Fill Out the Proper Tax Forms

With all of this personal and business information close at hand, now is the time to fill out the required CRA/Revenu Québec self-employed tax return forms. Here are the income tax return forms you will need to complete when filing your income tax for self-employed purposes.

The T4A Form

As a self-employed individual earning revenue from customers, you should obtain a T4 slip from your clients. This is known as the T4A form, Statement of Pension, Retirement, Annuity, and Other Income. Your clients should be sending you the T4 slip by the end of February the following year, which includes the total dollar amount for each completed job.

The T4A form is not used in Québec. If you are in Québec, you will have to fill out the provincial RL-1 slip and summary instead.

The T2125 Form

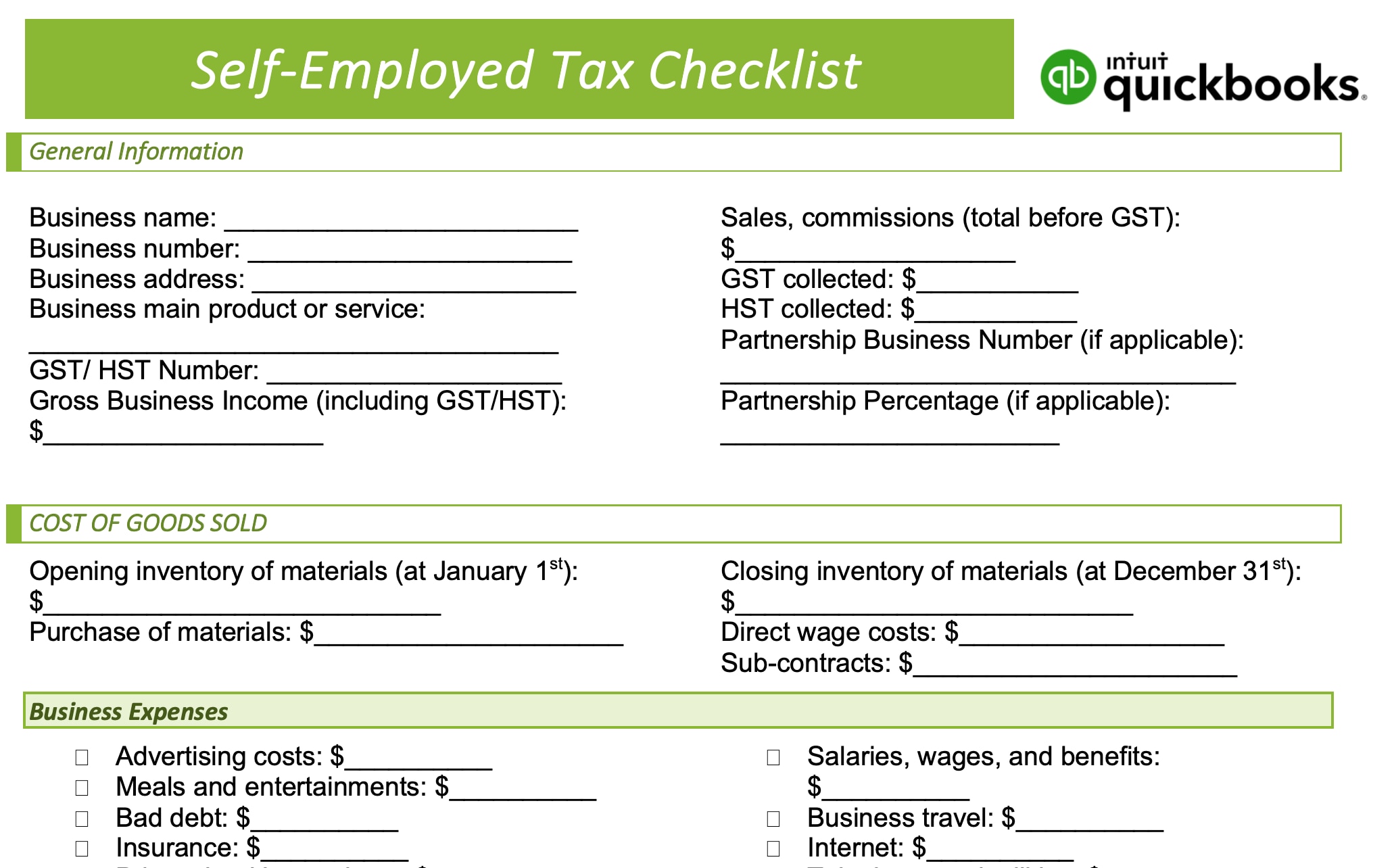

The T2125 form, Statement of Business or Professional Activities, is part and parcel of your personal tax return if you are self-employed or a small business owner. This form helps you determine your gross income, which is the total amount of money you earned in the specified tax year. This form also allows individuals to write-off self-employment expenses to lower their total taxable income.

Such business expenses that can be written-off for self-employed individuals on their personal income tax forms include:

- Office rent and utilities

- Home office rent and utilities

- Supplies

- Work-related travel costs

- Vehicle expenses

- Professional and legal fees

Industry Codes

When filling in the T2125 form, you will need to include your industry code, which corresponds to your primary business activity as a self-employed person. If you provide more than one business activity, opt for the code that most closely describes your business operations. Here's the CRA list of industry codes to help you determine which one applies to your business activity.

If you are in Québec, you will also need to fill out and submit the TP-80-V form.

The T1 Return

The T1 return refers to your personal income tax return form. When a person is self-employed, their business income is the same as their personal income. This means you will only need to fill out one return.

If you are in Québec, you will also need to fill out and submit the TP-1-V form.