Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, assaf. Happy to chime in and show you how to produce a DE-9c report in QuickBooks Online.

We can run Payroll Tax and Wage Summary report to give us an overview of your employee's taxable wages. It also shows you the taxes withheld from those wages.

Here's how:

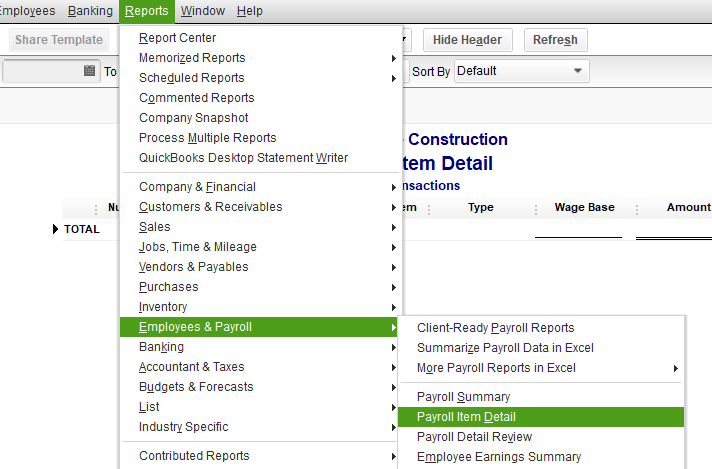

1. Go to Reports on the left panel then, click the Standard tab.

2. In the Find report by name field, search for Payroll Tax and Wage Summary.

3. Select a Date Range from the drop-down

4. You can run a report per location by selecting a specific location from the Work Location drop-down.

5. Once done, click Run Report.

In case you'll need to print the report, click the Share drop-down on the top right corner and select Export to Excel.

I've got some resources that you might need for additional information on how to manage quarterly tax forms in QuickBooks.

Stay in touch if you have other concerns about the DE 9C form. I'll be around to help you.

How is this done in the Desktop version? Thank you!

Hi there, Rebecca125.

I'll make sure you'll be able to produce a CA De-9c report in QuickBooks Desktop (QBDT).

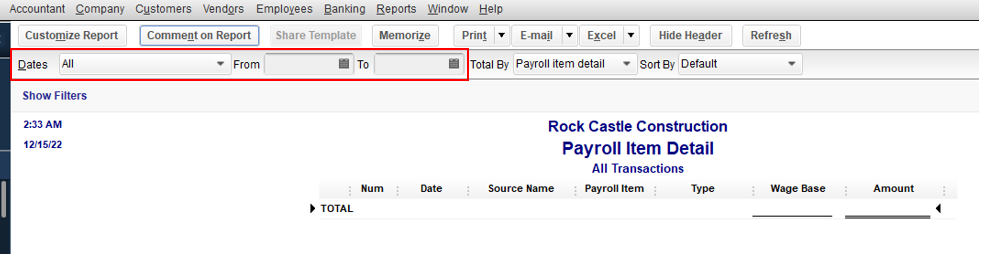

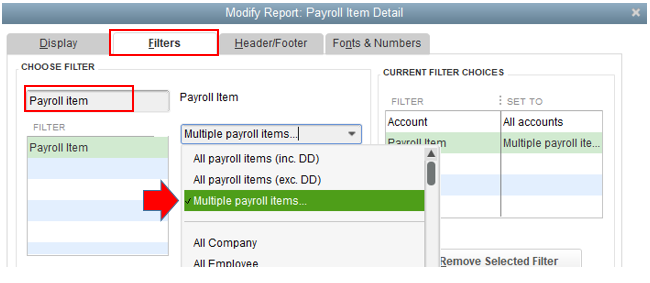

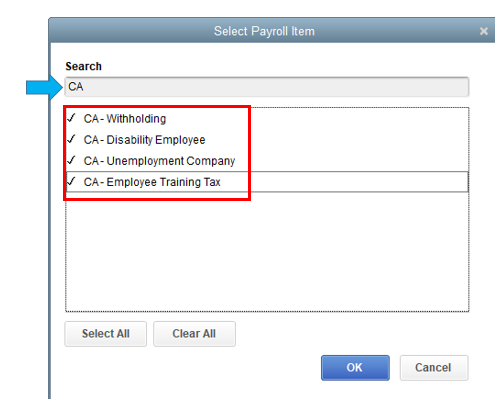

We can run the Payroll Item Detail report and customize it to show individual employee wages for each quarter.

Here's how:

To learn more about reports in QBDT and how to customize them, you can check out these articles:

Feel free to leave a comment below if you have any questions about running reports in QBDT. I'll be here to help you always.

This gets us the info that MAKES UP the DE9C report, but this is NOT a DE9C report.

This report is needed for a variety of reasons. Currently I need THIS report (that I USED to be able to access) for an insurance company to prove who worked last quarter.

Shame on you Intuit for taking away access to this report for Desktop users!

Accessing the CA DE-9C report is essential for providing employment details to your insurance company, Tom. Please be assured we'll share the steps to access the functionalities you need and address these concerns swiftly.

If you have already filed the DE-9 form, you can retrieve it from your Filing History. Before accessing this information, please ensure your tax table is up-to-date for accuracy and compliance.

Additionally, customizing reports in QuickBooks Desktop will allow you to tailor the specific data you want for your records. This feature enables you to filter and arrange data according to your unique needs, ensuring the reports you generate reflect the precise metrics and insights most relevant to your business.

If there's anything else you need as you navigate these changes after or other issues in QuickBooks Desktop, please don't hesitate to reach out as we can make this process smoother. Your concerns are important, and we're committed to helping resolve them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here