Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, Okie129.

I'm here to guide you on customizing reports in QuickBooks Online to display data from a particular period.

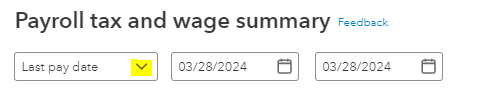

Reports give you a snapshot of your business and tell you about its different aspects. The Payroll Tax and Wage Summary report shows total and taxable wages that are subject to federal and province/region/state withholding.

Here's how to customize it to fit your business needs better:

To learn more about generating payroll reports in QuickBooks, please refer to the following articles:

If you ever need to export a report, here's a guide on how to do it: Export your reports to Excel from QuickBooks Online.

If you have any other concerns about running and customizing reports, please don't hesitate to leave a reply below. I'm always available to assist you.

I understand how to get a report, but since we went from desktop to online, we had to enter the YTD figures for the first two quarters of 2023. The report has figures that include both quarters. Is there an easier way than to manually figure it from the 941's that were submitted and subtract the 1st quarter from the totals on the report?

I understand the challenges in trying to separate the year-to-date payroll figures in QuickBooks Online (QBO), Okie. I'm here to share insights about this.

The report will depend solely on the data you've entered into QuickBooks. In this case, you'll need to run payroll reports as a reference in getting the data. Then, export it to Excel and manually calculate for each quarter.

Here's how:

Also, I've added an article about how to filter and customize reports in QuickBooks Online:

Keep us posted if you need further assistance generating payroll reports in QBO. I'm always here to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here