Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

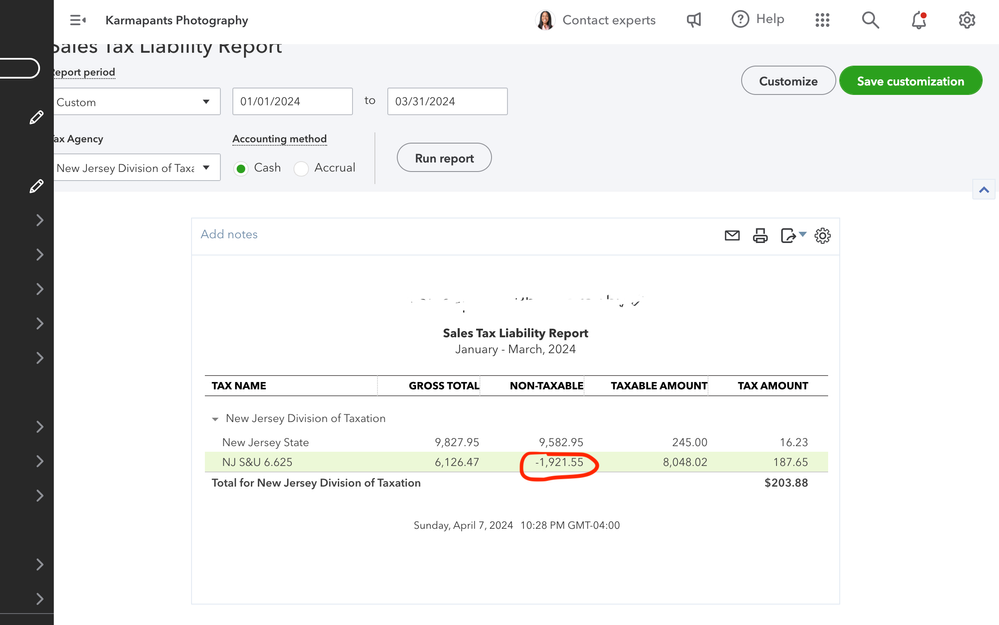

Buy nowHi there, @knicklow. Let me share with you some information about a negative non-taxable amount on your Sales Tax Liability report.

The non-taxable sales are from your credit memos or refunds and any negative entry on your sales forms such as a discount. It affects your liability report if the return is marked as taxable. An example is if you've sold something taxable at $100 and the discount is -$10 which is non-taxable, then the total sales is $90 but the taxable amount is $100.

For the time being, you can review your sales entries and discounts or returns recorded to see why you're getting a negative amount. If necessary, you may update the tax option for your transactions.

For additional tips while handling your sales taxes and liability reports, you can check out these articles:

On the other hand, you may review the topics from this link for more resources while working with your sales and other customer transactions in the future: Topics about your company's income and customers.

If you have any other follow-up questions about your non-taxable amount, please let me know by adding a comment below. I'm always here to help. Keep safe!

Hi, thank you so much for your response; however, I believe this is not the issue. I did not apply any credit memos or refunds in September. Also, my sales tax liability was fine in August and now that shows a negative amount when I run one now for August.

Going back and forth isn't easy, so I'm here to ensure you'll get the help you need, @knicklow.

I can help you fix the negative balance on your Sales Tax Liability report.

You'll need to access the liability report directly to make changes to the transactions. Then you'll have to go over everything and look for any errors. After that, open the transaction and change it to the correct one.

I'll show you how to do it:

You may run the report again to make sure it's showing the correct information.

In case the issue persists, you can reach out to Customer Support. This way, they can investigate it further and give you the best possible solution.

Just leave a comment below if you have other questions or concerns with QuickBooks and tax liabilities. I got your back! Stay safe always.

Hi. I am having the same issue. August is now negative and so is my September. Were you able to get this resolved?

Thanks!

I've come to share details about the Sales Tax Liability report in QuickBooks Online (QBO), @JAG9.

For the time being, we have an ongoing investigation about the Sales Tax Liability report showing negative nontaxable sales. Rest assured that this issue is being taken care of with utmost urgency. Hopefully, you can get back to business and run the said report with appropriate sales tax details.

In keeping with this, I'd recommend contacting our Customer Care team. They can add your account to the list of affected users. This ensures you're in the loop about the investigation's status and its fix. You can provide the INV-63361 as your reference. You'll first have to check out our support hours to ensure we can assist you on time. Here's how:

For additional tips in handling your sales taxes and liability reports, you can check out these articles:

Also, I'm adding this article to further guide you in managing sales taxes in QBO: Pay and manage sales tax in QuickBooks. It includes topics about automates sales taxes and filing returns, to name a few.

We appreciate your patience regarding this matter. You can get back into this thread if you have other sales tax and reporting concerns in QBO. I'm always here to help. Take care, and I wish you continued success, @JAG9.

This is making it impossible for me to accurately complete sales tax reports for my clients because QBO doesn't allow me to see the actual sales tax collected in one place. The tax amount in the sales tax screen is completely different than what shows in the liability report. Aside from manually pulling every invoice and adding the sales tax, I'm stuck.

Hello there, @Shel2. I've come to ensure you'll get the right support in fixing your sales tax report issue.

Currently, the investigation for the Sales Tax Liability report showing a negative balance for the non-taxable sales is still ongoing. Rest assured that our product engineers are working hard to resolve this issue as soon as possible.

That being said, I suggest contacting our Customer Support team to add your account to the list of affected users. This keeps you informed about the status of the investigation and how it will be resolved. To do so, you can follow the steps provided by my colleague, Rea_M.

Then, to ensure you'll be assisted immediately, you can visit our support hour’s page. It contains the exact time when our support team will be available.

There are a number of help articles and even video tutorials available on our QuickBooks Help page that can help you with your QuickBooks Online tasks. Simply browse from there and click the categories you need.

I'm always around if you have any other concerns about running the sales tax liability report. Don't hesitate to leave a reply below. Have a good one.

Ugh, their responses are meaningless.

So, they changed something since the last time most of us had to run Sales Tax. I am now showing my non taxable clients in taxable sales. One QB employee said something like "non-taxable sales" are your refunds and discounts. This isn't a whole picture. Remember Non-Taxable sales can actually include labor, shipping, etc. Further, I found recently that if you have an invoice/sales receipt without a taxable item.. ie you just bill for labor instead of the labor and a part, it will NOT show up on the tax liability report. Just an FYI. Or as in my case, I have dealers who are resellers, while they are counted in my total sales, I then remove their amount on the return (California) to get a net taxable amount. This amount does not show up on the tax liability report.

Now, negative non-taxable amount. I am not seeing this on any of my reports so far (I'm a bookkeeper and have several clients who use this feature). It might just be that whatever they changed, reversed the entry? Unfortunately, their system is far from perfect, and you might have to manually process. I'm happy to help and look at this with anyone. Message me, if that is possible here.

I always do the following as a way of helping me see if the amount is accurate. I compare a PNL to an item report (sometimes its item, sometimes its customer type). That usually shows me what my total sales are (remember non taxable sales on an invoice/receipt alone) do not show up in the tax liability report. I can also remove interest income, etc. Then compare that net amount to the sales tax liability report.

I am doing it right now, and I see about 6 clients not showing up on the sales tax liability report who had a taxable sale. If I figure anything out I will return.

@Shel2 There are a couple of reports, try any of the Sales By X reports that will allow you to add the sales tax amount as a column. I'm not seeing what you are seeing but that might help for the time being.

Is there any update on this? I have to file in a few days.

Is there any update on this? I have my ST due in a few days.

I know it can be difficult when you can't get the correct data on your Sales Tax Liability report, FM. I'm here to ensure this gets taken care of.

For now, the investigation about the Sales Tax Liability report showing a negative balance for the non-taxable sales is already closed. Since the issue persists, I'd suggest contacting our QuickBooks Support Team to determine its cause. They are also equipped with tools to securely review your file.

Here's how to contact our support:

For more details about managing your sales tax in the program, I'd suggest checking out these articles:

Additionally, I've included an article that'll help you file your sales tax return and record your tax payment in QuickBooks Online. This ensures everything is accurate before filing: Submit your Return to the Right Tax Agency.

Stay in touch with us if you need further assistance in managing your sales tax, FM5. We're always here to help you out.

Has anyone been able to find a workaround for this. I believe I have been paying more sales tax that I should be and quickbooks is showing the NET is more than the GROSS because the non-taxable income is negative.

Thanks!

Chris

Hello, Chris.

Ensuring the sales tax amounts to pay are correct is something we need to be keen at. So, I'd like to take this moment and help you with the negative non-taxable income amount.

As mentioned by my colleague, the negative non-taxable income is likely caused by credit memos and refund entries marked as taxable. These entries can affect how the sales taxes are calculated.

You can use the Sales Tax Liability report to see the affected entries. Here's how to do it:

If there are entries that were marked as taxable when it shouldn't, open the transaction and edit when needed.

Another way to do this is to create a sales tax adjustment entry to adjust the amounts. This article will guide you through the process: Create or delete a sales tax adjustment in QuickBooks Online.

If you need a reference on checking your sales tax amounts, I'll share this article: Check how much sales tax you owe in QuickBooks Online.

When you're ready to file and record your sales taxes, check this article out if you need a guide: File your sales tax return and record sales tax payments in QuickBooks Online.

I'll also add this article if you need to finalize the current accounting period by reconciling your accounts: Reconcile an account in QuickBooks Online.

Let me know if you have other questions in managing your sales taxes or other sales entries. If you happen to come across any difficulties while managing your reports or other transactions, add them to your reply and I'll help you out.

Hello,

I am having the same problem. When I look into that negative number, its just 3 invoices and there are no errors. Typically, we send an invoice and it gets pa

I've got you covered on how to correct the negative amount on your non-taxable column when running the Sales Tax Liability report, Coligreens.

We appreciate you for providing us with in-depth details of your concern and some screenshots to better isolate the issue. I've checked here our records and there's no reported case where the new invoice style affects the amount in non-taxable column when running the report. To resolve this, we can run the Sales Tax Liability report to review the affected invoices. Here's how to do it:

The non-taxable sales are from your credit memos, refunds, or any negative entry on your sales forms such as a discount. Just review your sales entries and discounts or returns recorded to see why you're getting a negative amount. Then, you can update the tax option for your transactions.

Also, we can create a sales tax adjustment entry to adjust the amounts. Let me guide you on how:

You can check out this article to guide you through the process: Create or delete a sales tax adjustment in QuickBooks Online. Furthermore, here are some articles that will help you streamline the reporting process in QuickBooks Online:

If you ever come across any more concerns or ideas regarding running your financial reports, you're always welcome to reach out. Do you need to export the report to Excel? Or would you like to take care of taxes in QuickBooks? Let me know and I'll lend a hand again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here