Why fixed costs matter

Fixed costs are the baseline expenses your business must pay, no matter how sales fluctuate. They’re the overhead you commit to—like rent, salaries, and insurance—even in slower months.

Here’s why understanding them matters:

- Budgeting: Fixed costs show the minimum money you need each month to keep the business running.

- Pricing: Knowing your fixed costs prevents underpricing. It shows how much revenue your products or services must bring in (along with variable costs) before you start making a profit.

- Financial planning: Fixed costs are key for calculating your break-even point—the sales level where you cover all expenses. Beyond that point, operating leverage comes into play, where profits rise faster than costs. Understanding both helps you plan growth and set realistic financial goals.

Fixed costs examples you might encounter in your business

Fixed costs show up in every business, no matter the industry. They are predictable, recurring expenses that don’t change with sales. Common examples include:

- Monthly rent or mortgage payments

- Insurance premiums

- Salaries of permanent staff

- Property taxes

- Loan payments

Many small businesses start out tracking these costs with spreadsheets or even paper records. While this can work early on, it quickly becomes time-consuming and error-prone as the business grows.

This is where accounting software, like QuickBooks, helps. It automatically tracks and categorizes expenses, making it easier to separate fixed from variable costs and understand exactly where your money goes.

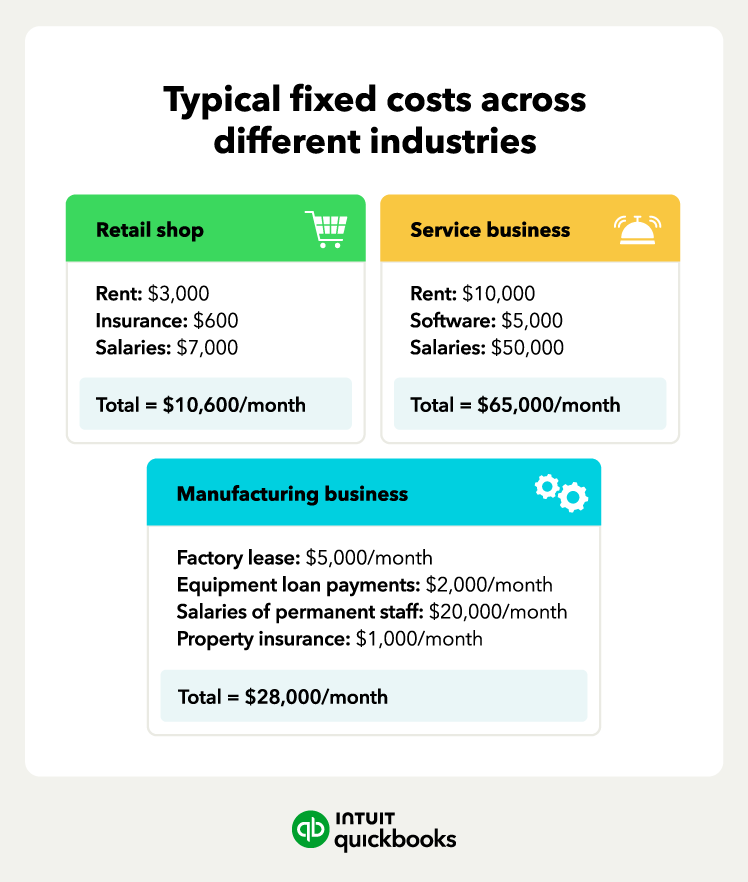

Example 1: A retail shop

A local clothing boutique pays $3,000 per month in rent, $600 for insurance, and $7,000 for staff salaries. Even if sales slow down, those fixed costs remain the same. Combined, that’s $10,600 in fixed costs every month—a baseline the owner must cover before making a profit.

Example 2: A service-based business

A marketing agency with a modest office has $10,000 in rent, $5,000 in software subscriptions, and $50,000 in staff salaries. These add up to $65,000 in fixed costs monthly, which make up most of their operating expenses. Knowing this total helps the agency set project pricing high enough to cover both fixed costs and variable expenses like contractor fees.