A business number is a nine-digit number the Canada Reserve Agency (CRA) uses to identify your business in communications with the federal government. You also use this business number to log into the CRA’s portal when you interact with the agency’s online services.

What Is a Business Number?

When Do You Need a Business Number?

For example, if you collect GST/HST, you need a business number to submit your GST/HST payments to the CRA. If you decide to incorporate your business, it needs a number. In addition, if you have employees, collect sales tax, or deal with imports or exports, you also need a business number. Not all businesses need a business number, but it’s a good idea to have one because it makes your dealings with the CRA much more efficient.

The CRA has several program accounts you can register for depending on your business activities, and you need a business number to register for these programs. For example, when you hire your first employee, you have to sign up for a payroll account program with the CRA. Your payroll program number for payroll consists of your business number, two letters to represent payroll, and a four-digit reference number.

How to Register for a Business Number

To register for a business number online, you need your Social Insurance Number (SIN), your business name, and address, and the SINs of any other owners. If you recently incorporated, you also need incorporation documents. You may need information related to the specific program you need to use. For instance, if you’re signing up for the payroll program, you need details on your employees.

Many businesses need a business number right away, but others don't. If you start out as a sole proprietor with no employees and not enough sales to pay GST/HST, you don’t need a number. As your business expands, you may need to register for one.

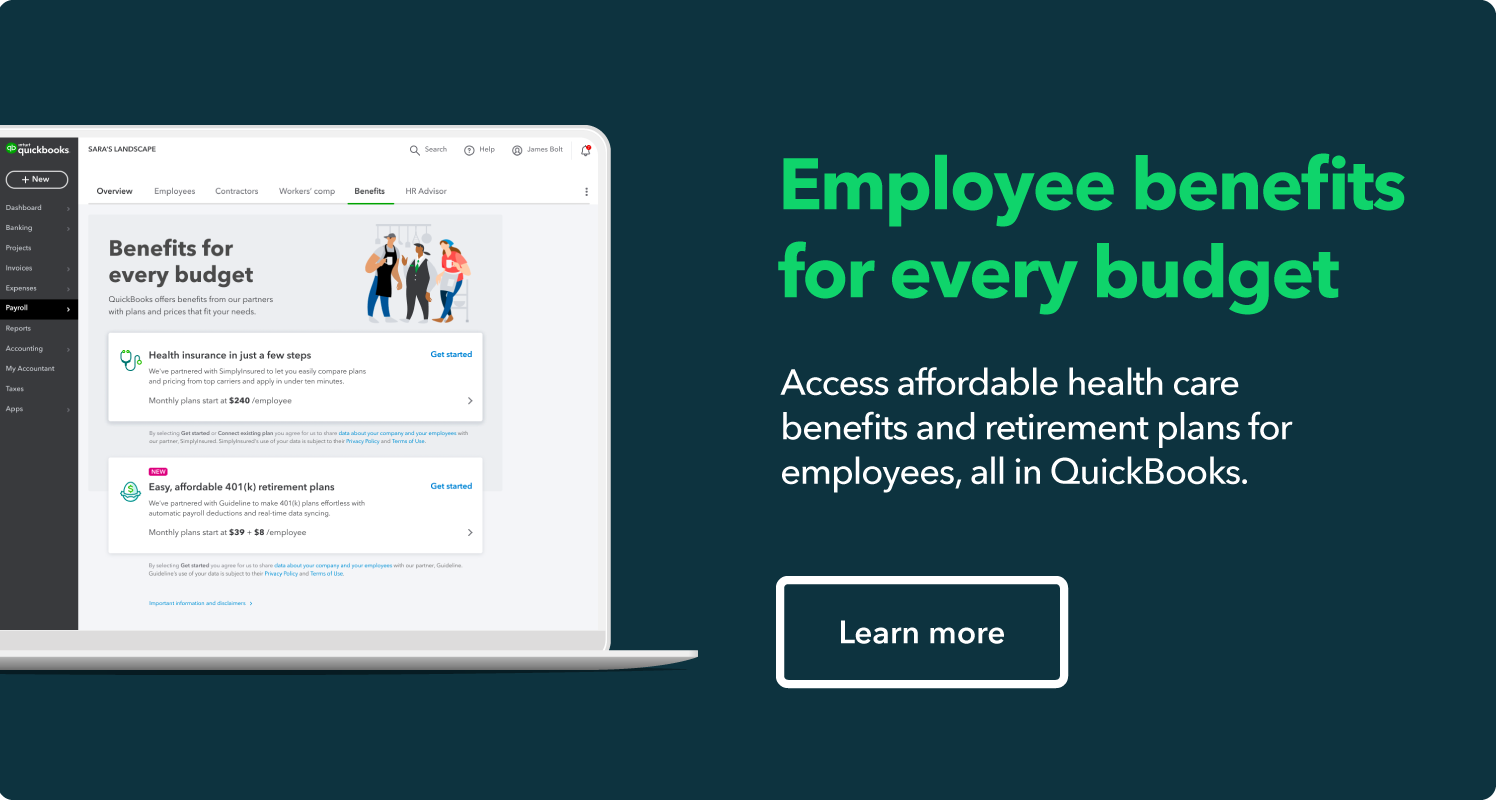

As your business grows and expands, you may also need financial software to help track expenses and manage payroll. QuickBooks Online keeps your data secure and in one place. The software also comes in handy when you need to file your tax returns with the CRA.

QuickBooks Online can help you maximize your tax deductions. Keep more of what you earn today.