Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowTo issue a partial refund in QuickBooks, you'll follow different steps depending on whether you're using QuickBooks Online or QuickBooks Desktop. I'll provide the instructions for both versions, nicholas.

To start, if you're using QuickBooks Online, you can follow these steps:

Moreover, to record the refund, please be guided by the steps below:

Finally, if you're using QuickBooks Desktop, here's the guide you can follow:

After that, proceed with issuing the refund:

To learn more about the refund process, refer to this article: Void or refund customer payments in QuickBooks Online. You can use it as a guide.

Additionally, here's an article you can use to learn how to send statements to show customers summaries of their invoices, payments, credits, and balances: Create and send customer statements in QuickBooks Online.

Always double-check refund details before issuing them to avoid discrepancies. For any questions about a partial refund or other matters, please let us know in the comment section below.

It looks like there's no Refund Receipt anymore. Can you show me how to do a partial refund BY CHECK? Thanks.

Yes, Julie. I can assist you in creating a partial refund using a check. Let’s go through the process together.

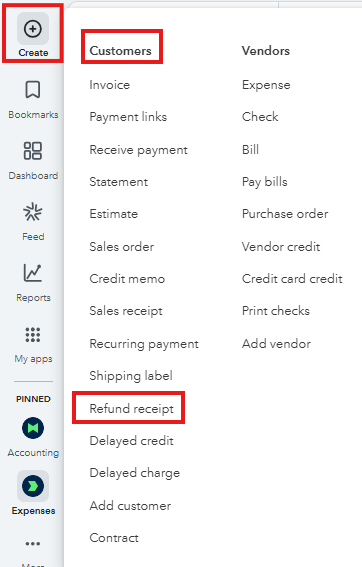

Before doing so, the refund receipt can still be accessed in QuickBooks. Simply click the +Create button, and you will find the refund receipt under the Customers menu.

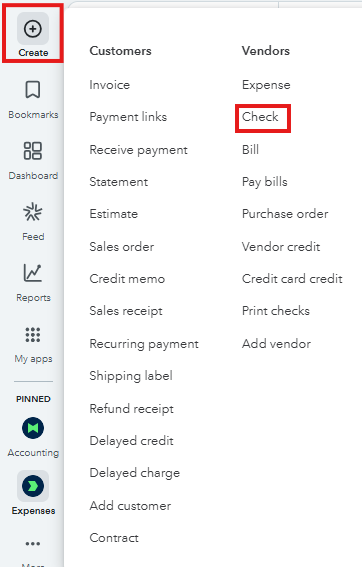

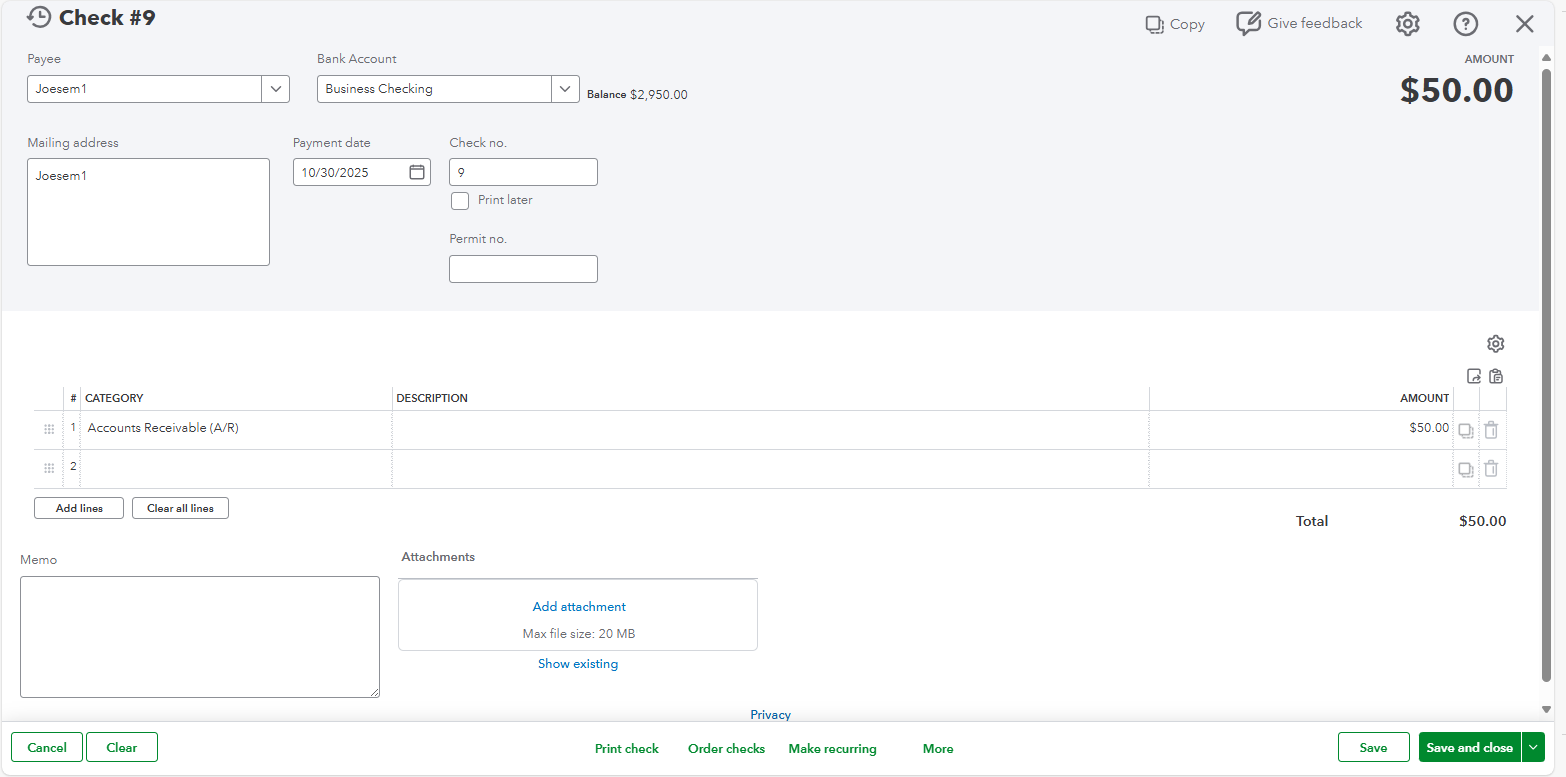

To start, if you received an overpayment for the invoice, you need to use the Accounts Receivable account when issuing a check. Then, create a payment and select the check recorded and the existing credits.

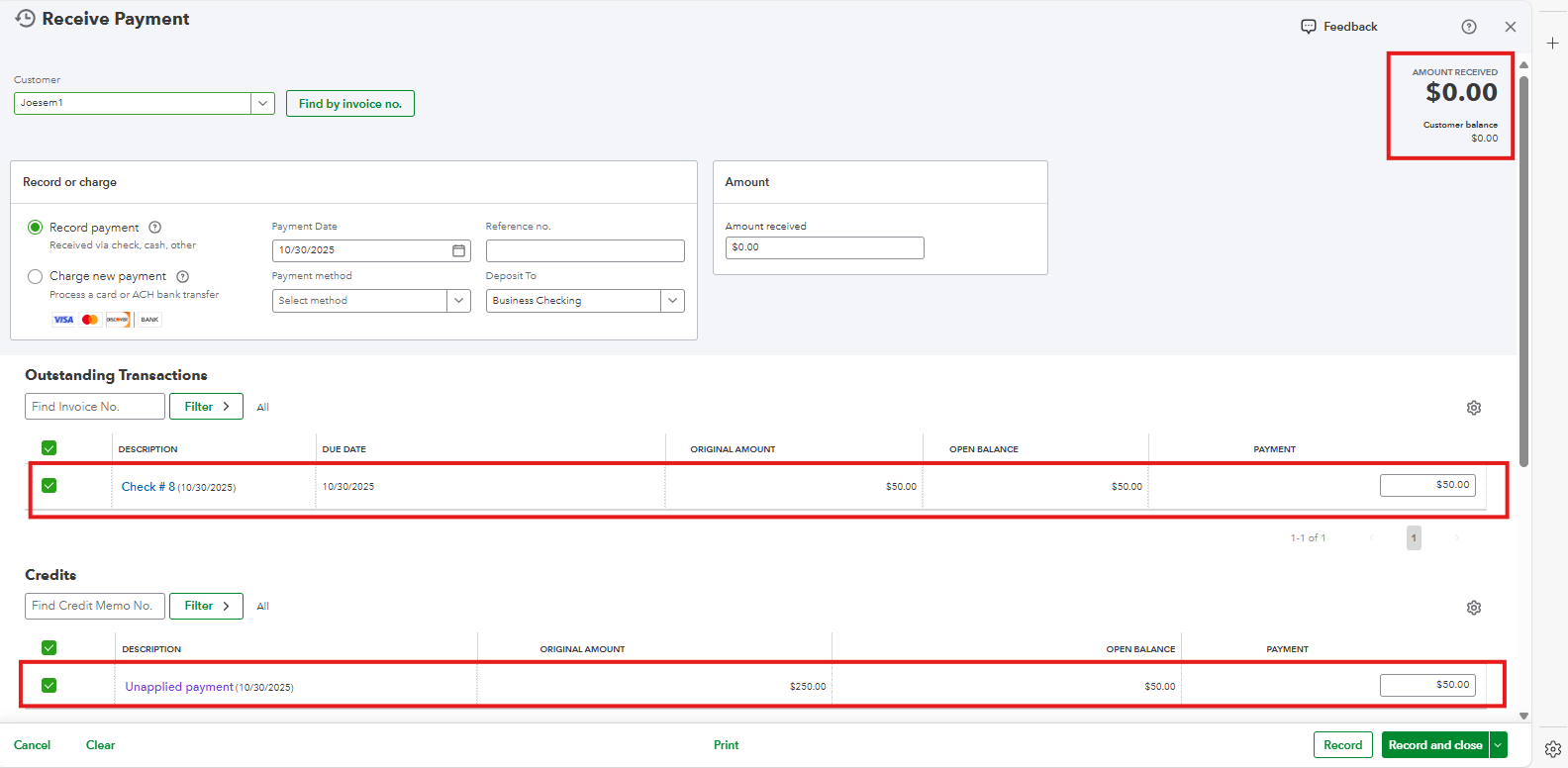

Once done, follow these steps to link the check and the unapplied amount.

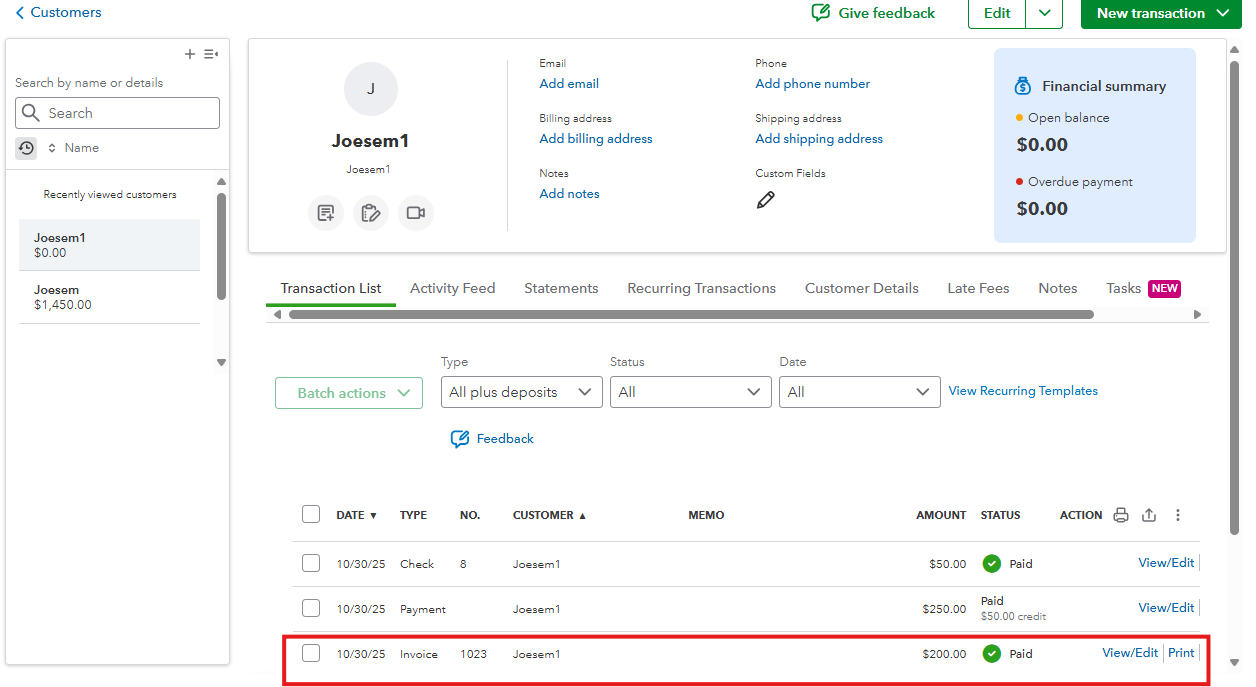

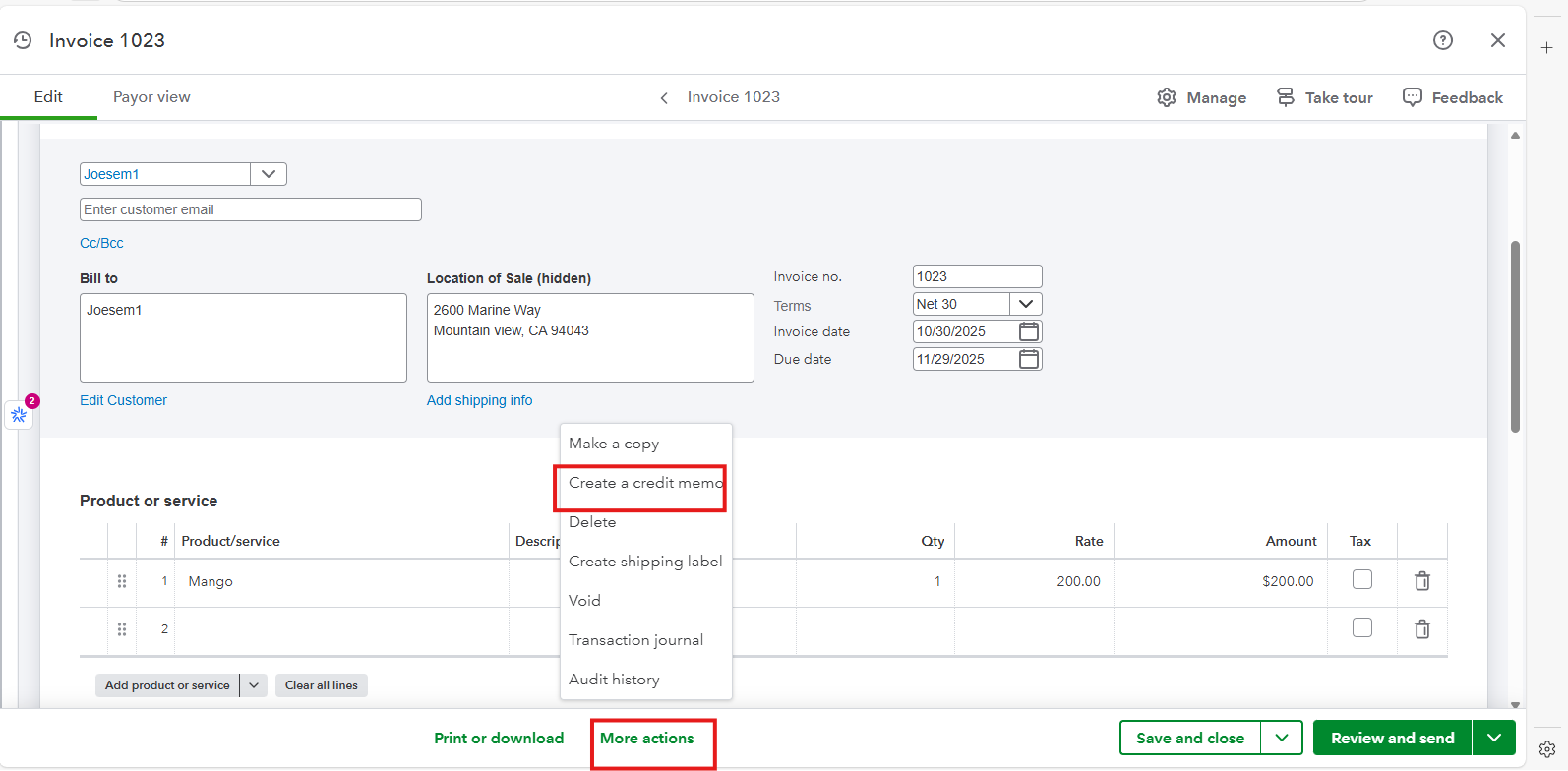

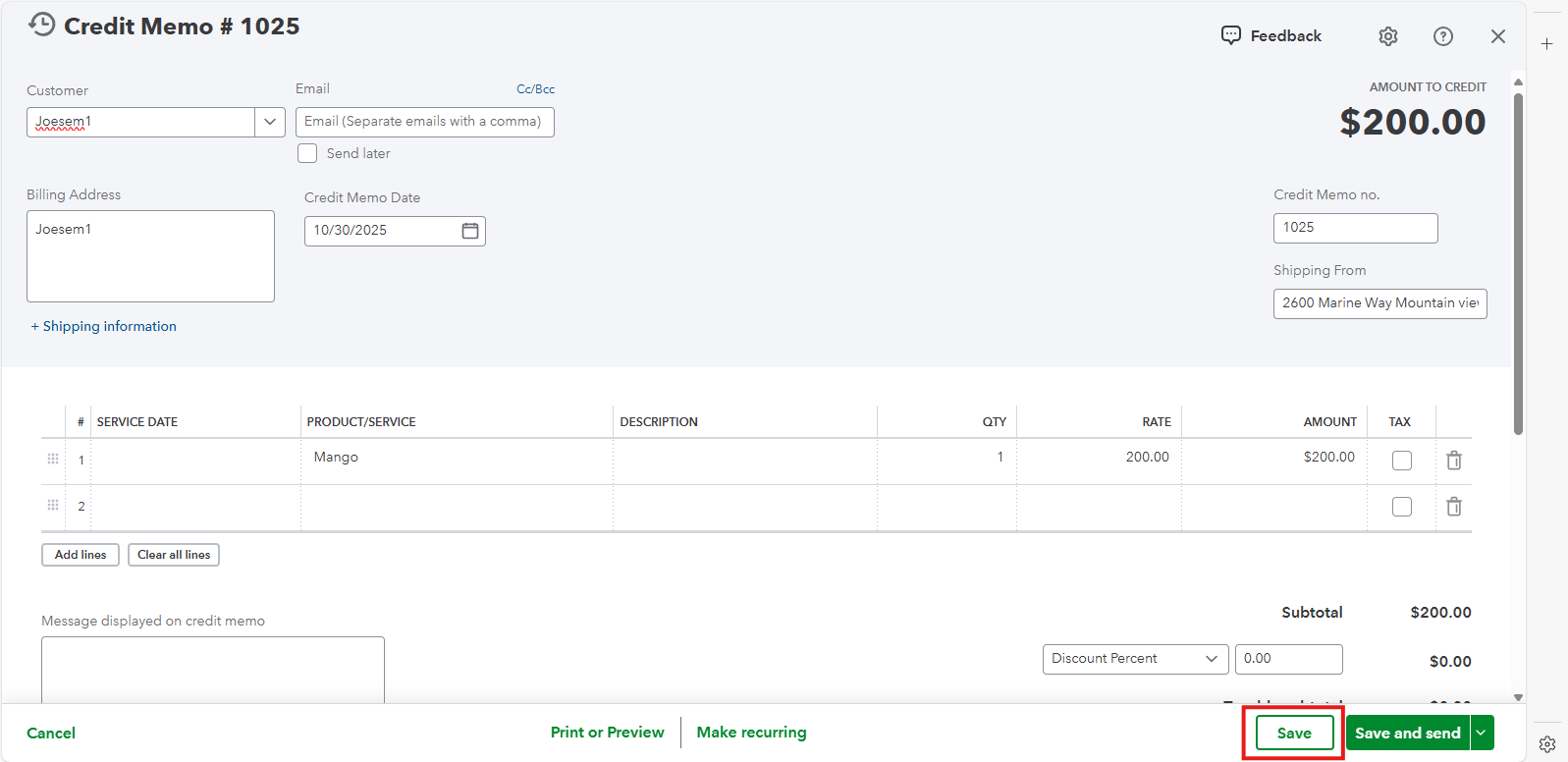

However, if you want to refund individual items or services, you can create a credit memo first to record the credit on the customer's account.

Here's how:

Next, create a Check to record the money you are refunding to the customer. You can follow the steps above to create a check and choose AR account.

Then, link the credit memo and the check to show the credit has been refunded.

For further guidance about the process, see this link: Refund your customer for a paid invoice in QuickBooks Online.

Let me know in the comments below if you have other concerns about creating refund transactions in QBO. I'll be glad to help.

Hello, we can't follow your instructions because the when we write a refund receipt check I can't chose it in the screen. It doesn't show up in the client payment section. But it shows up in the check register. We think there is a step missing.

I also can't upload documents because it says that we must be signed in to add attachments, but I am signed in. And I submitted this message yesterday but it's not populating because it says that there was an ‘error mismatch’ or something. I am trying from another browser.

We appreciate your efforts in reaching out to us in the QuickBooks Community, Julie.

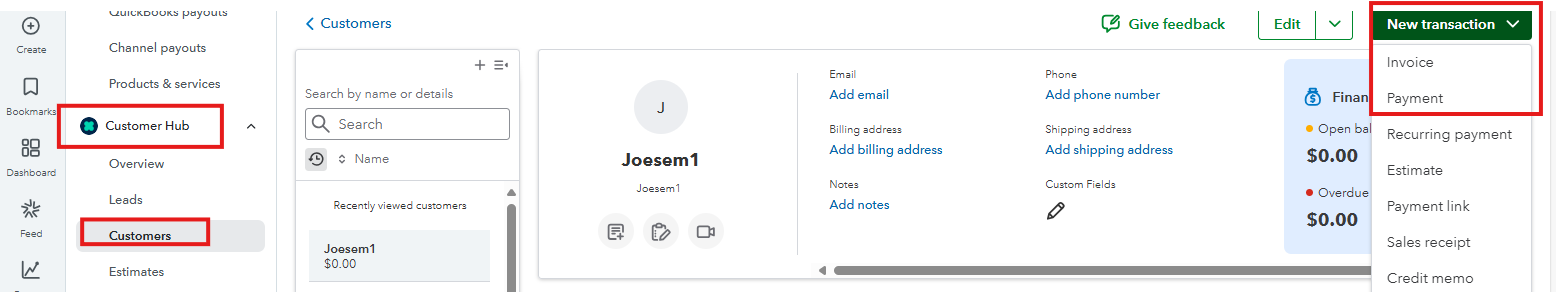

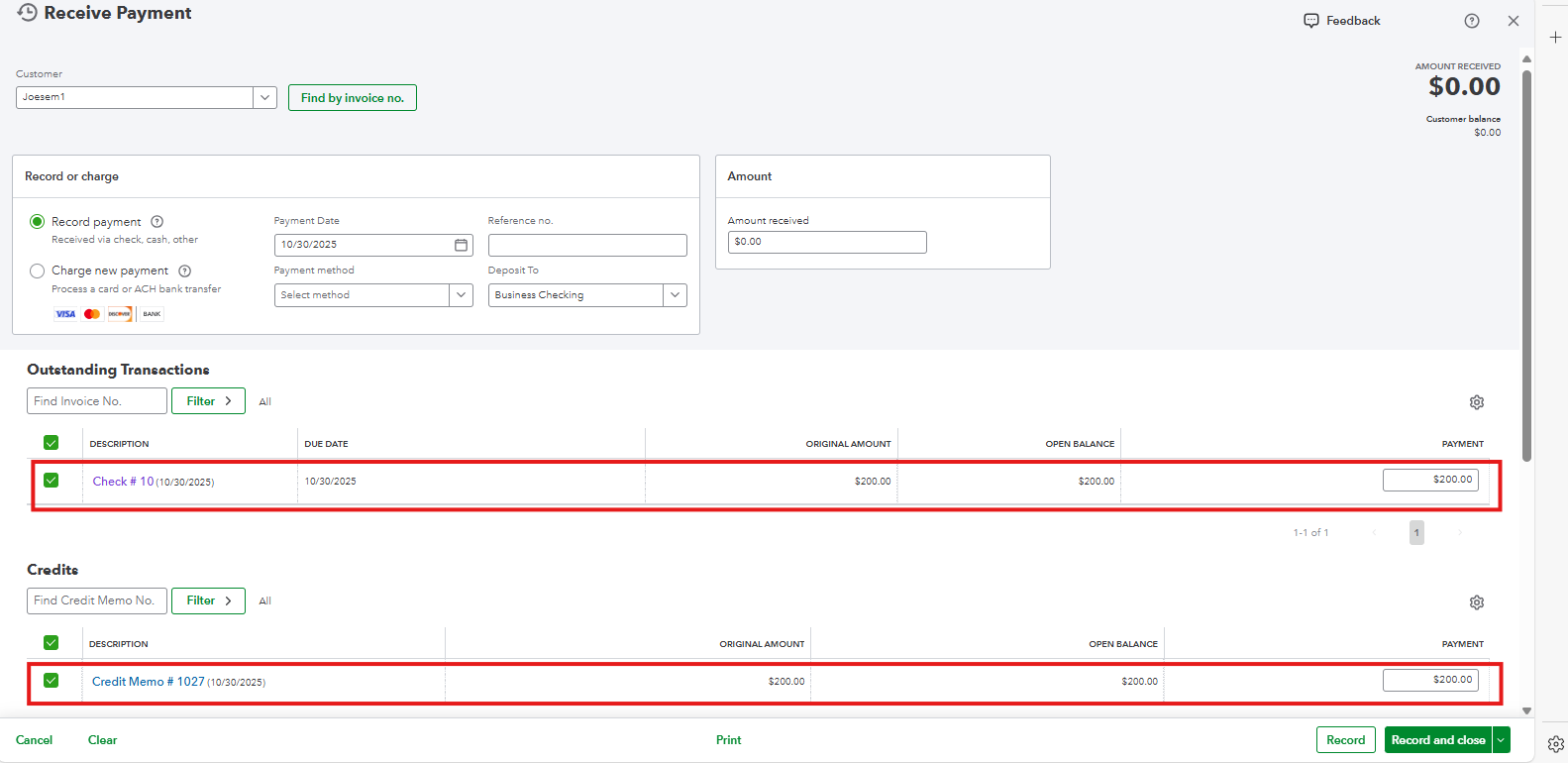

Referencing the image you shared, it seems that you created a refund receipt. Please note that refund receipts will not show in the Receive Payment window as these transaction is meant for recording money going out. Instead, you can find it by checking your Customer profile under the Transaction List or your account register.

Now, what my colleague provided above is to create a Check transaction, which is the reason it’s showing in the Receive Payment window.

For more guidance on processing refunds, explore these resources for step-by-step guidance. These guides provide detailed instructions on the appropriate refund process for different situations:

As for the mismatch error you encountered, it can be caused by cached files in your browser, which occasionally lead to issues. To fix this, consider opening the platform in a private or incognito window.

Alternatively, using a different browser, as you’ve already done, can also help create a fresh session. Keep these options in mind for future reference, as they can be helpful whenever similar errors arise.

Feel free to leave a comment below if you have further questions about processing refunds.

Hello, if I click here and say yes, refund, will this automatically refund in QB Payments, charging me the $25 fee, or will it give me the option to refund it in the method I see fit. I am hesitant to click that button without knowing.

Sorry, I figured how to put the check number!

Hi there, Julie.

We appreciate your dedication to learning and understanding how to process a partial refund.

If you confirm the refund, QB Payments will automatically process it, and no other options will appear for choosing how to pay the fee, as it will also be deducted from the payment source.

Reply here if you need more help with your QuickBooks tasks. We've got your back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here