Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have received Jan-May credit card statements from a client. There are 2019 charges that were not included in 2019 totals. How to deal with this?

Hi there, @Randy6.

You can manually add the 2019 transactions so they'll be included in the 2019 totals. Let me guide you through the steps.

Before we start, please make sure that the current dates aren't reconciled. This way, the reconciliation of the account won't mess up.

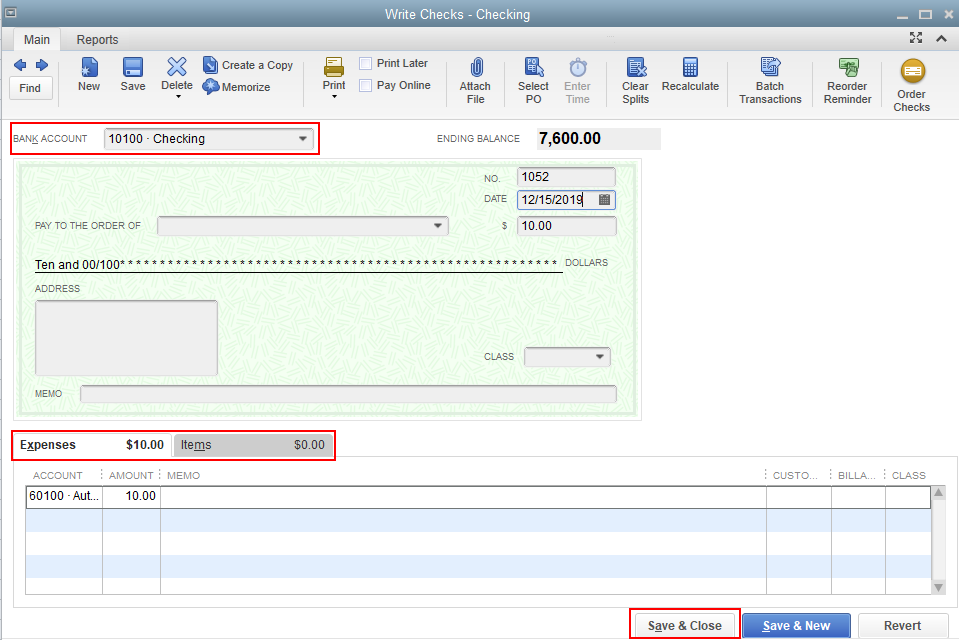

To proceed, you can write a check for the charges and make sure to enter the 2019 date. Here's how:

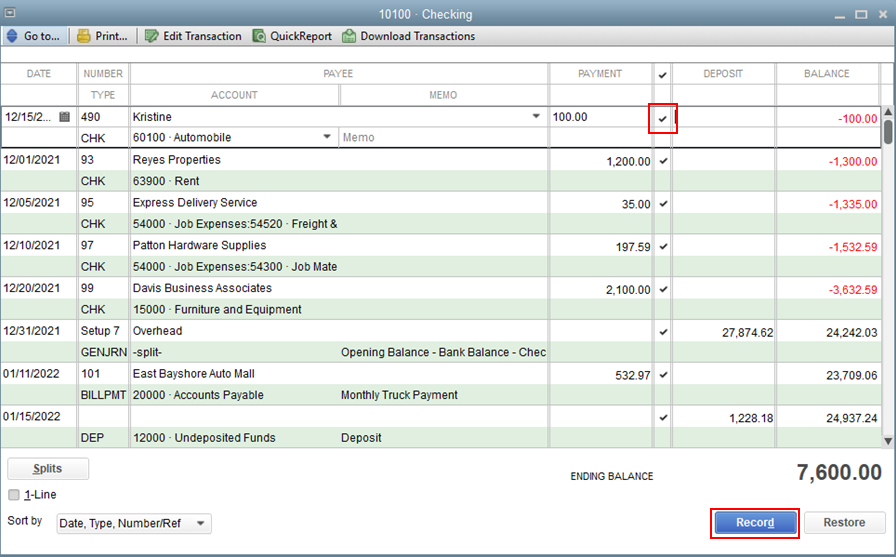

Once done, you can manually mark the transaction as reconcile if it's already reconciled from 2019.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a great day and keep safe.

As anoter option, utilize the trial period of these importer tool.

https:// transactionpro.grsm.io/qbd

https:// partners.saasant.com/affiliate/idevaffiliate.php?id=5051_2

You should prepare the template like this as CC Charge

| Credit Card Account | Payee | Transaction Date | RefNumber | Memo | Address Line1 | Address Line2 | Address Line3 | Address Line4 | Address City | Address State | Address PostalCode | Address Country | Vendor Acct No | Expenses Account | Expenses Amount | Expenses Memo | Expenses Class | Expenses Customer | Expenses Billable | Items Item | Items Qty | Items Description | Items Cost | Items Class | Items Customer | Items Billable | Currency | Exchange Rate |

| QuickBooks Credit Card | Barnes and Noble | 01/09/2020 | 1 | 1 Main Street | Anytown | NY | 12345 | USA | Misc Supplies | 100 | ||||||||||||||||||

| QuickBooks Credit Card | McDonald's | 03/09/2020 | 2 | 1 Jones Street | Anytown | NY | 12345 | USA | Meals | 25 | ABC Company | Y | ||||||||||||||||

| QuickBooks Credit Card | Joe's Taxi | 05/09/2020 | 3 | 1 Felt Ave | Anytown | NY | 12345 | USA | Transportation | 200 |

What if the 2019 taxes have already been filed?

Thanks for your prompt response, @Randy6.

There are two ways to deal with taxes when entering prior charges. You can write a check for the expense when the Tax Due payable for 2019 is not in QuickBooks. You can follow Mark_R's steps in dealing with it. And, if you see the tax due payable in QuickBooks, then you can utilize the Sales Tax payment feature.

Let me show you how:

You can always get back to this post if you need further assistance. I'll keep my notifications open. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here