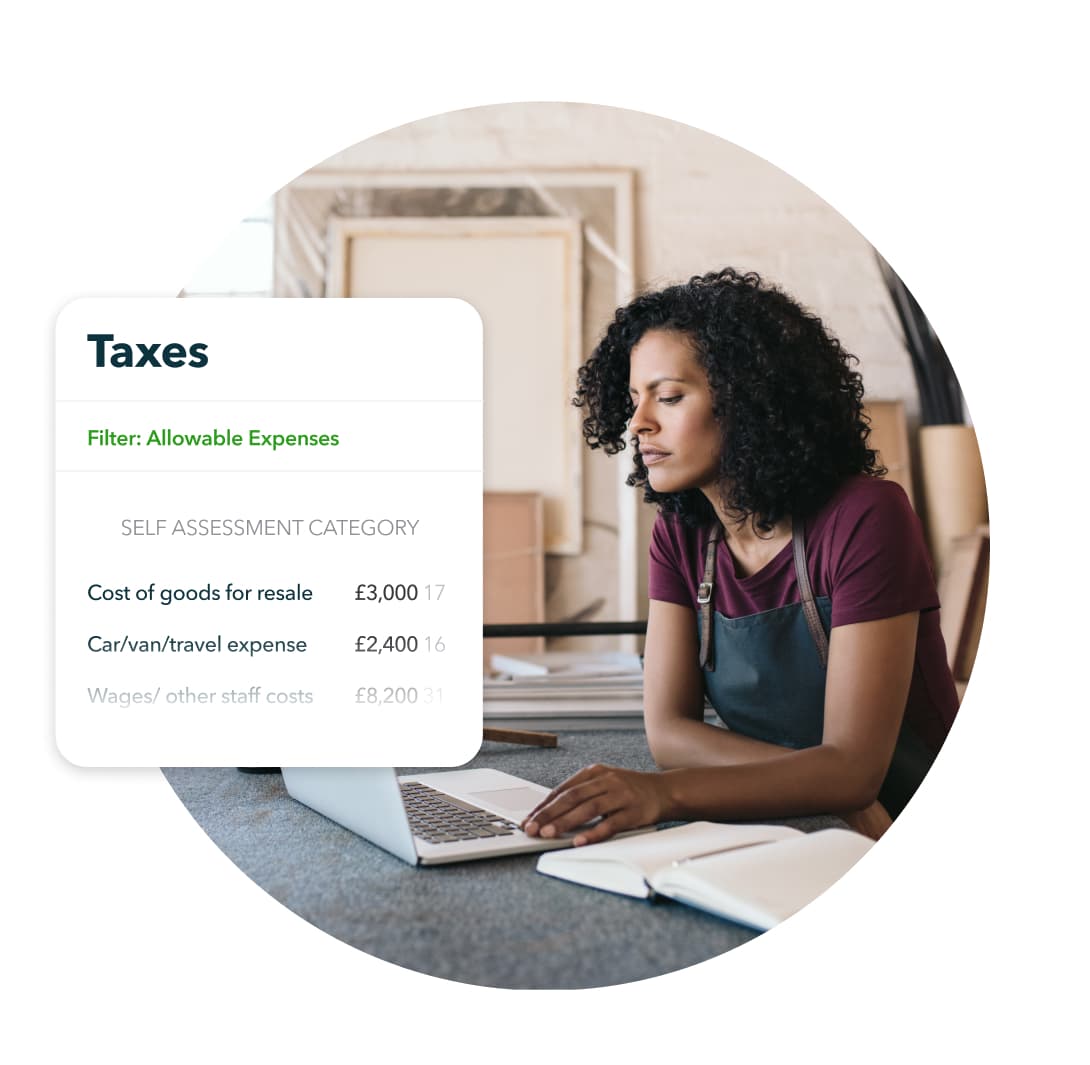

Self-employed or a single property landlord? Make light work of your business admin with QuickBooks Sole Trader—self-employed accounting software for busy business owners.

QuickBooks is the #1 recommended cloud accounting software.*

Harness the power of AI to separate personal and business transactions. Sort receipts, make Income Tax more relaxed, track mileage and manage your accountants with ease from anywhere. Plus, get support from QuickBooks product experts 7 days a week.**