Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt’s nice to see you today, katie28.

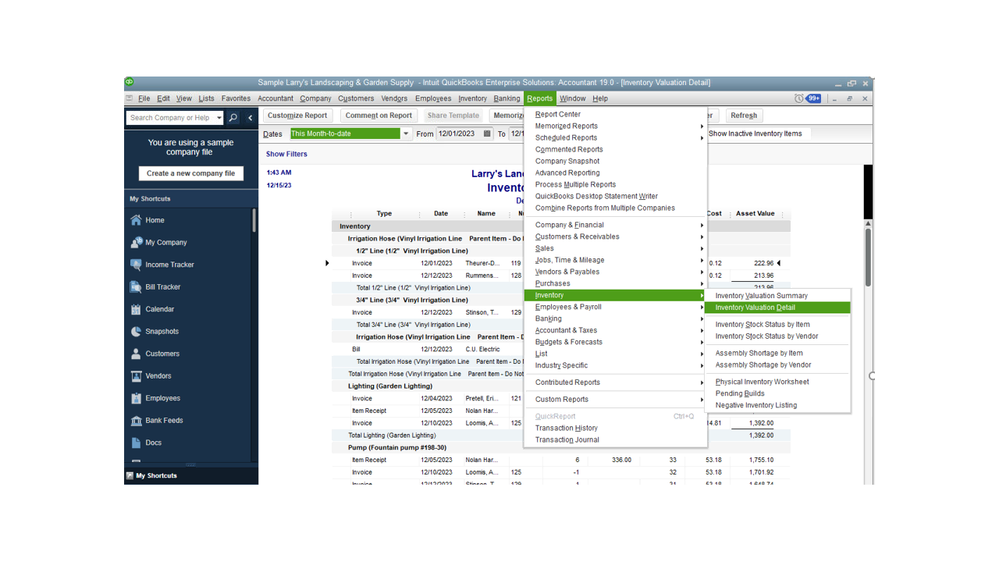

Let me welcome you first to the Intuit Community. The Inventory Valuation Detail Report will show all the data you mentioned above.

It also lists the transactions that affected the value of your inventory during a particular period. With just a few clicks, you can easily open the report.

For future reference, check out the following article. It provides an overview of how to resolve inventory issues: Common QuickBooks inventory accounting mistakes.

I want to make sure you have the information you need, so post a comment below if you have any other concerns. I’ll pop right back in to assist further. Enjoy the rest of the day.

I cant find "Avg Cost" in this report, where I can find a report with my inventory and my avg cost? Thank you

I cant find "Avg Cost" in this report, where I can find a report with my inventory and the avg cost? I'm using QB desktop 19.

Thank you for joining in the thread, @Aar0nBr.

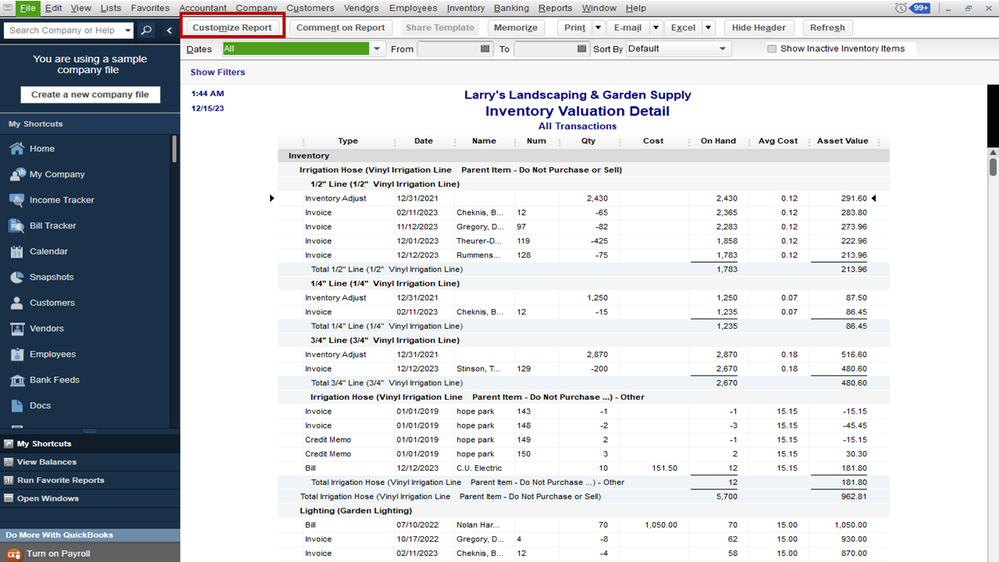

I've got some additional information that'll help make the average cost column appear on your Inventory Valuation Detail report.

It seems that this column was hidden in the display settings. You can check this out by performing the steps below:

You should be able to see the column of the average cost after trying this out. For other information you need to customize on your report, you can refer to this link: Customize reports in QuickBooks Desktop.

Keep me posted if you need anything. I'm here to help. Have a good one.

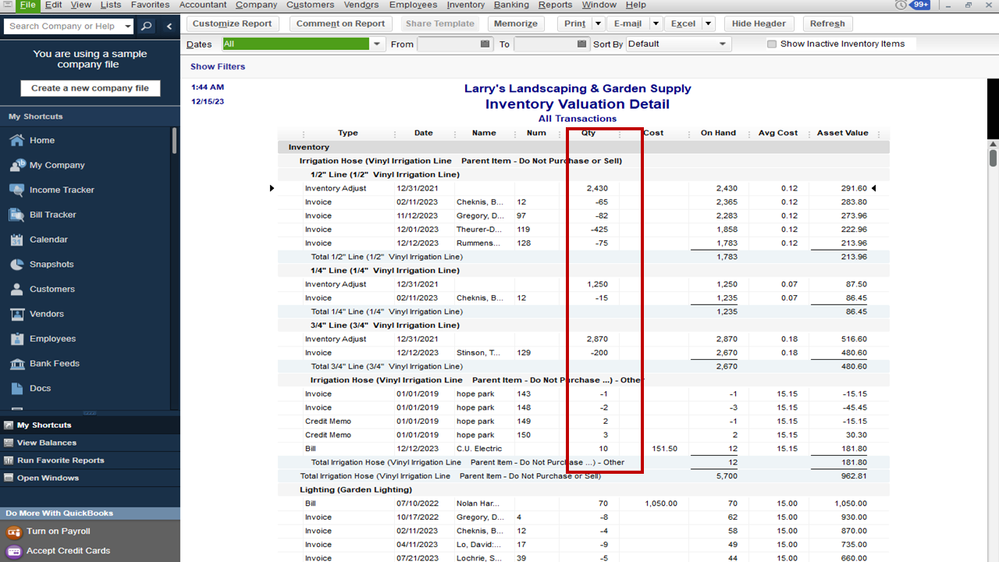

Thank you so much for your quick response, is exactly that I'm looking for, now my question is.. how this avg is calculated.. how this avg is affected if my cost always has been the same? This product has a 2.25 cost this year.. and in this report, there is 5.14, 208, -42.23 ... 8.8.. (I just trying to understand how this avg is calculated.. If anybody can help me with this, it would be great. We need to be sure that P&L is correct at the end of the month.

Thank you!

Thanks for the reply, @Aar0nBr.

I'm here to explain more about how the Average Cost is calculated in QuickBooks Desktop.

QuickBooks uses the Weighted Average Cost to determine the value of your Inventory and the amount debited to COGS (Cost of Goods Sold) when you sell Inventory. The Average Cost is the sum of the cost of all of the Items in Inventory divided by the number of Items. You can refer to this Community Article that provides more information about Inventory: Understand inventory assets and cost of goods sold tracking.

If you have any additional questions or concerns, please let me know! Have a nice day.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here