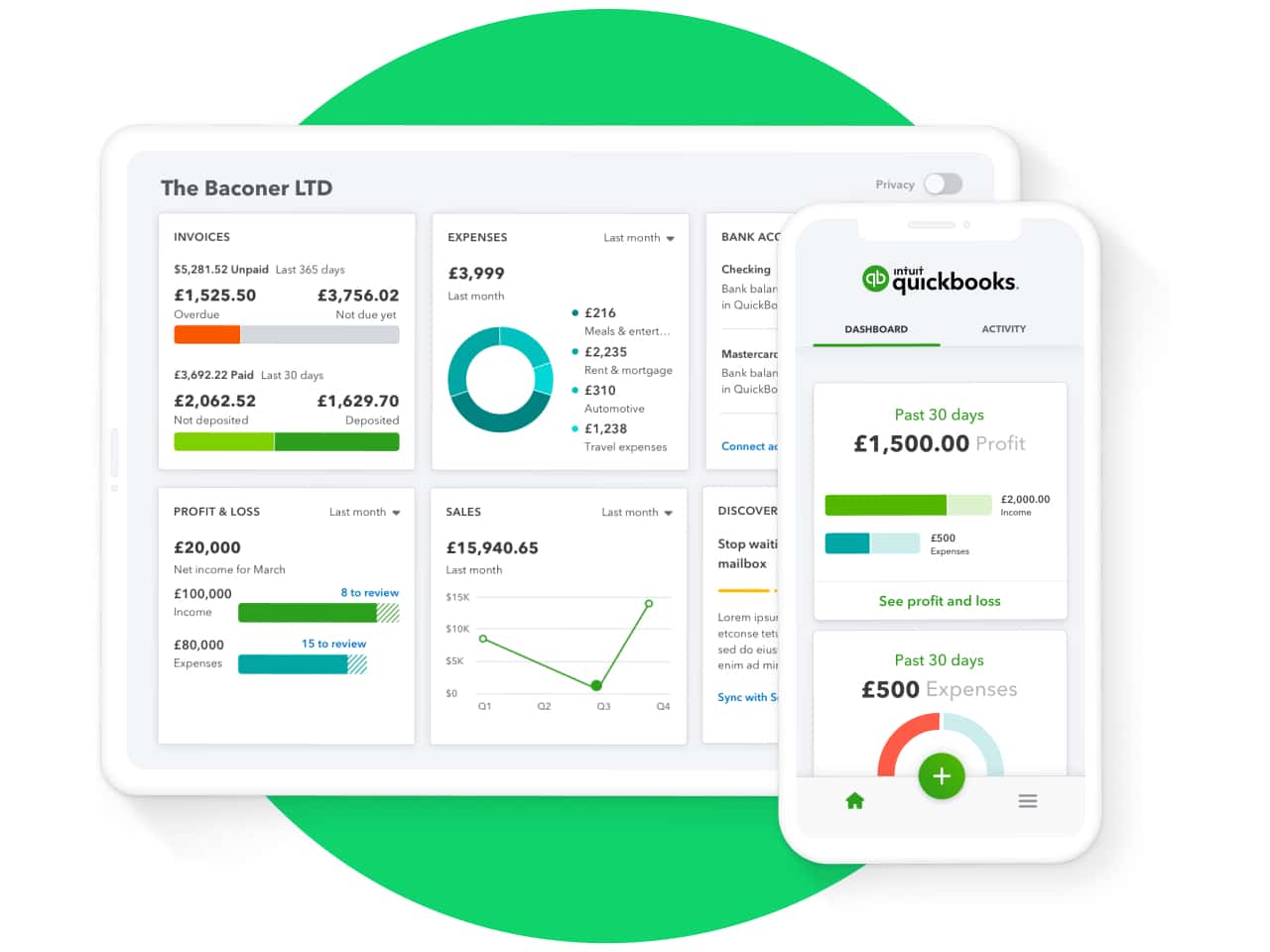

Contact support Visit support pageWith QuickBooks’ powerful accounting software for e-commerce businesses you have all the tools you need to manage your finances. Integrate popular e-commerce apps, keep track of expenses and optimise your sales channels – all in one place. Get ready for the tax period with seamless data storage and financial management.

Build your e-commerce business with QuickBooks Plus

QuickBooks Plus is your all-in-one e-commerce accounting solution for taking payments, tracking costs and optimising sales channels. Make informed business decisions with QuickBooks by your side.

Make sales across the globe

Accept and make payments in over 145 different currencies as easily as you do in pounds, and win your customers’ trust by working in their local currencies in the process. Invoice without the hassle by using our automatic exchange rate; QuickBooks’ e-commerce accounting software auto-adjusts for exchange rate fluctuations.

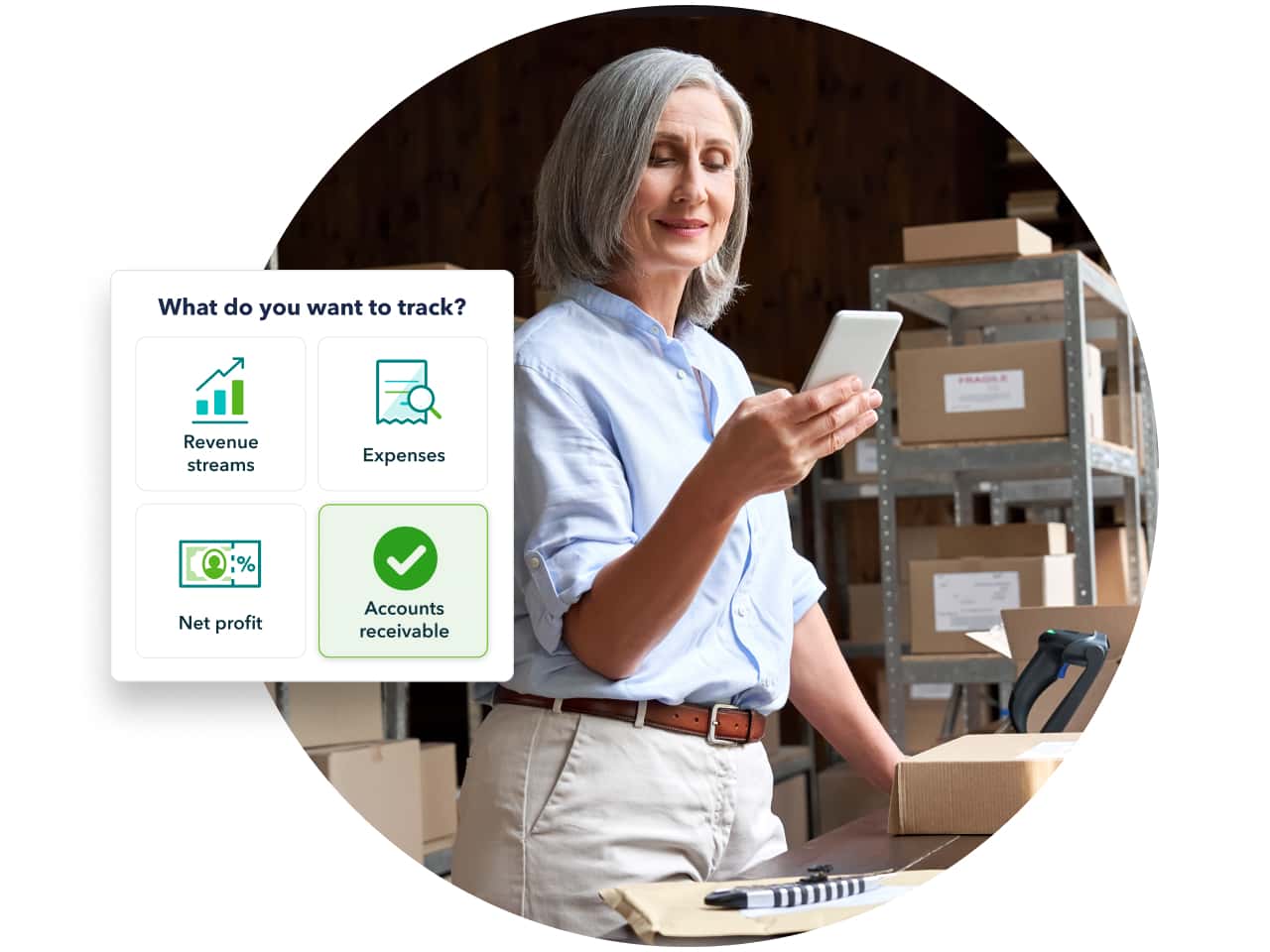

Stay on top of stock

Track products and their cost – we'll send you notifications when stock levels are low. See what's selling well, create purchase orders and manage vendors, all within your online accounting software.

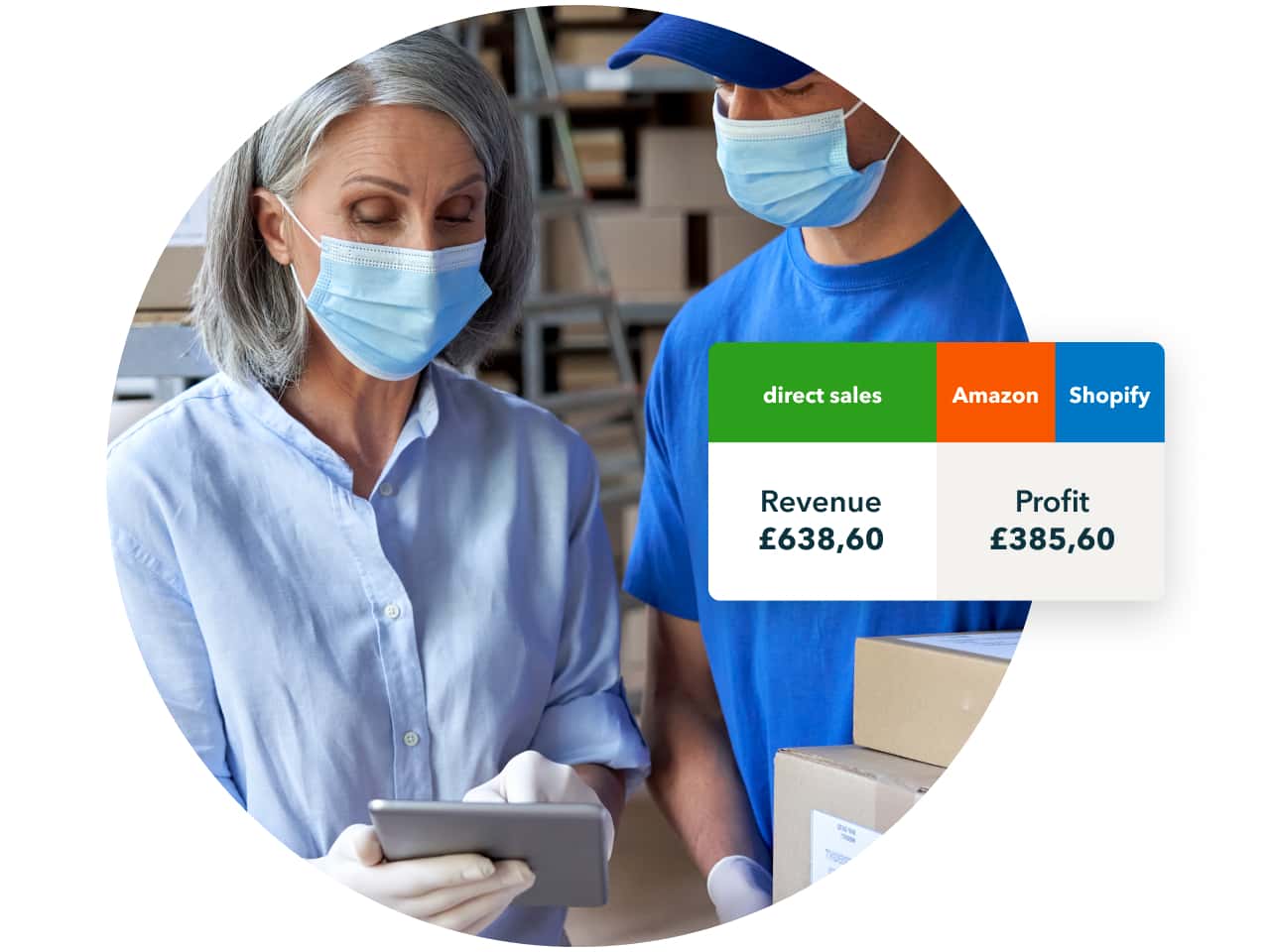

Optimise your sales channels

Know which sales channels are making you money with QuickBooks Online Plus. See each channel’s profitability at a glance through clear dashboards and reports. Make more informed business decisions about where to sell your products online.

Set smart budgets

Set monthly, quarterly or annual business budgets based on predictions of your income and expenses. Keep track of spending to make sure you stay on target.

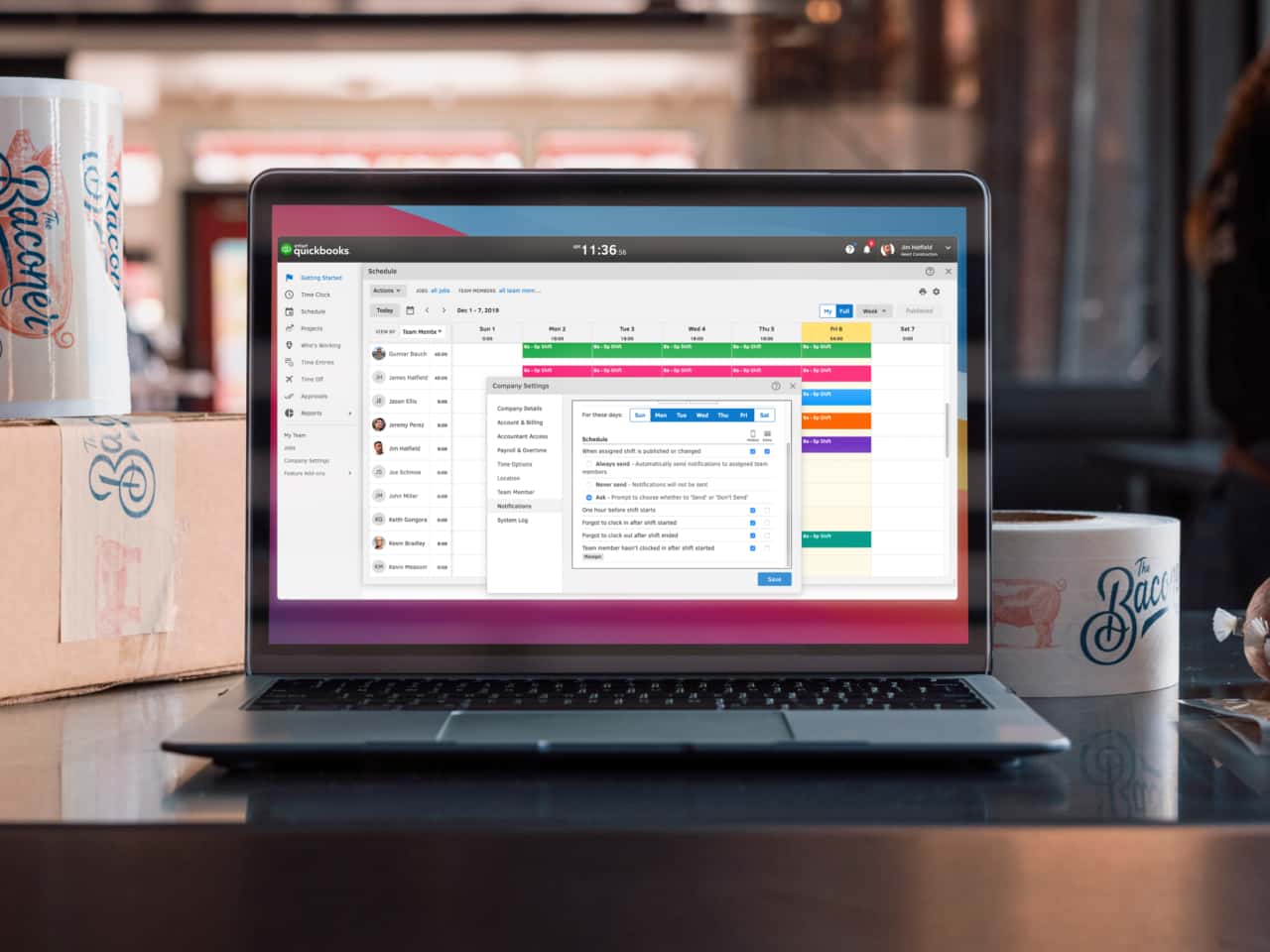

Track time up to the minute

Log chargeable hours and expenses by client or employee and automatically add them to an invoice. Effortlessly track labour costs, payroll and expenses within QuickBooks Online Plus.

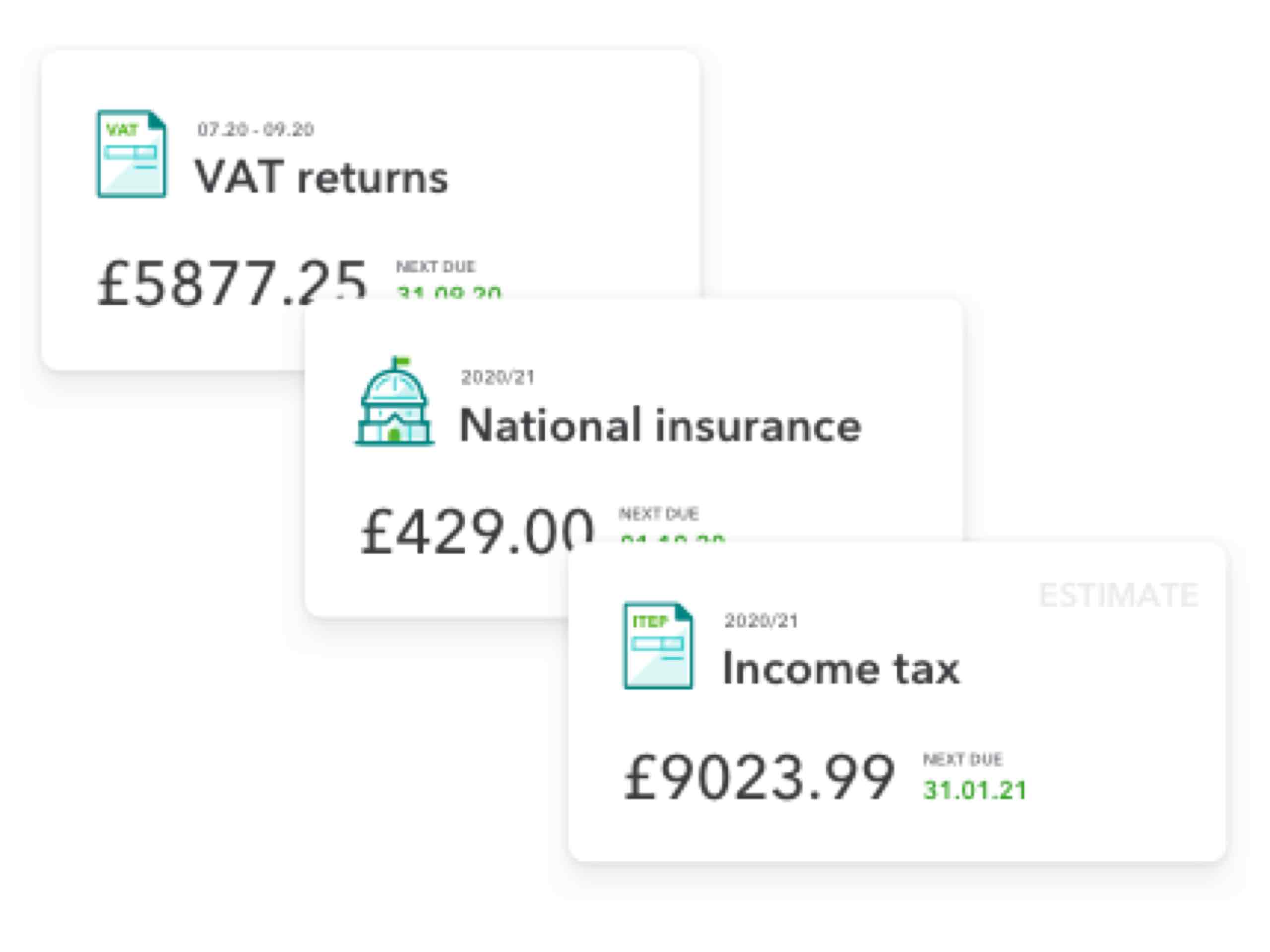

Be ready for tax time

Track VAT throughout the tax year with QuickBooks’ online e-commerce accounting software. Automatically check your VAT with our clever error-checking technology and connect directly to HMRC to submit your VAT returns in line with Making Tax Digital regulations.

Recommended add-ons for e-commerce businesses

Make running your retail business easier by connecting popular e-commerce, payment and expense tracking apps to our e-commerce accounting software. Your data will be automatically synced and reconciled in QuickBooks.

Shopify Connector by Intuit

Sync orders, products and inventory from your e-commerce store automatically. Save time and money by automatically sharing data between Shopify and QuickBooks.

Wix Connector by Intuit

Save time and money by automatically sharing data between Wix and QuickBooks Online

Etsy Connector by Intuit

Automatically sync eCommerce sales by sharing data between Etsy and QuickBooks Online.