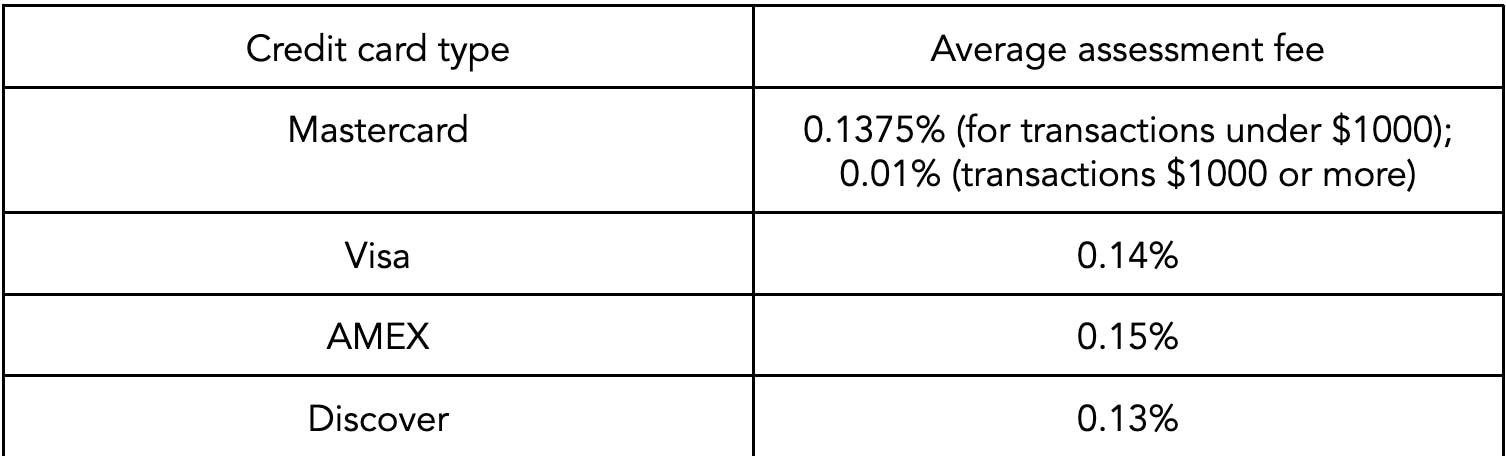

Payment processing fees naturally come with the territory of owning a business. On average, merchants pay around 2% or more anytime a customer uses their credit card. And with different types of payment processes come extra fees and rates. Credit cards are a more expensive option for business owners, especially when compared to debit cards and cash.

That being said, there are a total of 9.68 million Visa and MasterCard cards in circulation in Canada right now. It could be beneficial to your small business if you start accepting credit cards at your place of business.

Before accepting credit card payments from clients, you need to know about credit card costs like interchange and assessment fees. In this article, we explain what credit card processing fees and electronic payment methods are and what it takes to lower them in Canada.