Personal Income Tax Returns

As a self-employed individual who earns money from your professional activities, you will need to file your business and financial information together on your personal income tax return.

Self-employment is a one-person business, or possibly more if you have employees working under you. In any case, your work is your business, meaning you run a business. In doing so, you will have had to choose between structuring your business as a sole proprietorship, partnership, or corporation.

Self-employed businesses run as sole proprietorships and partnerships will file their business information and employment income on their personal income tax return. To do this, you will need to fill in form T2125, Statement of Business Activities. This completed document informs the CRA of your self-employment income information, where you will also be able to claim back deductions.

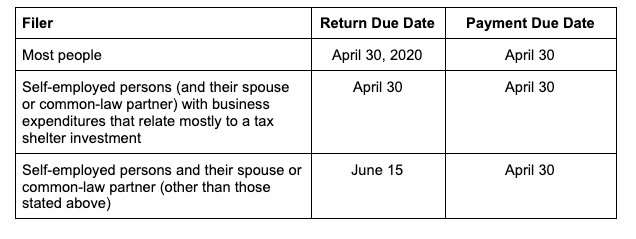

The T2125, alongside your other financial documents, will make up the T1 General return, which must be submitted to the CRA before the appropriate filing due date. If you are part of a partnership, further forms are required as part of the return, namely the T5013 Partnership Information Return.

If your self-employed business is incorporated, then your tax return filing process and deadlines will differ.

Find out more information on small business tax deadlines and how your business structure will dictate your tax deadlines.