How can we help?

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support page

What is Making Tax Digital (MTD)?

Making Tax Digital (MTD) has been introduced by HMRC to help individuals and businesses to get their tax right. It means many people are leaving their spreadsheets or paper records behind and moving over to a new system.

At the moment, Making Tax Digital is all about VAT submissions. But over the coming months and years it will include Income Tax and Corporation Tax too.

Are you still filing on the HMRC website?

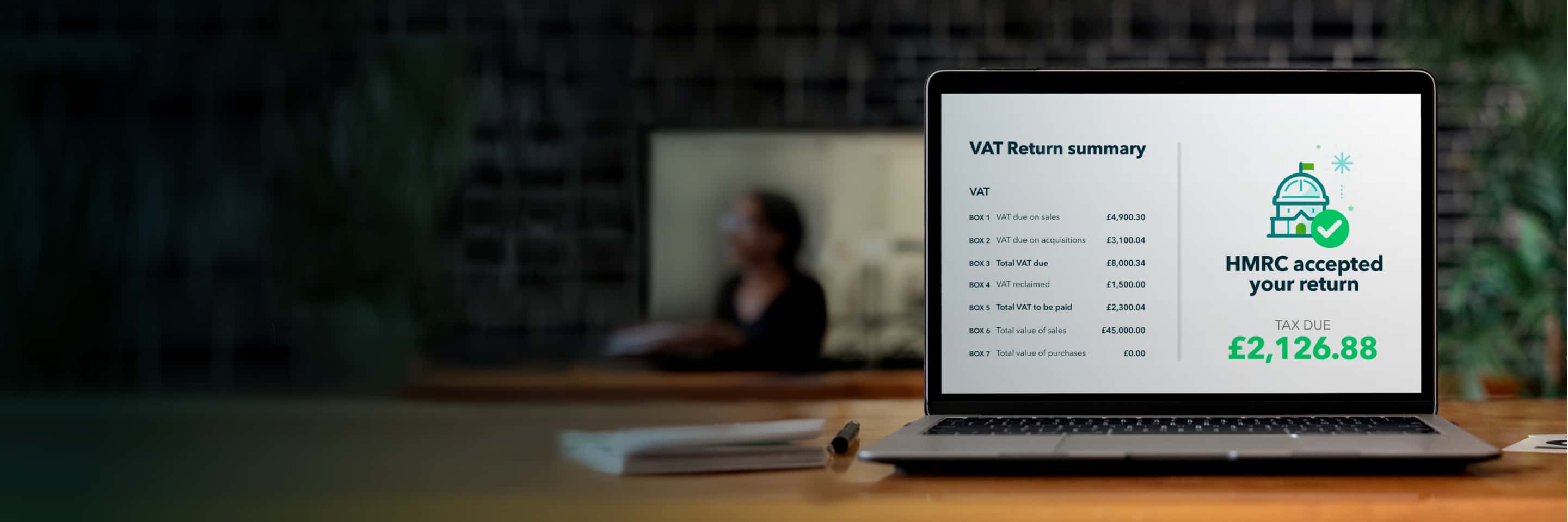

From 1 Nov MTD will be the way* to file your VAT. With the portal closed, VAT submissions can no longer be done on the HMRC website. Don’t stress, you’ve come to the right place. QuickBooks’ HMRC-recognised MTD VAT software is the solution.

*Exclusions apply, please visit gov.uk for more information.

How do businesses comply?

To comply with Making Tax Digital for VAT, businesses have to keep digital records. This must be done using what HMRC calls 'compatible software’. In other words, it must be able to connect directly to HMRC and send your details to them using digital links.

When will MTD affect me?

MTD was introduced for nearly all VAT-registered businesses with a taxable turnover above £85,000 in April 2019. They have to use Making Tax Digital software to keep digital records and make VAT submissions to HMRC.

From April 2022, MTD requirements apply to all VAT-registered businesses in the UK

You're in the right place to get ready. QuickBooks' HMRC-recognised MTD software is designed for small businesses.

Making Tax Digital deadlines

QuickBooks has been helping small businesses prepare for Making Tax Digital since 2018. Here are the latest key dates for compliance.

April 2022:

Making Tax Digital for VAT applies for nearly all VAT-registered businesses

April 2026:

Making Tax Digital for Income Tax applies to self-employed businesses and landlords with annual business or property income above £50,000

April 2027:

Making Tax Digital for Income Tax applies to self-employed businesses and landlords with annual business or property income above £30,000