If you’re self-employed or run your own accounting firm, the question of how much to charge each client is one you probably encounter quite frequently. But what about the method by which you charge your clients? Is it better to invoice clients a flat fee for your services or to charge by the hour? The answer depends as much on your own preferences as those of your clients.

Invoicing Clients: How to Price Your Accounting Services

Why Your Pricing Method Matters

If the total amount comes out to about the same, does it really matter how you charge? For some accounting firms, either method works fine. For others, pricing can impact both what you make and how your clients perceive you. And that can affect your future business. The key is balancing an adequate income for you and attracting new clients. Some clients may prefer paying by the hour, while others prefer a flat fee because they know what to expect upfront. Understanding the differences in the two client invoicing methods helps you decide what works best for your firm.

Charging a Flat Rate for Services

When you create your invoice for accounting services based on a flat rate, you set a specific price for a specific service based on the value of that service to a client. To calculate your rate with this method, decide on a target hourly rate you want to make and then figure out how many hours you typically spend on a particular service. For example, if you charge $30 an hour to review a client’s quarterly revenue and it takes 40 working hours to complete the task, that service is worth $1,200. Add up the total value of all the services you perform during a contract, and you get a flat rate to quote to a client. This method works best if you have a solid understanding of how long different account tasks take you or your employees to improve the accuracy of your rates.

Charging by the Hour

Another option is charging your clients by the hour. You set an hourly rate, and you base client invoicing on the total number of hours you work on their project. You simply keep track of how many hours you spend working for a client and bill at the end of an agreed-upon cycle, whether that’s weekly, bi-weekly, or monthly. An hourly invoicing method might also mean you get to stick to a more traditional accounting role, working on whatever needs to be done to keep your client’s books up-to-date.

Hourly billing works particularly well if you tend to work in-house for a client during your contract period. If a client can see that you’re physically in the building, working like any other employee, there shouldn’t be too much cause for dispute. That said, not all accountants work this way, and hourly billing can be very difficult if you’re working remotely on projects for more than one client at a time. If you’re a master of multitasking and working from home, you have to be extremely organized and vigilant to keep an accurate count of how many hours you spend on each project.

Benefits of Charging Hourly

Charging an hourly rate is the most accurate way to bill for your services. After all, you end up billing for exactly the work you perform and for the exact personnel involved. You can bill for the right amount without shortchanging your company or overcharging your clients. This approach makes it easier to recoup the time of more experienced staff members who bill at higher rates. You also cut down on the need for strict contracts. If your client wants additional services, you simply add hours and bill more rather than drawing up a new contract for the additional services. This same flexibility can be difficult to maintain under a fixed-fee contract.

Downsides of Charging Hourly

As clients request additional services or cut back on services, the amount you get paid changes since you only get paid for the hours you work. This uncertainty makes it more difficult to plan and make strategies for the future. You also deal with the administrative aspect of tracking your work time. That might not be difficult if you work for only one client, but many accounting firms have multiple clients on their roster. That means you need to track which employees work on each project. If you switch to work for a different client, you need to remember to document when you start and stop each project. You must keep detailed records about when you work, what you complete, and who completes the work. Those record-keeping tasks can take you away from your actual accounting work, which lowers your hourly rate. Otherwise, there is not enough information to pass along to your clients when you produce your invoice.

You also deal with the potential of clients disputing the figures you report. People outside of the accounting industry may not understand why your work takes so long to complete accurately. They may think you’re padding your hours to get more out of them. It’s understandable that a client wants to keep their costs as low as possible, but that questioning also eats away at your work time and may force you to lower what you charge, which makes you lose money. It’s also worth mentioning that a client may be less eager to agree to an hourly rate if they haven’t worked with you before or aren’t sure of exactly what they need. It’s often easier for a business to budget for a set rate and selection of services than it is to pay an hourly rate without knowing how much that ends up being beforehand.

Benefits of Flat Fees

Implementing a flat-fee structure eliminates many issues with billing your clients. Since you and your client know the final dollar amount upfront, you can develop a payment structure so your client knows the exact amount due on certain dates. Because your clients agree to rates upfront, there is little room for disputing the charges. As long as you cover you bases about the specific services you provide for the fixed fee, the contract with your client is straightforward. This approach also helps you forecast cash flow, as you should have a pretty good idea of what you expect to collect and when. You also eliminate the extra time-tracking responsibilities that come with charging hourly. Pricing accounting services with a flat fee requires a solid understanding of your own work habits and the scope of the client’s needs, but it’s often much easier to negotiate a fixed price with a client than it is to figure out an hourly rate.

Downsides of Flat Fees

With fixed-fee billing, unforeseen events may result in more work for you. To explain, imagine you initially meet with a client and propose a quote based on the information provided. The work takes much longer than expected. As a result, the initial quote no longer matches the workload, and you earn less than you need to cover your time and expenses. As a new accountant, you may underestimate how long it takes to complete a certain task, which can also lead to undercharging and lowering your hourly rate. But if you set your flat fee too high, you run the risk of overcharging your clients or setting rates that scare clients away because of the high cost.

Choosing a Pricing Method

When you first start out, hourly billing is often the easiest method because you may not know for sure how long different services typically take you. By charging hourly, you ensure you get paid for all of your work. For example, helping a client properly record invoices and receipts may be fairly simple, or it may be a nightmare if your new client just presents you with a box full of unorganized paper.

As part of determining how to price your services, consider how much income you need personally and for your business. Be sure to figure in all of your operating expenses, such as computers, internet fees, and software costs. When you first start growing your business, you may spend a lot of your working hours on marketing and soliciting new clients, so those hours aren’t billable. Charging a sufficient rate for your billable hours helps you make up for those other activities that don’t generate revenue.

You should also do some research on the rates other accountants in your area charge so you can set your rates competitively. When you first start your new business, it’s probably unrealistic to try to charge top dollar for your services. You want to be a competitive firm , but you also don’t want to set your prices extremely low in comparison to other accountants because you want clients to view you as being among the best. Setting your prices too low communicates the unwanted message that your services aren’t that valuable. One way you can support the price of your services is by pointing out how much money you save a client by effectively giving them access to sophisticated accounting software or offering other value-added services.

Changing Your Pricing Method

At some point in your career, you may want to transition from one type of billing method to the other. It’s a good idea to give your clients sufficient notice. The shift has a greater impact when going from hourly to flat fees. Flat fee agreements require heavier communication and contract development upfront. You must also ensure you foster trust with your clients, as the proposition to pay a set amount for services may drive some clients away. On the flip side, if you switch from fixed-fee billing to hourly billing, you need to find and integrate software to help with time tracking.

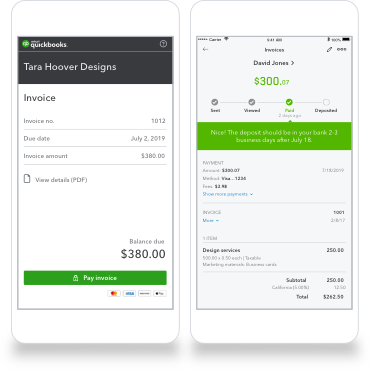

Pricing correctly right from the beginning helps get your accounting business off the ground and make it profitable. Comparing the pros and cons helps you decide which method to choose. No matter how you charge, using the best accounting software helps you maximize your work time. Collaborate with clients, stay on track, and grow your firm with QuickBooks Online Accountant. Sign up for free.”