Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello All,

I recently got hired on as Office Admin at a small business that suffered quite a loss due to COVID-19, and the owner had been forced to fire his previous Administrator because she'd been... incompetent, for lack of a better word. The owner had struggled to get any kind of consistent performance from her, and he'd been relying on her to keep his books for him but it is apparent to me that she had no idea what she was doing. I did not claim to be an expert in Quickbooks when he hired me; the extent of my previous experience was a decade ago and mostly kept to invoicing. Despite this full disclosure on my part, he has asked me to enter paperwork for and reconcile nearly 4 months worth of records. Looking at the accounts in QBO, I honestly do not even know where to start with the mess left behind by the former Admin. It won't let me even begin reconciling because the beginning balance is off due to some transactions having been deleted (??), and I cannot seem to fix this no matter what I try. I'm also afraid to do much of anything out of fear of making things worse. The amount in Quickbooks versus the amount in the bank account that is linked with the QBO account is WAY off, like massively off, and I don't know where to start to balance things back out. Most of the paperwork and receipts the owner gave me (in a single gigantic unorganized folder overflowing with random papers and no clear filing system in place) appear to have already been entered via the bank account auto-adding things, or possibly already factored in elsewhere? It's such a tangled mess, it's hard to even know for certain.

What do I do?? I am just looking for some guidance in what steps I should take next. I really need this job, and telling him I can't fix it seems like a last resort.

Solved! Go to Solution.

I can relate...I've been with my employer for 4 months now and in a similar situation. I'm in the process of cleaning up the books from 1/1/2020 forward. I think the first thing you should do is go back to the last successful checking reconciliation and then move forward. You might be able to find the deleted checks by using the audit trail feature, or if it's only one or two checks maybe just by looking at the amount that you're off and checking the statements for transactions that are that amount or add up to that amount. It's a tedious process but will be very rewarding when you can present clean books to your boss. Be sure to use this forum frequently...it has helped me a lot. Good luck!

I can relate...I've been with my employer for 4 months now and in a similar situation. I'm in the process of cleaning up the books from 1/1/2020 forward. I think the first thing you should do is go back to the last successful checking reconciliation and then move forward. You might be able to find the deleted checks by using the audit trail feature, or if it's only one or two checks maybe just by looking at the amount that you're off and checking the statements for transactions that are that amount or add up to that amount. It's a tedious process but will be very rewarding when you can present clean books to your boss. Be sure to use this forum frequently...it has helped me a lot. Good luck!

Welcome to our forum @Admin4Holliday and @kaycee1,

Don't worry, I'm here to get you to the right path to fix your reconciliation discrepancies.

To restore deleted transactions, you have to enter them manually using the details from the Audit Log.

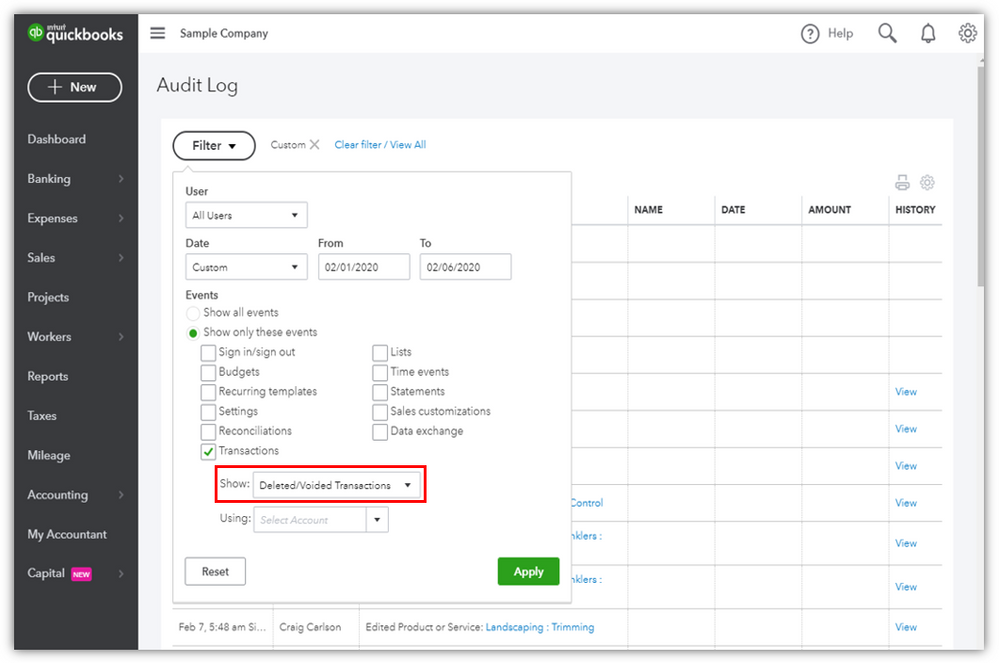

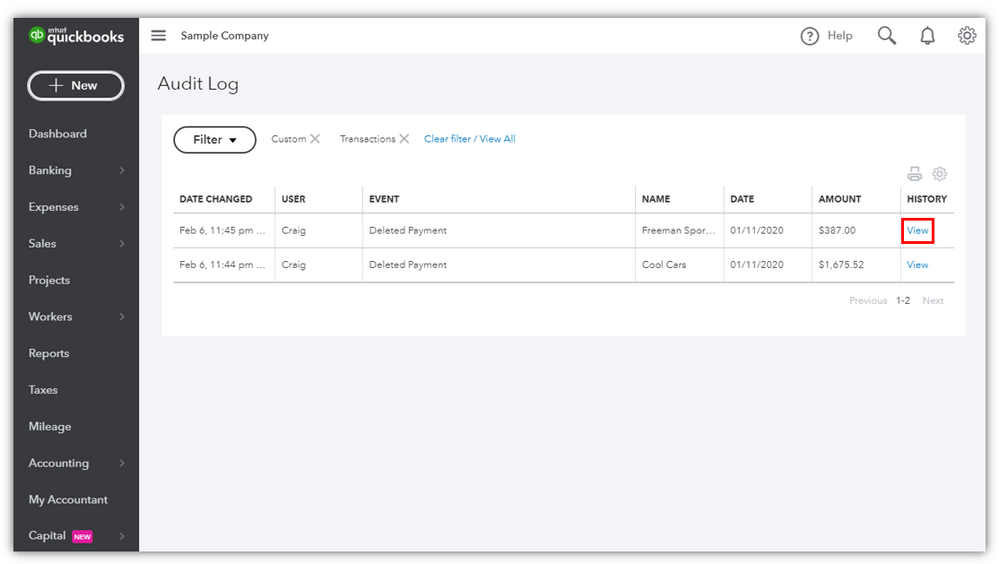

This report will show you the history or detail of a modified or deleted entry. Here's to use it:

After getting the details of the deleted item, recreate it by clicking on the + New button on the toolbar.

Here's an article to guide you on how to utilize the Audit Log: Use the audit log in QuickBooks Online.

Also, there are a few reasons why your bank statement differs the balance in QuickBooks. To fix them, here are some articles you can refer to:

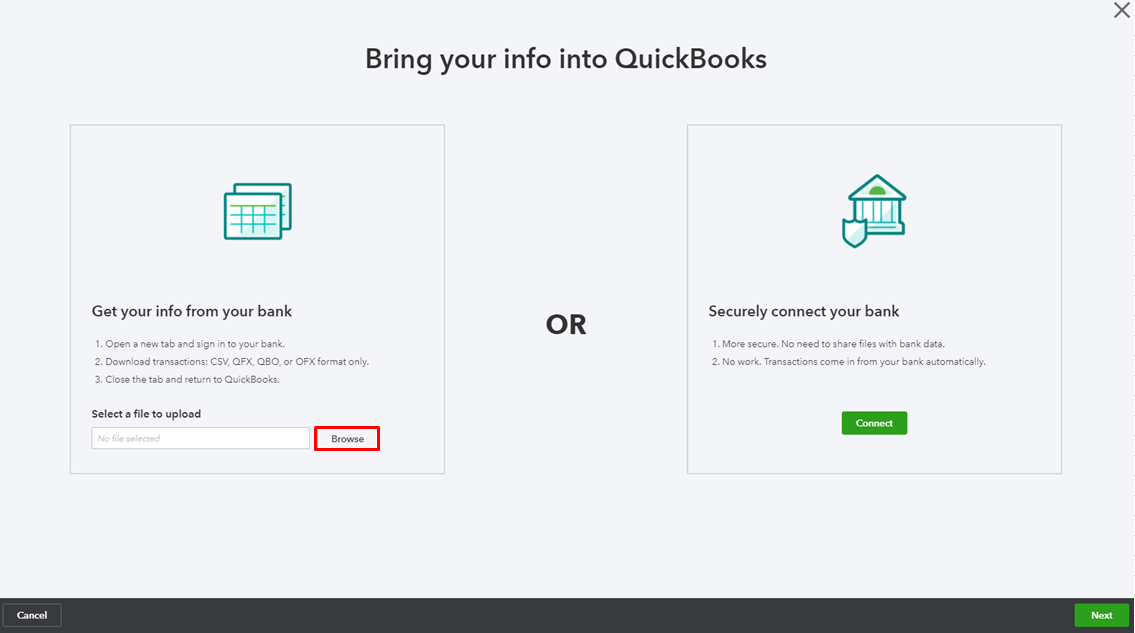

If there are transactiosn from the bank that were not imported, or those beyond 90 days, upload them manually through a CSV file. Here are the detailed steps to do it:

To learn more about mapping and uploading bank entries, see the following article:

Once you're done, make sure to categorize the transactions properly. This link will guide you with the right way to do it: Categorize and match online bank transactions in QuickBooks Online

Feel free to get back to me if you have additional questions about this topic or need anything else with QuickBooks. I'll be more than happy to help you. Have a lovely week ahead!

@Jen_D Did you even read what was asked? You didn't even answer a single question.

So typical of an Intuit employee.

@Admin4Holliday Go with the first response given. She is actually paying attention and is most helpful.

Take what ANYONE from Intuit (including Mods) says with a grain of salt. They RARELY answer your questions, and will just "Robot" their answers.

Good luck.

Thank you so much! To everyone who responded, and to you especially Kaycee1 - this was incredibly helpful, and though it's been time-consuming (not to mention a serious headache) it has already made a big difference and I don't feel quite as overwhelmed now that I have a clear plan of action to bring the books back into order. I've already managed to reconcile the months of May and June: it was seriously gratifying, even exciting, to see that big fat 0 and the green check mark, hitting that big green button that said "DONE"! Now I just have to repeat the process for July, August, and September, and once I have everything cleaned up it will be much easier managing it going forward.

I'm sure I'll have many more questions in the future, and I'm very glad to have this community as a resource. Thanks again! :)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here