Best practices for implementing ABC analysis

ABC analysis works best when applied consistently and reviewed regularly. Here are some best practices when implementing ABC analysis in your business:

Keep inventory classifications simple

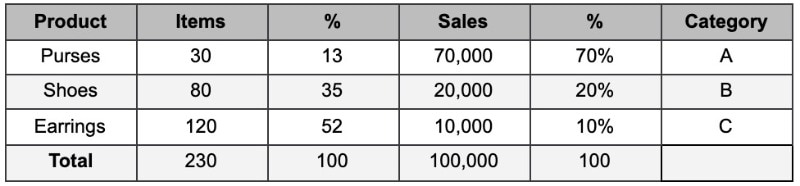

With the goal of streamlining your inventory management, the classifications of your ABC analysis are best kept simple. It should be easy for your teams to know which products belong to specific classes immediately. For example, common classification methods are according to the product's price or sales frequency.

Set labor levels according to classification

Each classification should be assigned its labor level or the number of hours dedicated to working on the particular inventory class. Naturally, the more value or impact the class has on the business, the higher labor levels should be allotted to the classification.

Review each class individually

Every classification should be measured against its own rules set by the initial ABC analysis. This includes a different set of KPIs, performance reviews, and approach to reordering or selling any overstock.

Revisit original classifications

The initial ABC analysis took into account the types of products and business status at that point. As inventory and markets change, it’s important to revisit the existing classifications and reclassify, if necessary. Consider consumer trends, new industry competitors, and changes in sales per class and product.

Utilize software tools and data

Inventory software can help track all the changes in product turnover and sales. With an established set of rules and actions, you can easily use an inventory management system to automatically track and create reports to highlight any key areas of improvement.