I'm glad to see you in this forum, Teresa. Let’s correct those payroll contributions to ensure everything aligns perfectly.

Properly mapping your payroll deductions is essential for accurate financial reporting and compliance. Let’s ensure everything is set up correctly to avoid any future issues.

For detailed steps, here's how:

- Navigate to the Gear icon and select Payroll settings.

- Scroll down to the Accounting section and click the Pencil icon on the right side.

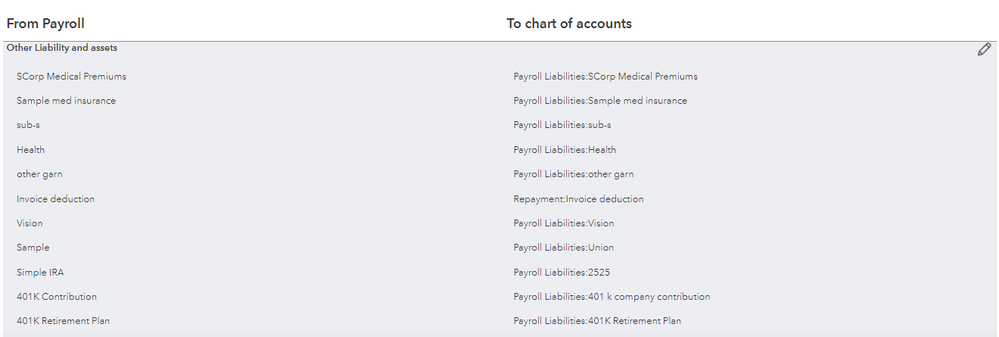

- Review the accounts under the Chart of Accounts column and locate the 401k payroll contributions under Other Liability and assets.

- Once you find it, take note of the attached payroll item. Then, click the Pencil icon in the upper right corner to move it to the correct account.

- Select the right expense account and click Save.

- Hit on Done.

Please refer the screenshot below for reference:

Additionally, I’d like to share a valuable resource that offers comprehensive guidance on effectively customizing your payroll accounts to ensure optimal accuracy and efficiency: Change your accounting preferences in QuickBooks Online Payroll.

Keep this thread handy for future questions or concerns about your payroll contributions in QBO. My team and I are here to ensure you feel supported and confident in managing your finances. We always look forward to assisting you.