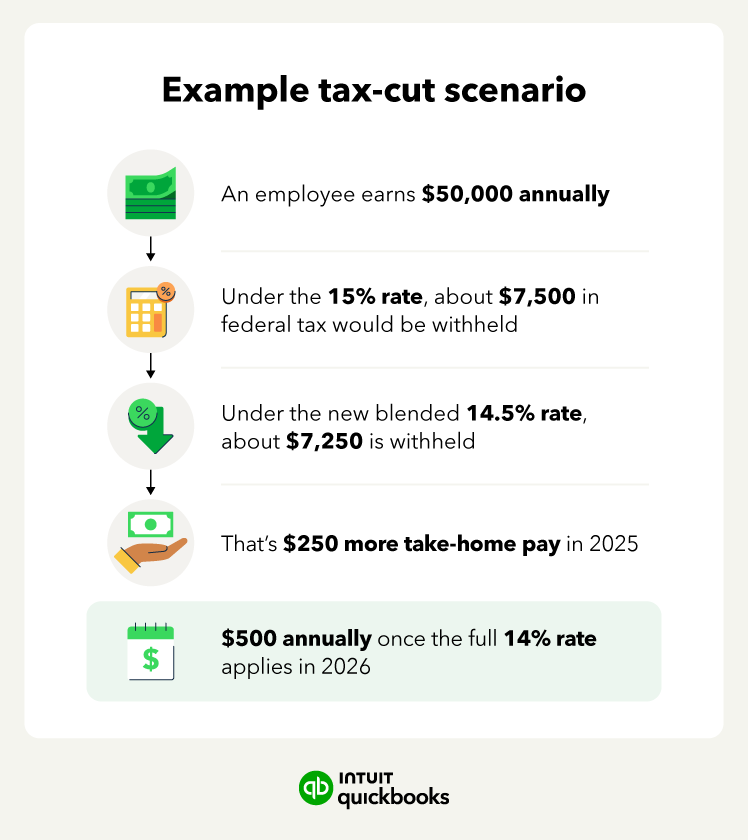

Canada’s middle-class tax cut is now in effect. On July 1, 2025, the lowest federal personal income tax rate dropped from 15% to 14%. While the one-percentage-point drop may sound minor, it affects nearly 22M Canadians through lower payroll deductions. For employers, it means updating payroll systems to maintain compliance and accurate reporting.

To adapt, you’ll need to apply new CRA tax tables, update payroll software, and review how credits flow through to employee pay. Even routine tasks—like calculating deductions or explaining pay stubs—now require closer attention. As a business owner, understanding how to process payroll under these new rules is essential.

In this blog, we’ll break down what the middle-class tax cut Canada 2025 means for business owners, payroll admins, and employees—and show how QuickBooks helps automate updates, simplify compliance, and keep payroll accurate.