What Information is on a Pay Stub?

Pay stubs vary depending on state employment laws and industry requirements. For instance, New York requires food service businesses to include a breakdown of tips and wages earned on each pay stub. If the employer provides a uniform or meals, those must also be included as “allowances” or “credits.”

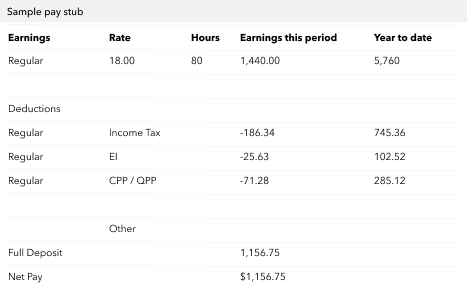

Here are other common items you might expect to see on a pay stub:

- Employee details

- Dates covered

- Gross wages

- Net wages

- Hours worked

- Rates paid

- Deductions

- Year to Date

Gross wages

Gross wages are the full amount an employer pays before deductions. This pay often includes more than the employee’s regular wages. Overtime pay and additional income, such as paid time off, bonuses, and payroll advances, are also included under gross wages.

Gross wages are calculated differently for salaried and hourly employees. To calculate an hourly employee’s gross wages for one pay period, multiply their hourly pay rate by their number of hours worked. To calculate a salaried employee’s gross pay for a single pay period, divide their annual salary by the number of pay periods in the year.

Typically, pay stubs for hourly workers show the number of hours the employee worked. Salaried employees’ pay stubs may also show the number of hours they recorded working if they track their time. If the employee works over 40 hours in a week and is eligible for overtime pay, those hours should be on their pay stub.

Deductions

Deductions are cash amounts taken out of the employee’s gross wages. They include taxes, contributions, and even allowances like meals.

Typically, on pay stubs, deductions are shown in two places: deductions current and deductions year to date. Current deductions are deductions being taken out of the current pay period. Year-to-date deductions are totals for each type of deduction. For instance, income taxes are taken out for each pay period. So the pay stub would show an amount being deducted for that pay period and the total amount deducted for the year so far.

Taxes

Taxes are often listed as deductions on employee pay stubs. Most commonly, they include taxes that go toward EI and CPP and federal and provincial income tax deductions. Tax amounts tied to the employee’s Form TD1 might be changed at the employee’s request, especially if they’ve indicated additional withholdings. The CRA sets tax rates.

Federal Income Tax: Calculate the amount of federal income tax to deduct from your earnings. The tax system in Canada is ‘progressive’. This means that the more income earned, the higher percentage of income will go toward taxes.

Provincial Income Tax: You will also calculate the amount of provincial income tax to deduct from employee earnings. This amount will be lower than the federal tax and is different in each province.

Canada Pension Plan (CPP): For those 18 years old and over, it is mandatory for a . 4.95% deduction from gross earnings over $3,500 until the maximum annual pensionable earnings is reached. Find the most recent maximum contribution here.

Employment Insurance (EI): 1.78% is deducted from gross earnings until the maximum contribution is reached. Find the maximum annual insurable earning here.

Unsure of how much you have to deduct from your employees paycheque? Try our payroll calculator for an accurate result every time.

Contributions

Contributions are another kind of deduction. But if the contribution comes from the employer, it may be included in the employee’s gross wages. For instance, say an employee contributes 3% of every paycheque to a RRSP, and their employer matches that contribution. The employee’s contribution would be a deduction from their paycheque, while the employer’s contribution would be listed as part of the employee’s gross wages.

Contributions will vary depending on the benefit opportunities offered by the employer. For instance, an employee might request that a small percentage of their paycheque be put toward an employee stock purchase plan (ESPP). They might make contributions to a pension or have a small sum taken out of each paycheque as a nonprofit donation.

Net pay

Net pay is the amount left over after deductions have been taken out of the employee’s gross pay. Net pay is often called take-home pay. It’s the amount the employee receives when they are paid, either by direct deposit or a paper cheque.

Depending on the size of the deductions, an employee’s net pay may be significantly lower than their gross pay. On the employee’s pay stub, net pay is recorded both for the pay period and cumulatively for the year.

Year to date

Year to date is used on pay stubs to keep track of the amount of something since the first day of the year or the first day the employee started working in the year. Many pay stubs will keep a running total of your employees’ earnings and deductions for the year. For example, if an employee’s YTD earning on March 1st is $9,000, that means from January 1st to March 1st, they have earned a total of $9,000.