Too often, small businesses get caught in the trap of trying to control situations they cannot control.

We’ve witnessed several circumstances outside of an entrepreneur’s comfort zone. COVID-19, a rollercoaster economy, and tightening credit markets weren’t factors many small business owners could have predicted.

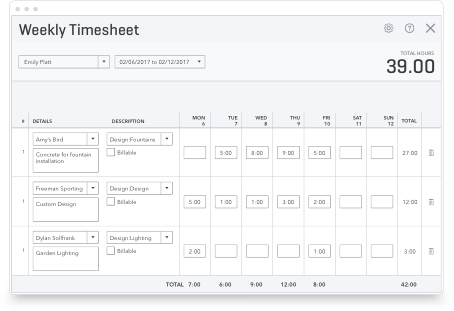

One of the other things that may have fallen outside a small business’ control was its cash flow. Many companies had large customers with long payment terms ranging from 60 to 90 days. But their frustrations rose when many large customers extended these payments due to the pandemic and a range of other factors.

Waiting well beyond agreed-upon payment terms can put a lid on a company’s growth at best and threaten its survival at worst.

But invoice funding has emerged as a viable best practice that puts businesses of all sizes back in control of their cash flow. During the pandemic, many businesses discovered relief by exchanging outstanding invoices for working capital and reducing their wait times.

Today, we highlight three companies that use invoice funding as a best practice to accelerate their business growth in innovative ways.