It's completely valid to be concerned about ensuring everything is recorded accurately in QuickBooks, as they directly affect your business's financial health, @Deadeye1985. I'd be more willing to help you sort this out.

When you deposit personal funds into your LLC account in QuickBooks Desktop (QBDT), you should categorize these transactions correctly to maintain accurate financial records.

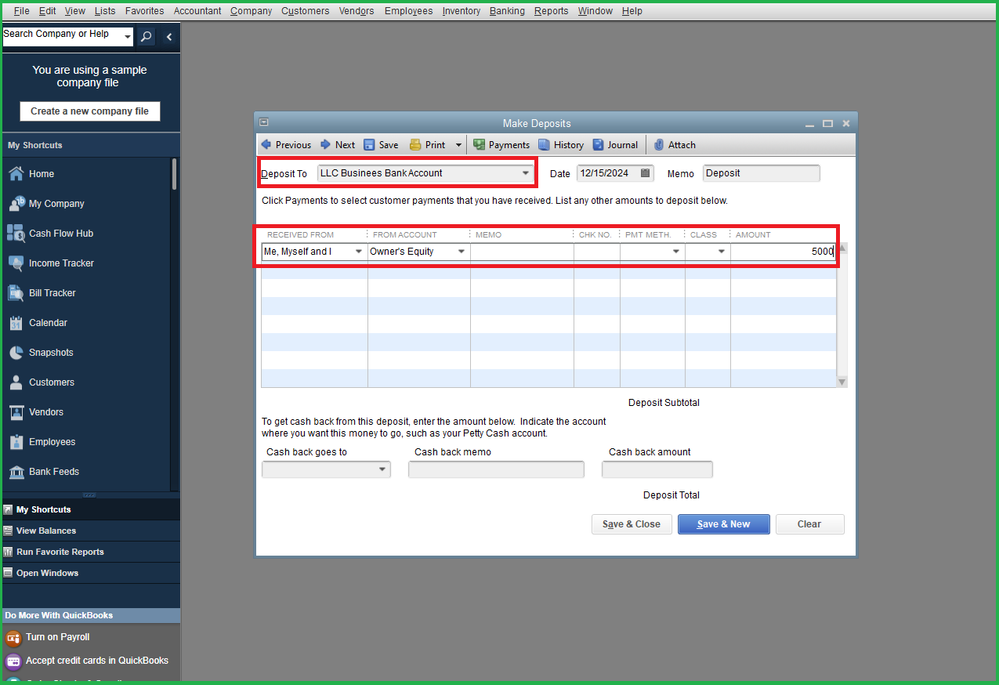

To begin with, let's record the deposit:

- Open your QBDT company.

- Go to the Banking menu and select Make Deposits.

- If the Payments to Deposit window appears, click OK to proceed.

- In the Deposit To field, select your LLC business bank account.

- In the Received From column, enter your name (as the individual contributing the funds).

- In the From Account column, choose an appropriate equity account, such as Owner's Equity or Owner's Contributions. This reflects that the funds are coming from you as the owner and not as revenue.

- Enter the amount deposited and add a memo if needed.

- Click Save & Close.

To ensure the deposit will be accurately reflected, let's view the register:

- Go to the Banking tab and click Use Register.

- Choose the LLC business bank account in the Select Account dropdown.

- Click OK.

- The entry appears as a deposit in the business account. Although you're the payor, it reflects the business receiving the funds.

Also, consulting an accountant for personalized advice on categorizing personal fund deposits into an LLC can provide valuable insights. Their expertise will also guide you confidently through the process.

As a future reference, you can systematically review your bank and credit card statements, ensuring that your recorded transactions align with the actual figures provided by your financial institutions and maintain accurate and reliable data: Reconcile an account in QBDT.

If I can be of any additional assistance with recording or categorizing deposit transactions, please don't hesitate to insert a comment below. I'll be available to help you quickly and efficiently whenever needed.