Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageSmart, simple accounting software

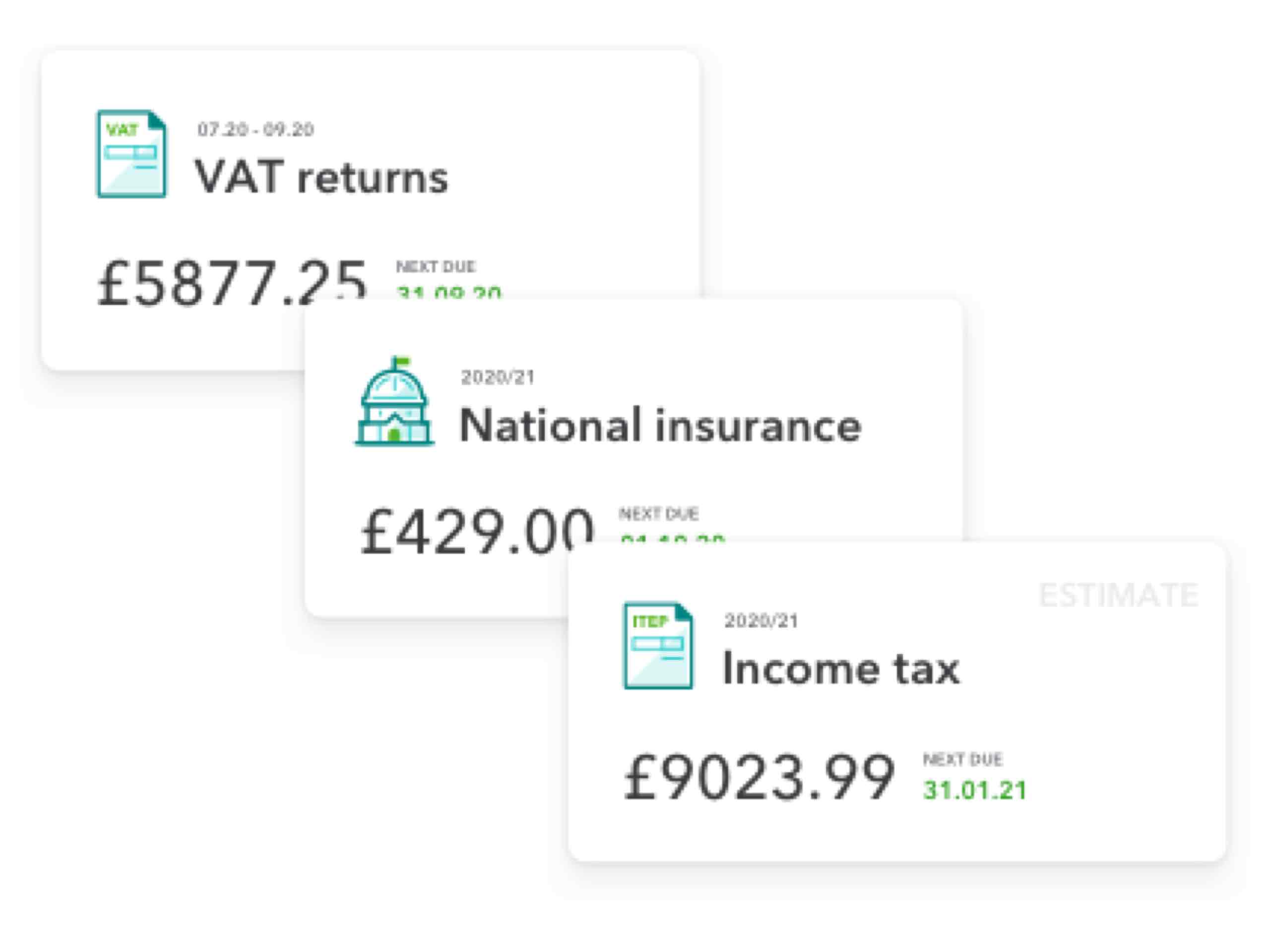

Tax returns are effortless when everything's in one place. Automatically organise, calculate and prepare Making Tax Digital for VAT and Construction Industry Scheme tax, then e-file to HMRC from QuickBooks. You can get real-time income tax estimates too, avoiding any Self Assessment surprises.

Know what you owe

Track VAT and construction tax (CIS) in real time so you know how much to set aside. Self Assessment tax can be already managed in QuickBooks Self-Employed and it's coming soon to QuickBooks Online. Watch this space.

Automate your admin

Swap manual data entry for automatic calculations and accurate record keeping. Snap & store receipts, auto-track mileage and easily categorise transactions - all in one place.

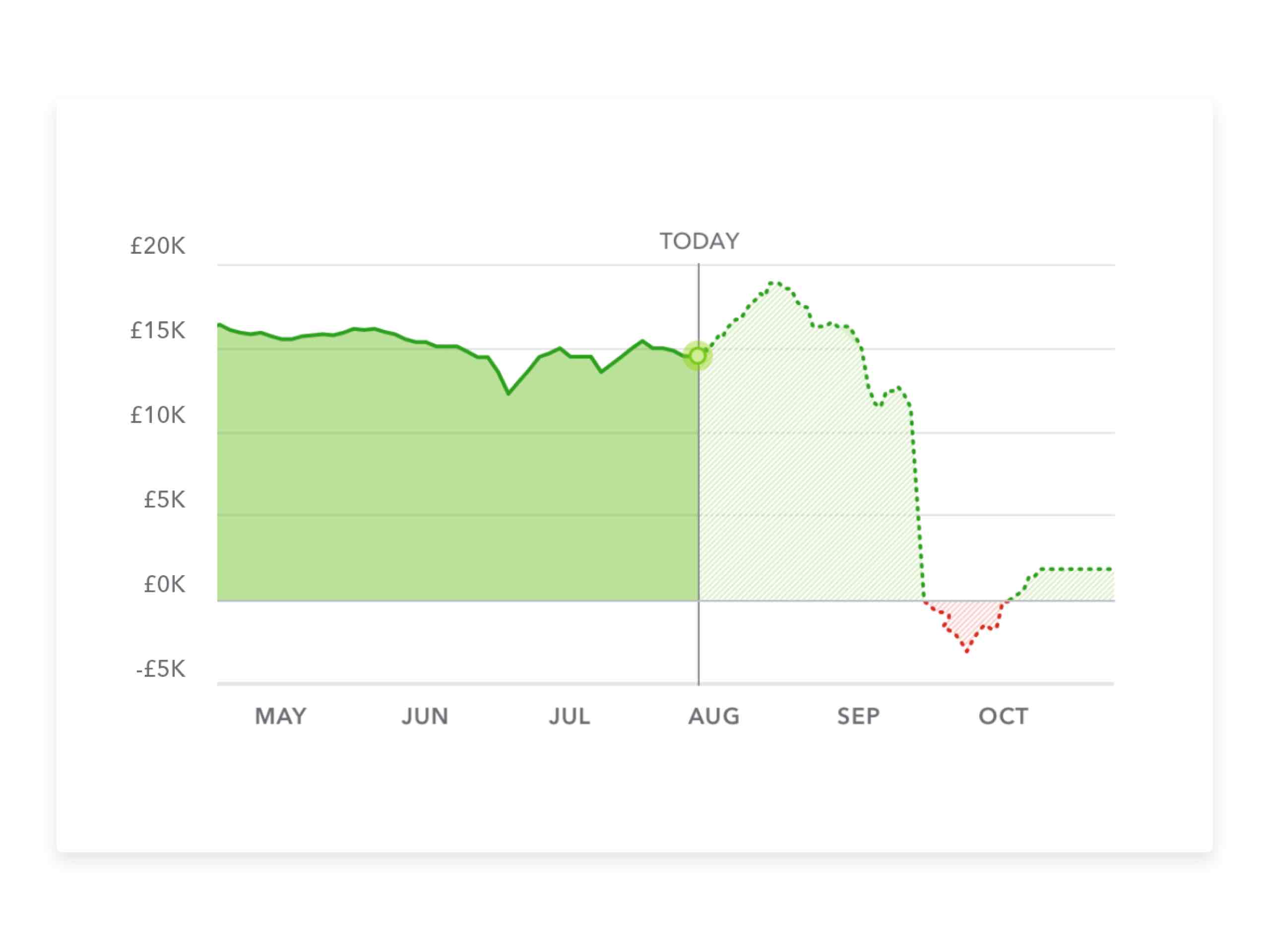

Stay on top of your finances

Get a real-time view of transactions, invoices, expenses and taxes. Look 90 days ahead with QuickBooks’ Cash Flow Planner.

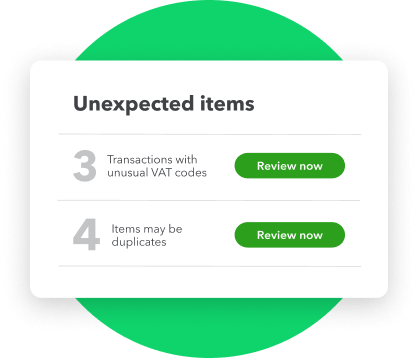

Speed through your VAT

Prepare, track and file VAT directly to HMRC. Use our error checker to spot common mistakes in your VAT return, saving time and giving you peace of mind.

Get instant, free support

We offer free technical support with instant chat including screen sharing.

Be clear about compliance

Our no-nonsense blogs and guides help you understand your allowable expenses for Self Assessment and get to grips with Making Tax Digital for VAT.

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.