Hello there, @usedtoyman. Let me help you record your consignment sales in QuickBooks Online (QBO). This way, you can track your sales and how much you've paid your consignors accordingly.

When you sell items on consignment, you'll be performing four basic steps to complete the procedure. These are the following:

- Set up consignors as vendors and classes.

- Set up consignment income accounts and items.

- Record consignment sales and payouts.

- Create consignment reports.

Since you won't pay your consignors for 30 days to account for any return, you'll only need to record your consignment sales. Then, continue once you're ready to pay consignors by recording your payouts.

You can start by setting up your consignors as vendors and classes. But before that, you'll first have to make sure you've turned on the Class tracking feature. Here's how:

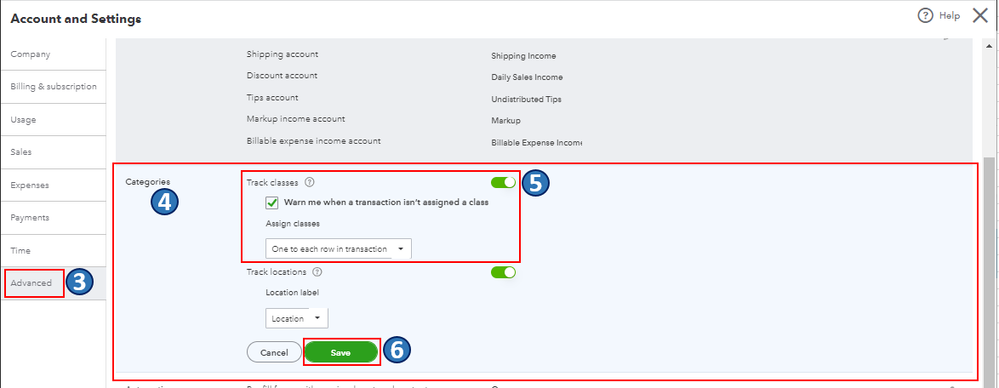

- Go to the Gear icon.

- Select Account and settings.

- Choose Advanced.

- Click anywhere in the Categories section to open the fields.

- Enable the Track classes option.

- Click Save.

Then, enter consignors as vendors (repeat the process as necessary) and assign them to a class for reporting purposes.

Once you're done, you can create two accounts to help track consignment sales and payouts. Then, set up your consignment sale item.

When you're set to sell consignment items, create an Invoice or Sales Receipt. Make sure to use the Consignment item for your sale and select the appropriate consignor in the Class field.

For the complete guide, please see this article: How to record consignment sales. It includes steps in creating and saving a customized report showing a breakdown of your consignment sale s and payouts.

In case you're using the QBO Plus version, you can use the built-in inventory feature to make it easier to track consignment sales.

Also, you may want to check out this great resource to use reports to get helpful insights on the things you buy and sell and the status of your inventory using QBO: How to see your best sellers, what’s on hand, the cost of goods.

Please let me know if there's anything else you need or concerns about recording consignment sales in QBO. I'm always ready to help. Take care, @usedtoyman.