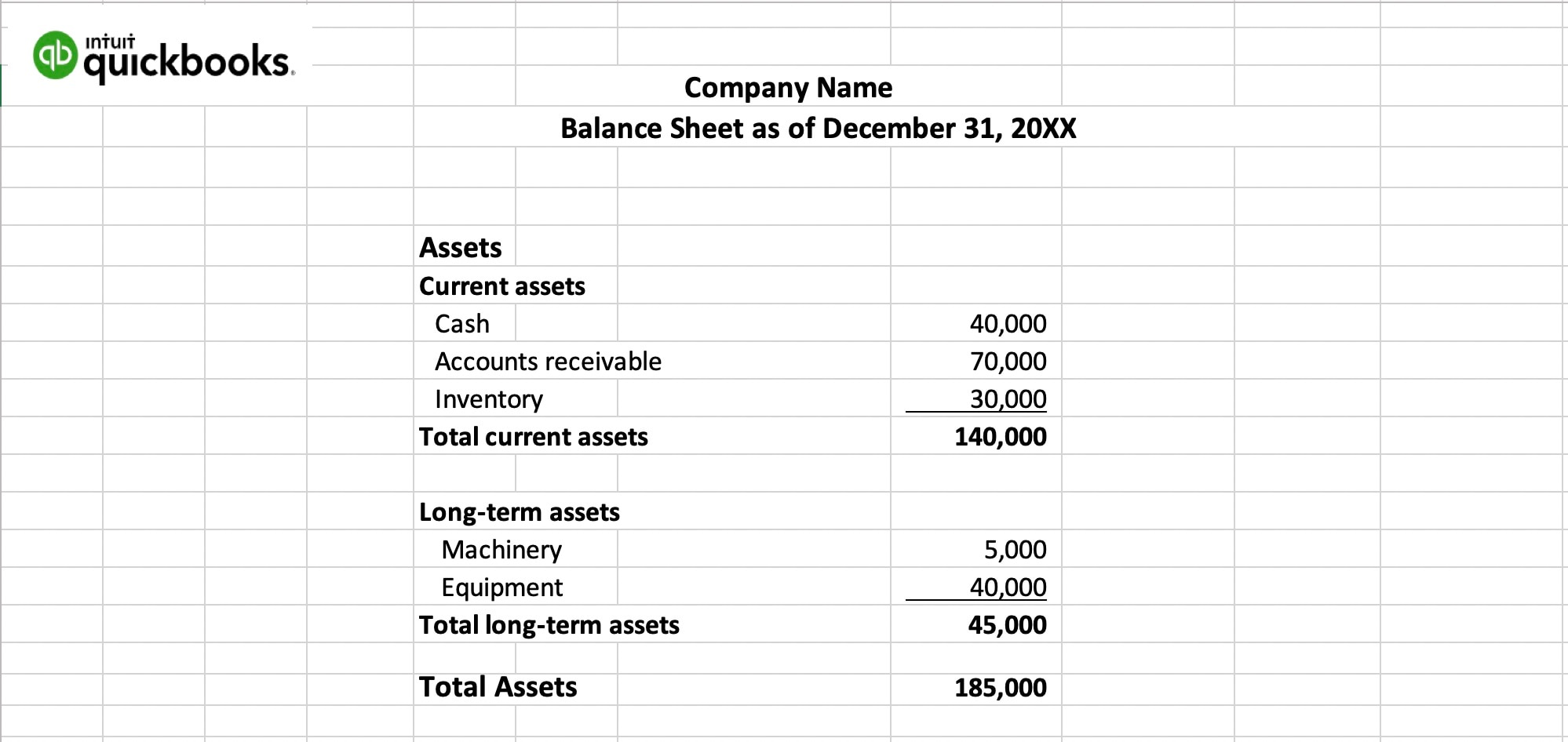

Use our guide to learn the importance of balance sheets for small businesses. Learn how to format your balance sheet through examples and a downloadable template.

A balance sheet, along with an income statement and cash flow statement, is an integral part of your financial reporting. It will give insight into what your company owns and what it owes.

No matter the size of your business, keeping financial reports is an important aspect of managing your company. Use the data found in your balance sheet to make more informed decisions. In fact, research has shown this can lead to an increase in marketing productivity by 15% to 20%.

Plus, when your balance sheets are paired with your accounting software it allows you to have a complete picture of the health of your company.

Back: What are Financial Reports?