Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowIt’s nice to see you in the Community, idahoctp-gmail-c.

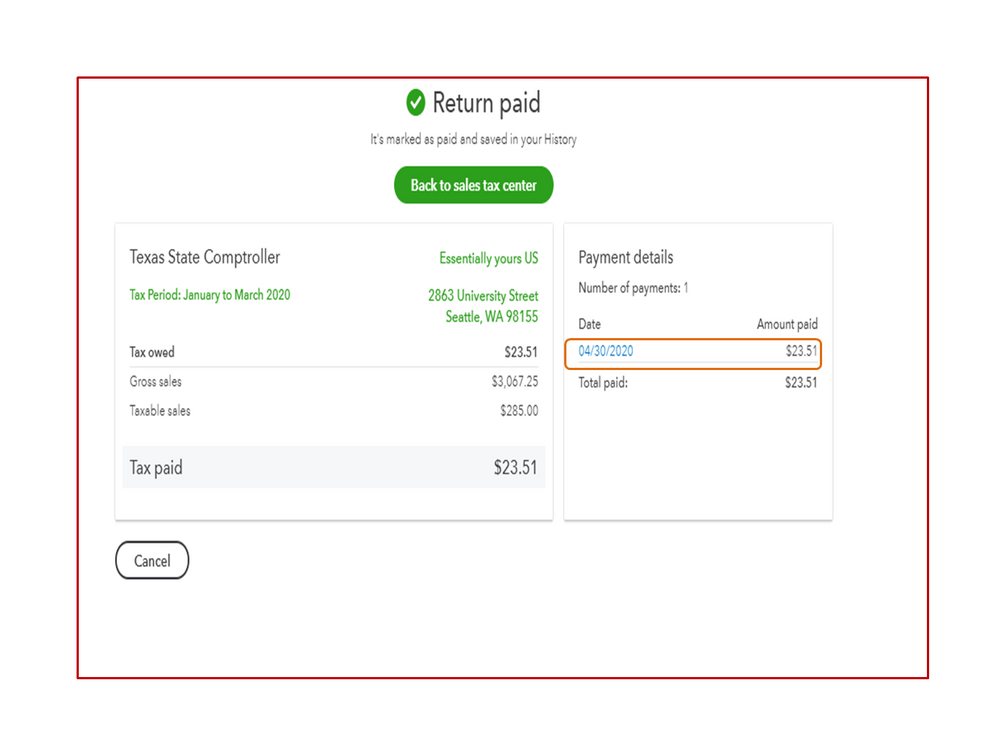

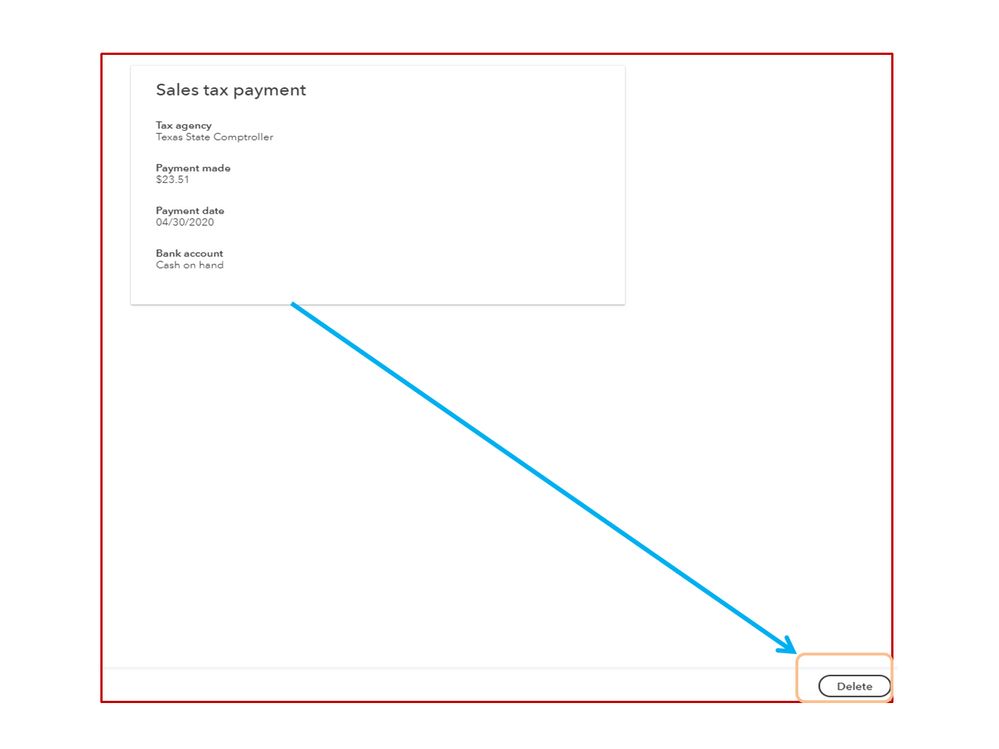

If you have created a payment for the sales tax, let’s delete it to keep your records correct. Then, choose the right month for the tax return.

Here’s how:

To run the tax return:

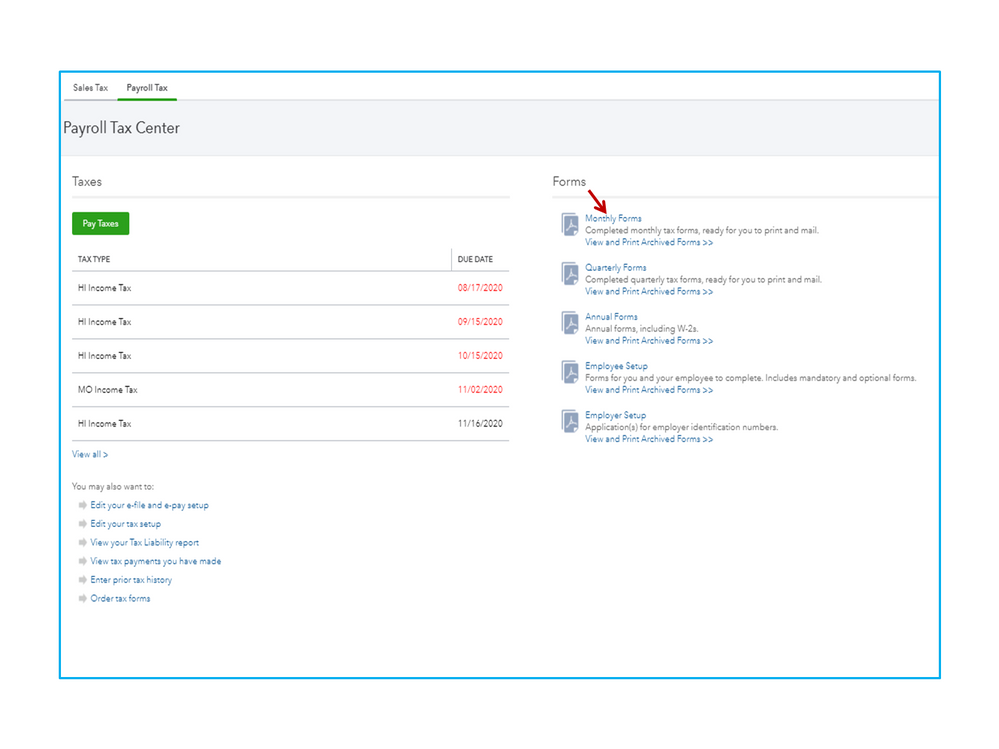

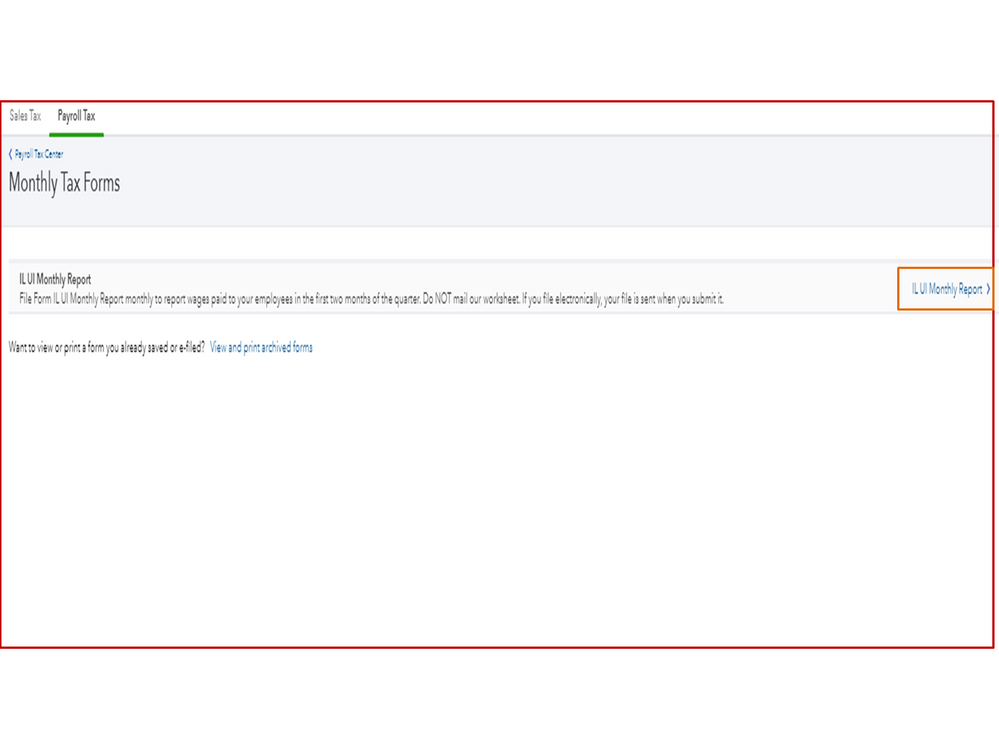

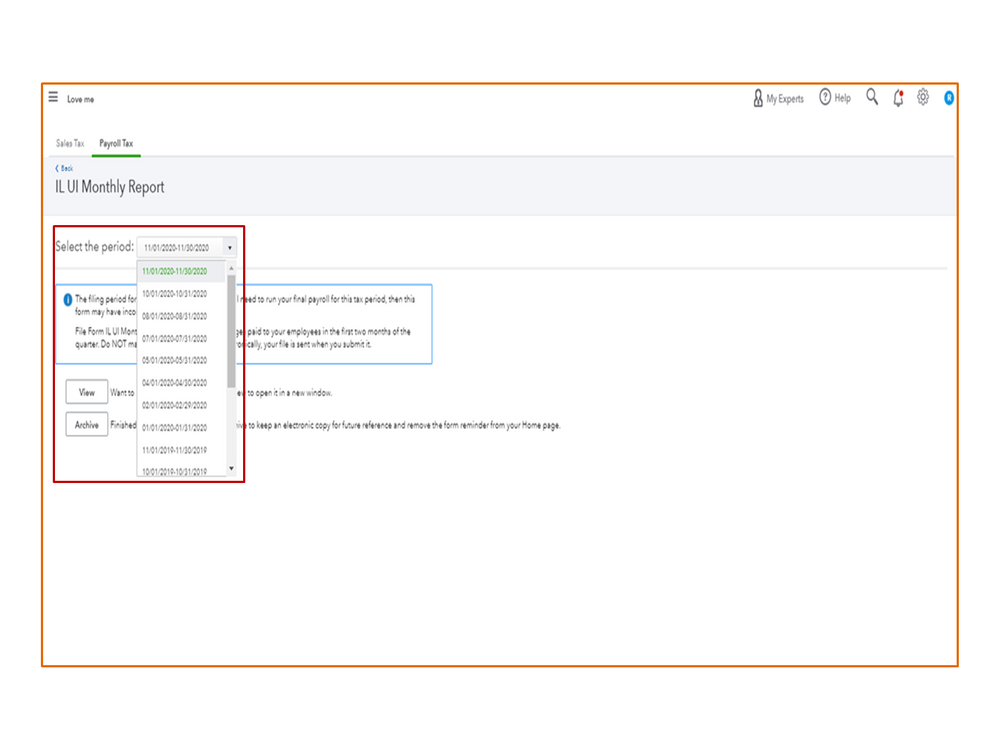

However, if this is for a payroll tax return, QBO will automatically generate the form based on the frequency period. Since the incorrect one was selected, let’s go back to the Payroll Tax Center and pick the right tax return.

For a payroll tax payment, you’ll have to delete it and enter the right one. Check out these guides for the step by step process.

You can also bookmark this article for future reference. It includes a video for visual reference and steps on how to: File your sales tax return and record tax payments in QuickBooks Online.

Don’t hesitate to get back on this thread if you have additional questions or concerns. I’m more than happy to lend a helping hand. Have a great rest of the week.

Hello again, idahoctp-gmail-c.

I’m back to check if you have successfully corrected or edited the monthly tax return? Let me know if the solution I shared helped keep your tax form in order. I’m here to make sure this is taken care of for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here