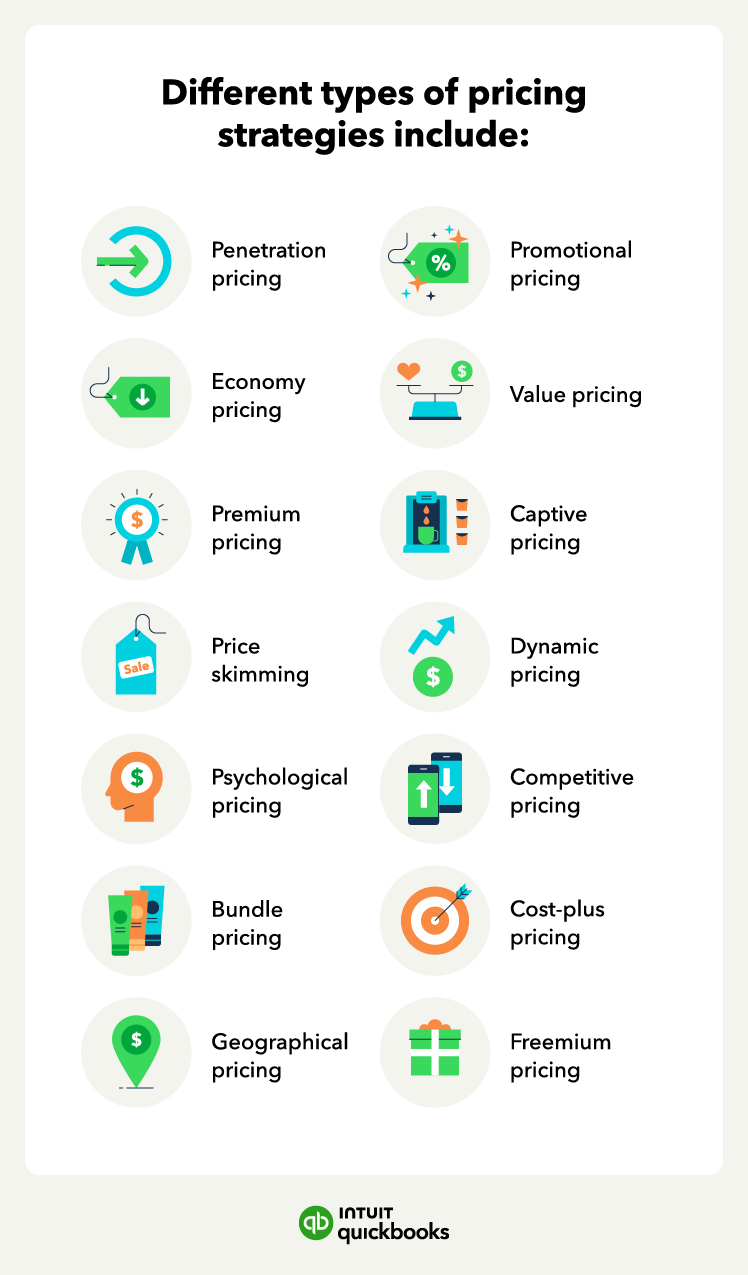

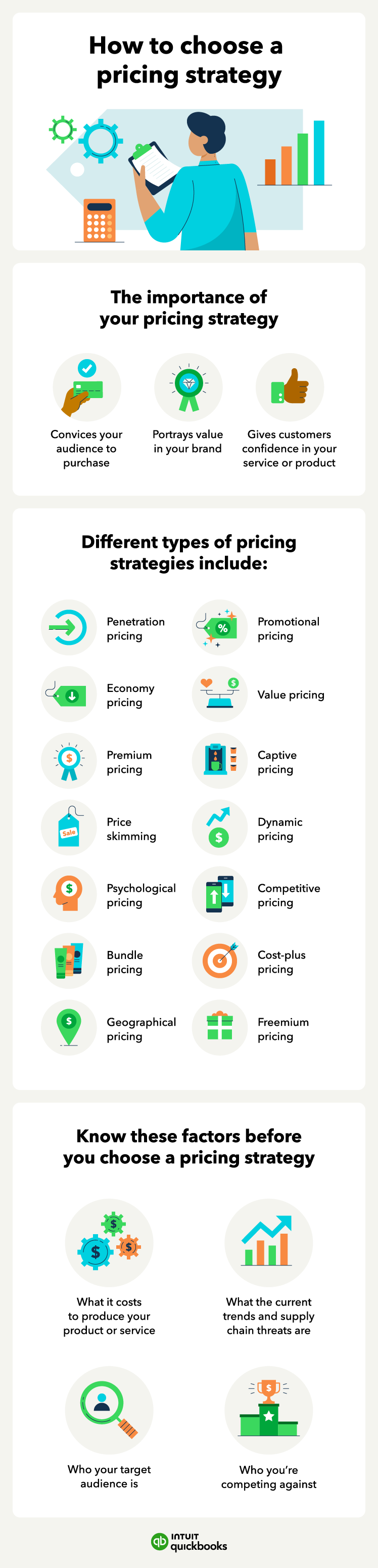

Whether you’re starting a new business or you’ve had your small business established for years, you know choosing the right price for your products or services is crucial. Nailing down a pricing strategy will allow you to maximize profits and attract a new customer base.

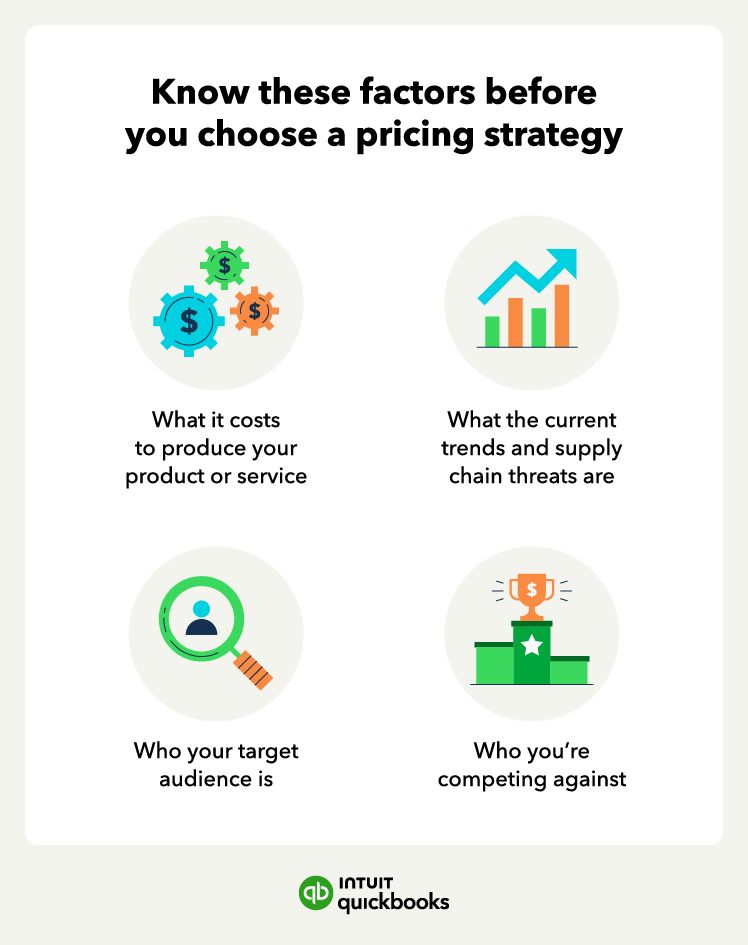

To get this right, it’s critical to use financial reporting and insights to guide your decisions. You also need a good understanding of the many different pricing strategies you can choose from for your product or service.