Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello,

I've been using QBO for about a year now and I'm trying to clean up my messes.

When I originally set up my daily sales receipt following advice I found online, I had my Cash Sales going to a Cash clearing account and my credit/debit card sales going to Visa/MC/AMEX/Discover Clearing account.

A few months after using that template I read online about using the Undeposited Funds account, so I switched my Cash Sales to go to the Undeposited Funds account instead of the Cash Clearing account and left my Visa/MC etc clearing account the same.

Question 1: As the cash was deposited to my bank account I would clear those transactions, and the same with my Credit/Debit clearing account. But they are just Cleared, not Reconciled. How do I reconcile them?

Question 2: I now have my Daily Sales Receipts in two places. Is there a way to go back and change all those Cash transactions that went to the cash clearing account to say that they went to the undeposited funds account without screwing up balances since they are already cleared?

Thanks

Katie

Single member LLC

Solved! Go to Solution.

Thanks for being detailed about your concern, PPPV1.

You'll no longer have to create a bank deposit for your credit card transactions. This is because the entries are already recorded to the correct account. Aside from that, you're able to reconcile them along with the other data in your company.

I’m adding some links that will guide you on how to use the Bank Deposit feature and Undeposited Funds account. These resources contain videos that will visually help you through the process.

Stay in touch if you need further assistance when working in QBO. I’m more than happy to lend a helping hand. Have a great day ahead.

I’ve got you covered, @katie AKA PPPV1.

As long as you haven’t reconciled your account yet, you can always modify your transactions in QuickBooks Online.

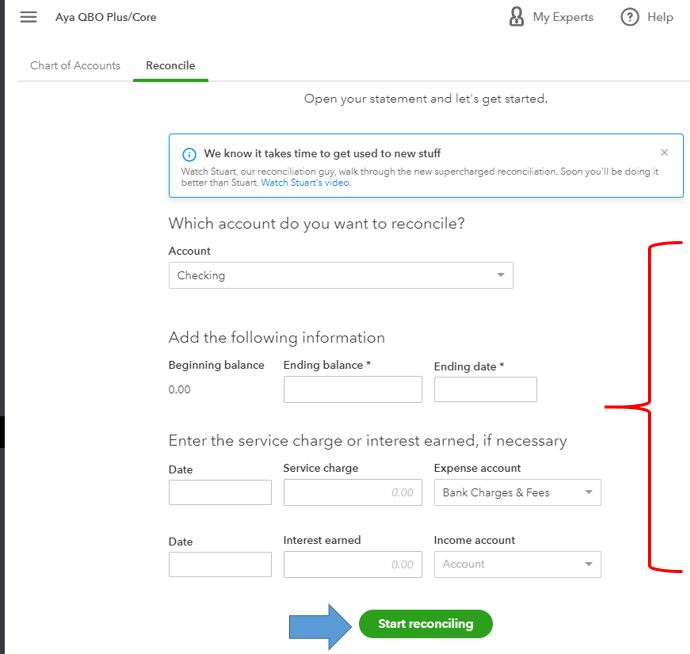

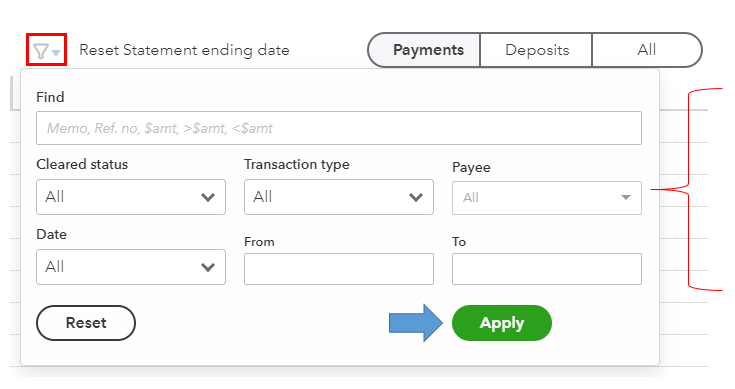

You can manually edit your cleared transactions and change the payment account. Once done, you can follow these instructions below to reconcile:

You can use this information to learn how to reconcile accounts in QBO. This includes a video tutorial for your visual reference.

And if in case you have issues during the process, check out this reconcile workflow guide to ensure everything is balanced and accurate.

You can visit our Support page anytime if you need tips and resources. Doing this helps you learn more about QuickBooks.

I’m just right here if you need more help with your transactions and reconciliation. Always take care.

Thanks for the reply. I think I may be missing a step somewhere but I'm not certain. I'm new to double-entry accounting. My credit card processor deposits directly into my checking account, and my checking account is linked to Quickbooks so it automatically uploads my transactions. As for expenses, I categorize them to their various accounts rather than enter expenses and match them, except for my accounts payable for inventory which I do enter as bills. As for my credit card transactions, once the deposits show up in my bank account I approve them and then go to the credit card clearing account and change them to Cleared. I was reading earlier something about doing a bank deposit for my credit transactions which I have never done. Am I supposed to be doing that or does it matter? Since these credit transactions show up on my monthly bank statement they do get Reconciled along with everything else.

Thanks for being detailed about your concern, PPPV1.

You'll no longer have to create a bank deposit for your credit card transactions. This is because the entries are already recorded to the correct account. Aside from that, you're able to reconcile them along with the other data in your company.

I’m adding some links that will guide you on how to use the Bank Deposit feature and Undeposited Funds account. These resources contain videos that will visually help you through the process.

Stay in touch if you need further assistance when working in QBO. I’m more than happy to lend a helping hand. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here