Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've taken over helping reconciling a previously set up account. They have two credit cards/users on the same account. In Quickbooks it has them listed separately but they are included together on the monthly statements. How do I fix this so I can properly reconcile the monthly statements since they aren't connected in Quickbooks?

Great to have you here in the Community, @massey222. I’ll help you with reconciling your bank accounts in QuickBooks Online (QBO).

The first bank account must be set up as a parent account, while the second must be set up as a sub-account.

Although, for reconciliation purposes, we must add the bank account (parent) before setting up the credit card accounts as sub-accounts. Because all transactions from the sub-accounts are rolled up into one, you'll only need to reconcile the parent account.

Also, the transactions will remain intact since we’re only adding the parent account.

Here’s how you can add the parent account:

Next is to set up the credit card sub-account. I’ll show you how:

Moreover, you can check out this article about bank or credit card subaccount setup.

Furthermore, you can utilize this article to reconcile your account in QuickBooks Online.

Let me know if you need further assistance with banking transactions. The Community always has your back. Have a great day!

Is there any way to do this after the fact, after two credit cards have been listed as their own parent accounts? The 2nd card has been used for a year (before I took over cleaning up & helping categorize). So it won't let me change it now. Does this mean I'd have to remove the 2nd card, reconnect it to Quickbooks like a new account & then newly re-categorize everything?

Thanks for updating this thread, Massey.

I'm joining the thread to share some insights about this banking concern. If the two accounts are not yet connected to online banking, you have the option to merge them, so all transactions go into one account. This way, you can reconcile them properly.

The merging process is recommended if you have the following scenarios:

Once done, follow the steps below to merge the two registers. Don't worry, you will not lose any transactions during the merging process. All entries will go to the winning account (active). Follow the steps below:

Once merged, connect the correct parent account to online banking. These are the steps:

The system does not allow connecting both parent and sub-accounts for online banking. If all transactions download to only one account, connect only the parent account. To guide you further, check out this related link to learn about the connection in QBO: About bank or credit card subaccount setup.

We do not recommend merging if the account is still actively downloading transactions in QuickBooks. This is because online banking downloads data based on your bank info and credentials.

If you want to merge accounts that is still connected for online banking, you will need to disconnect the connection first. Then, add the new account information as a separate register in the Chart of Accounts and merge them afterwards.

I've outlined the steps for you below:

Next, add the new account information by going to the Accounting tab then Chart of Accounts. Tap the New button then add a new name for the updated credentials. Skip this step if you already have the account added.

I'll be right here if you need further help with our banking process. Message us anytime. Have a nice day!

I have a Chase Business credit card account that has two employee cards. They are both linked to my bank, and have separate registers. Can you please provide me with the steps to combine the two cards on to one register. The main account (Chase Credit Card) has 17 years of data and the (Credit Card) account has this 2022 year on it. I would like not to lose any data.

I’m here to guide you with merging your account in the Chart of Accounts (COA) in QuickBooks Online (QBO), @Rhusch.

To combine the transactions into one register in COA, you’ll need to merge them or set a parent account and add the two employee cards as sub-accounts. Since you mentioned that the credit cards have already been connected to your company file with a separate register, you will have to disconnect the two employee cards first and set their registers as sub-account.

Take note that before disconnecting your online banking, please ensure that all transactions have been categorized. Otherwise, all uncategorized transactions will be deleted.

Afterward, use your Chase Business Credit Card account as the parent account. Then, add the two employee cards as a sub-account. To do so, you can follow the steps below:

Once sorted out, reconnect your bank to keep receiving your latest bank transactions. Then, learn to categorize and match this to the correct category and reconcile after.

Feel free to comment below if you have more questions regarding this or any QuickBooks concerns. I'll be here to help. Have a good one.

RoseJillB, I have this set up already and have been using parent accounts like how you explained it. Throughout the years employees have had company credit cards and some have either lost the credit card and we opened a new one or have canceled cards for employees who are no longer with us. However, their cards are still "active" in QB and I would like to make them inactive so that they do not show up on reports, etc.

However, they look like they have balances since reconciling is done in the parent card register and the card as a whole is paid off monthly in the parent, not each individual card. Therefore, I can't make the card inactive since it does not have a zero balance (even though it does).

What is the best way to zero the cancelled cards, either create a journal entry or something else?

RoseJillB, I have this set up already and have been using parent accounts like how you explained it. Throughout the years employees have had company credit cards and some have either lost the credit card and we opened a new one or have canceled cards for employees who are no longer with us. However, their cards are still "active" in QB and I would like to make them inactive so that they do not show up on reports, etc.

However, they look like they have balances since reconciling is done in the parent card register and the card as a whole is paid off monthly in the parent, not each individual card. Therefore, I can't make the card inactive since it does not have a zero balance (even though it does).

What is the best way to zero the cancelled cards, either create a journal entry or something else?

Thanks for getting involved with this thread, CR92323.

To properly identify how you should go about zeroing out cancelled credit cards, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form:

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

If there's any additional questions, I'm just a post away. Have a great day!

I disconnected both accounts from online banking, made them parent and sub account, but when I try to reconnect them to my bank, QBO gives the message, "The account {} has a parent account that is already connected to an account at one of your banks and won't let me complete the link. Any suggestions?

Hello there, @JStrieber.

Let me share information about connecting parent and subaccounts in QuickBooks Online.

In QuickBooks Online, you cannot connect to online banking for both the parent and subaccount. It will only allow you to connect the account where the transaction flows.

Do you know what account your transactions flow? If they flow in the parent account, connect the parent account only. If they are in the subaccounts, connect the subaccounts only.

Here's how:

To guide you further, check out this related link to learn about the connection in QBO: About bank or credit card subaccount setup.

Moreover, I've added this article as your guide in categorizing transactions: Categorize online bank transactions in QuickBooks Online.

Let me know if you have questions about connecting bank accounts in QuickBooks Online. I'm always here to help. Have a great day.

Hi! We have the same situation and need some support. We have 2 Chase Business Cards (let's call them Card A and Card B) which different numbers but they roll up to the same account that we reconcile in Quickbooks as a Parent Account. My issue is the cards say the following:

Card A - $0 balance, $18k in Quickbooks

Card B - $3k balance, - $19k in Quickbooks

Why is it negative and can we correct this? We do have a $3k current balance which we'll pay after we reconcile our June Statement.

The differences you're noticing between your Chase cards and QuickBooks may be due to how transactions have been recorded or categorized in QuickBooks, StephGer.

The Bank Balance shows the actual amount currently available in your bank account based on the latest statement or real-time data from Chase. If this balance appears to be incorrect, we suggest clicking the Update button to refresh the latest transactions.

In contrast, the QuickBooks Balance represents the total of all transactions (expenses, payments, adjustments) that you have entered in QuickBooks for the account. This balance is dynamic and updates automatically as you add, edit, or delete transactions.

To resolve the discrepancies, it is essential to review and compare your QuickBooks records with your bank data. You can follow these steps:

After making the necessary adjustments, initiate the reconciliation process. It will help you confirm that the transactions in QuickBooks match your bank statement, and you can identify any remaining discrepancies.

You may also want to check out these articles that can help you generate your reconciliation report and learn how to use bank rules to categorize transactions from your bank automatically:

If you have any additional questions or need further assistance, feel free to revisit this thread. We are here to help you.

Hi, while this is extremely helpful, I don't think you fully understand what my issue is.

We receive 1 statement from Chase bank each month (that covers both cards) and make 1 payment, which hits our parent reconciliation credit card account. We reconcile the 1 parent credit card account monthly and have no issues.

Card A - has a positive quickbooks balance.

Card B - has a negative quickbooks balance. Why is this?

I appreciate you getting back to us, StephGer. Let's dig into why your Cards A & B show positive and negative amounts in QuickBooks.

Card A shows a positive balance because of overpayments, refunds, credits, or misclassified transactions. Meanwhile, Card B shows a negative balance due to unpaid charges, incorrect payment allocation, or missing transactions.

To fix this, review how payments were applied and correct any misclassified transactions. By reviewing each account individually and cross-checking with your Chase statement, you should be able to identify and resolve the discrepancy.

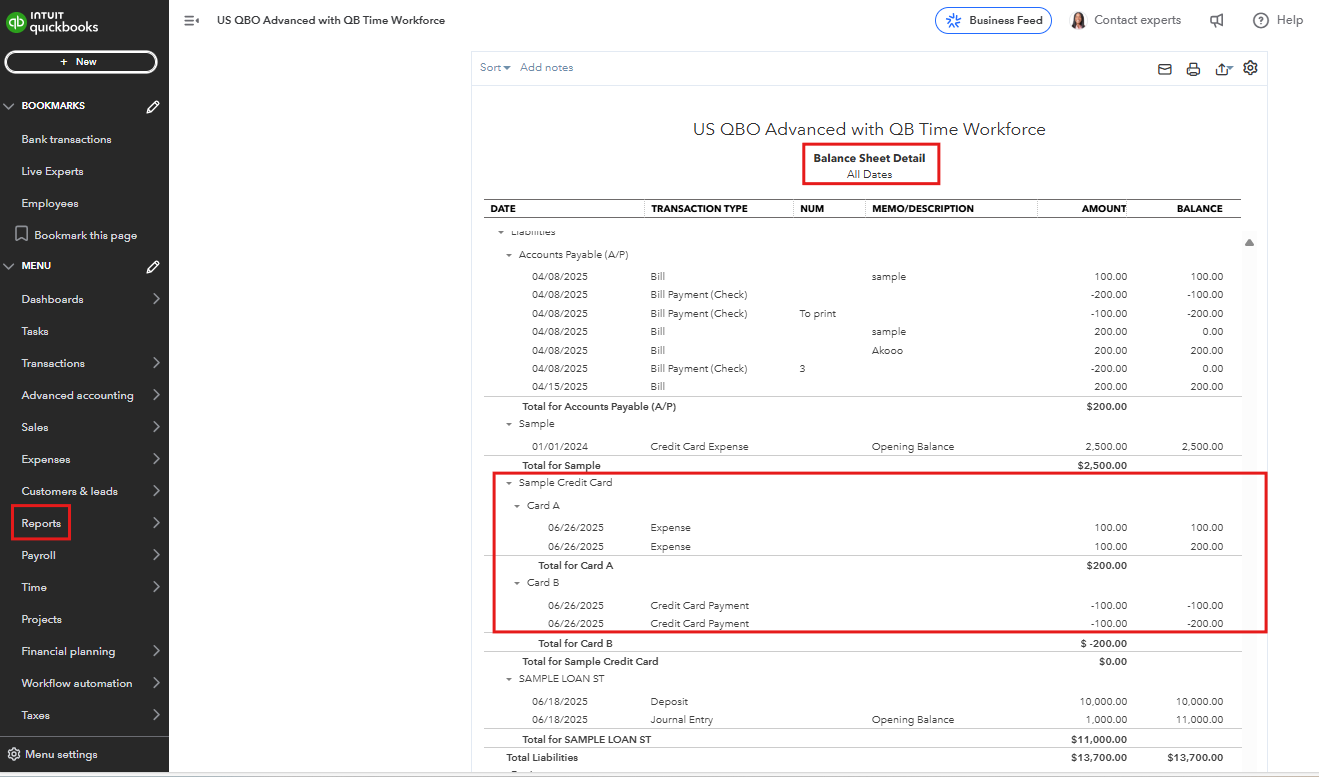

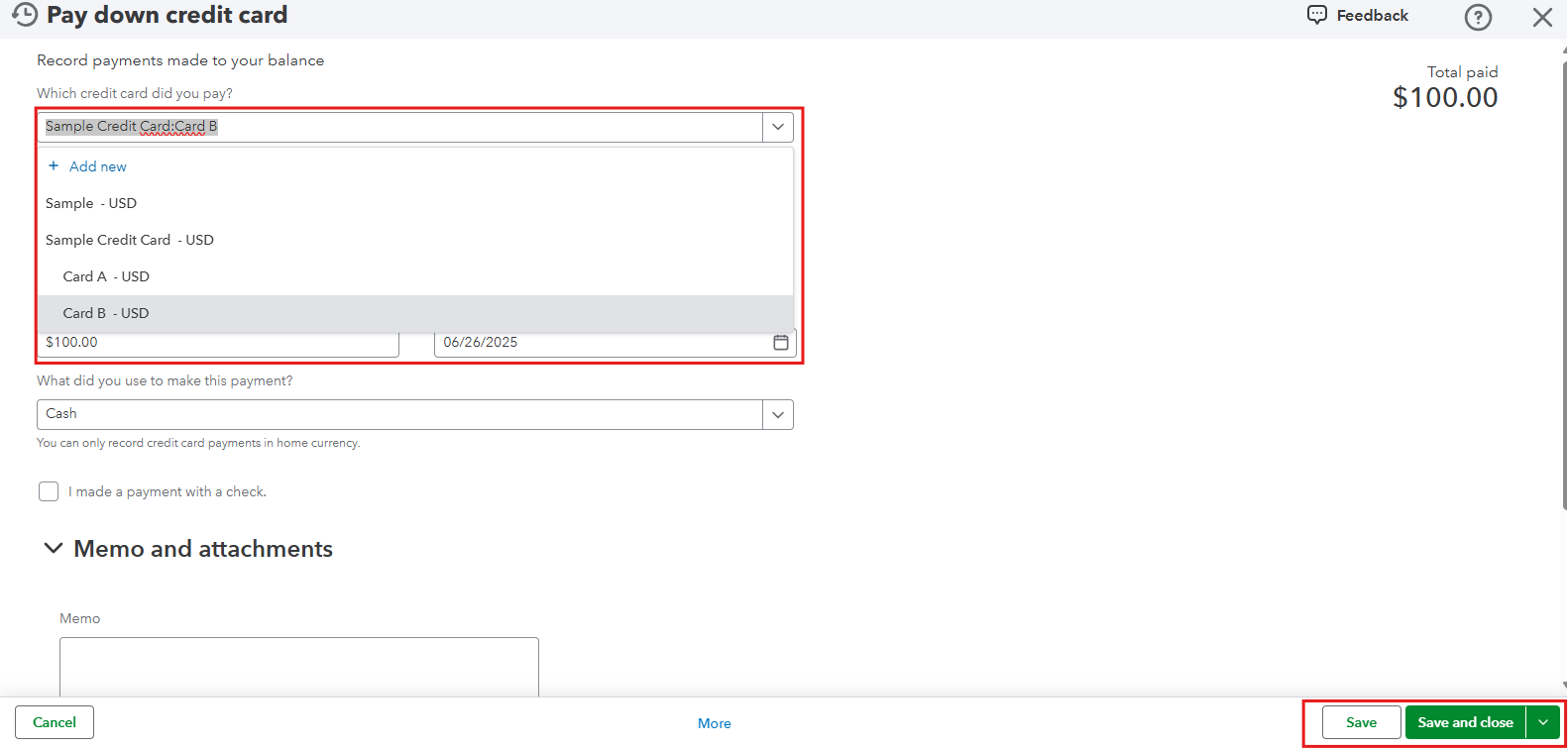

You can run the Balance Sheet Detail report to review the transactions. Then, edit the transactions and assign them to the correct card via the Transaction Details.

Here's how:

Once everything is fixed, refer to this guide for various methods to help you reconcile your online transactions: Reconcile an account in QuickBooks Online.

On top of that, you can use this article to help you review your beginning balance to ensure accurate numbers in QuickBooks: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

I'll be around if you need additional help with your banking transactions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here