Payroll calendar templates are predesigned forms, spreadsheets, or PDFs that allow business owners to track important dates and deadlines, ensuring employee pay is accurate and on time. Payroll calendars can work with other payroll tools, such as time tracking, to provide a convenient and efficient way to organize and manage pay periods.

By using a payroll calendar template, businesses can avoid errors and miscalculations that may occur when managing pay periods manually.

Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic.

- How many pay periods in 2025?

- Weekly payroll calendar templates

- Biweekly payroll calendar templates

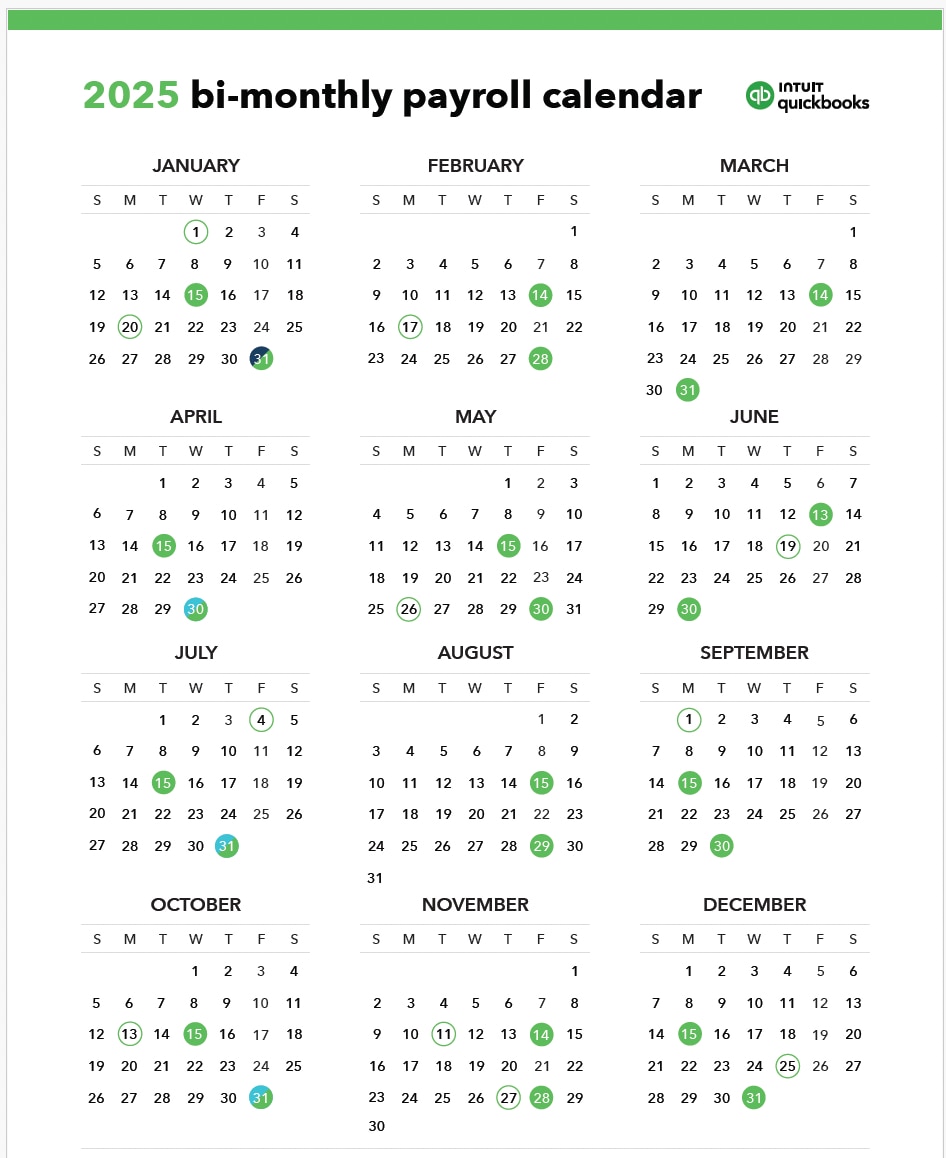

- Bimonthly payroll calendar templates

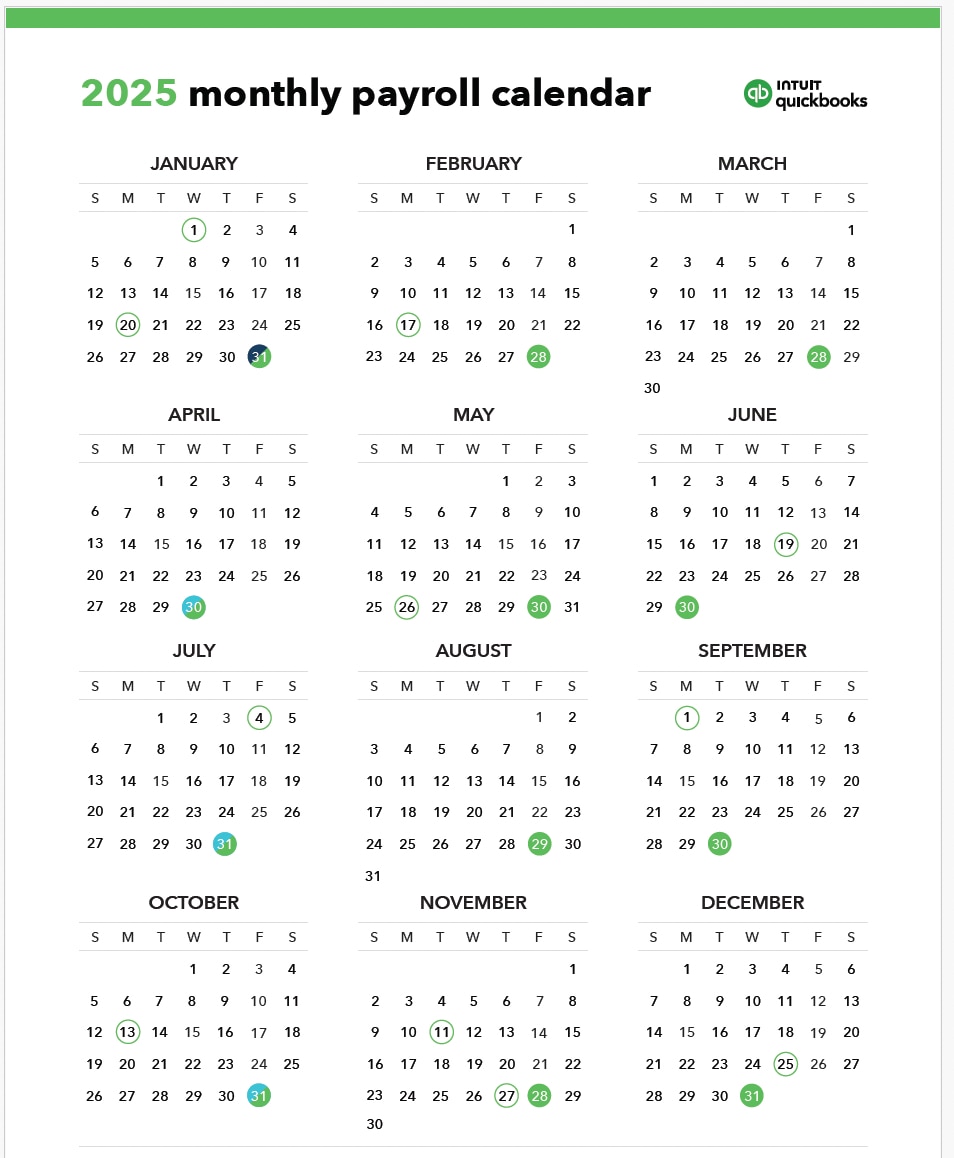

- Monthly payroll calendar templates

- How to keep your payroll organized in 2025