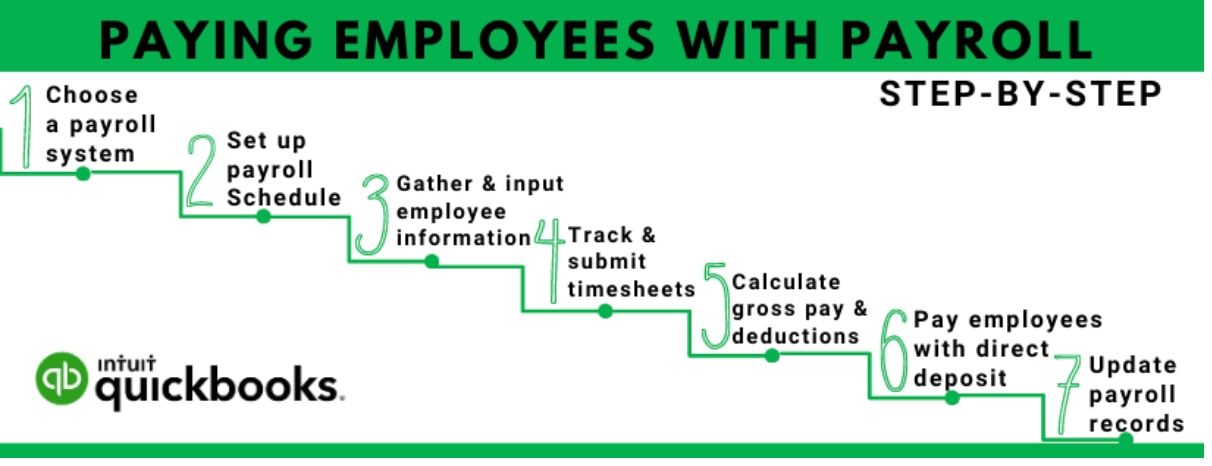

Step 3: Gather Employee Information

Once you’ve hired someone to work for your business, you will need to gather pertinent information from the new employee. It is best to collect this information before they start working to ensure that all required paperwork is complete.

Typically, you can provide your new hire with an Employee Information Form, which will allow them to write down all applicable information in one place and hand it back to you. This form should include spaces for:

- Social Insurance Number

- Their full name as it appears on their bank account that will be used for pay

- Bank account details, including their account number and financial institution branch number – a void cheque or direct deposit form will provide the information you need to set up a direct deposit to their account.

- Date of birth

- Gender

- Employee’s current address

- Their contact information with the phone number they can be reached at

- Emergency contact information

On top of the personal and banking information, Canadian employers must also obtain a completed TD1 Personal Tax Credit Return form from their new employees. This form helps businesses determine how much tax they should deduct from the employee’s income.

All provinces except Quebec will be required to use the TD1 form. These employers will need to obtain a complete TP-1015.3-V form, the Source Deductions Return form, from new hires for businesses located in Quebec. Canada Revenue Agency will require these forms during tax season to ensure that companies pay the appropriate payroll taxes for their company’s staff members.

Other business-related information needed includes:

- Hire date of the worker

- Assigned employee number

- New role title, internal department names and codes

- Hourly or salaried wages, part- or full-time employment

- Any bonuses

- Deductions: Canada Pension Plan and Employee Insurance

- Benefits package, if applicable

- Vacation or holiday information