3 steps to calculate cost-plus pricing

1. Calculate the total cost of the product

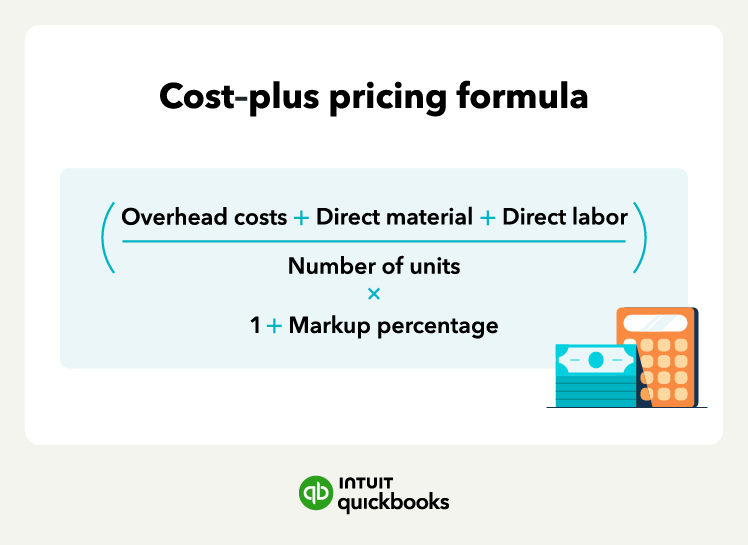

First, you’ll need to calculate the total cost of producing the product, which consists of material costs, labour costs, and overhead costs. Overhead costs include indirect expenses such as rent, utilities, and office expenses.

If using the second formula above, you’ll need to go a step further by taking the total product cost and dividing it by the total number of units to determine the cost per unit.

2. Establish the desired markup percentage

The next step is to decide how much you want to mark up the product. Each industry will have its own range. Other factors like price elasticity and government regulations can influence how your business will set the markup percentage. For example, retailers generally aim to have a 30% to 50% profit margin.

3. Determine the selling price

This is where you use the first formula, combining the total item cost and the markup percentage to finalize the selling price. This method is commonly used in companies that provide construction services.

However, companies that manufacture products in bulk quantities will use the second formula, taking the cost per unit and multiplying it by the markup percentage to determine the selling price.