Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Is there a good way to have a vendor credit without reducing the accounts payable. That is sort of contradictory, but I don't want to reduce my liability by the amount that was loaned to my vendor.

Does this make sense?

I’m here to share information about managing vendor credits without reducing accounts payable in QuickBooks, Mike.

You can use a Wash account when creating vendor credits in QuickBooks Desktop. This way, the amount won’t reflect in your Accounts Payable account. Before doing so, I recommend contacting your accountant to ensure everything is accurate.

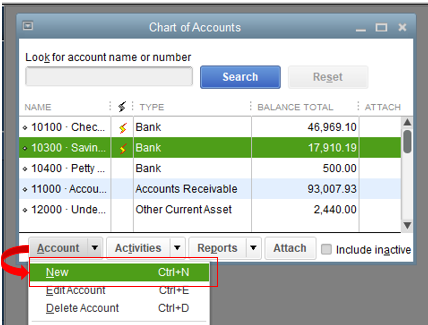

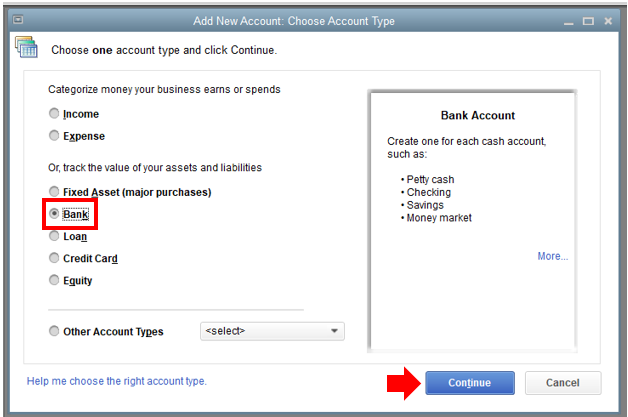

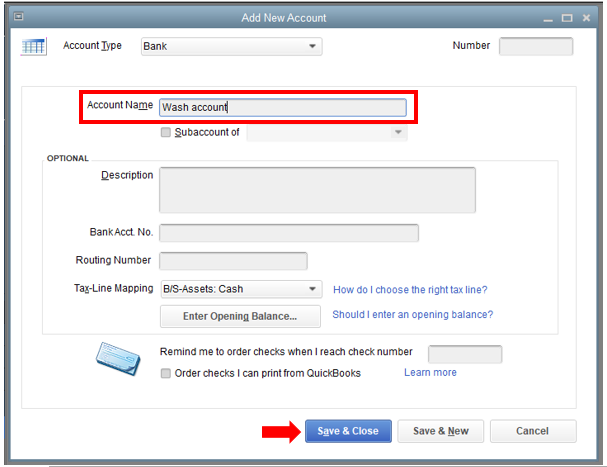

Here are the steps to set up a Wash account or Clearing account.

You can use this information to learn more about the said account and how to use it: Set up a clearing account.

Once done, you can now record a vendor credit in the program. I’ll show you how:

I've also added this article in case you'd like to create a credit for your customers: Give your customer a credit or refund in QuickBooks Desktop for Windows.

Fill me in if you have any other questions or concerns in managing your vendor transactions. I’d be glad to assist you further. Have a good day and always take care!

I've created the clearing account. But when I make a bill (credit) for the vendor using that account, the accounts payable does reduce by the credit. What am I missing?

I guess I put the General Journal Entry for the amount of the outstanding credit, and then reverse the journal entry each time the vendor pays the credit for that amount. At the end, the clearing account will show zero, and the AP account will reflect the appropriate amount. Is this correct?

Then, in my bills, my general entry shows up as something to pay. I'm pretty confused.

Let me clarify things for you, mikeshick.

Vendor credit is used for rebates, reward incentives, refunds, and reimbursements. Hence, it'll reduce your accounts payable once you enter this transaction into the vendor's account.

You may want to consult your accountant if this is the right process for you. If you don't have one, please visit this link: https://quickbooks.intuit.com/find-an-accountant/. They can provide specific instructions to ensure your books have accurate records.

I'm also adding this link in case you need additional information about vendor credits: Record a vendor refund in QuickBooks Desktop.

Don't hesitate to leave a comment below if there's anything else you need. I'll be right here to provide the information that you need about the vendor credit.

Hi MadelynC,

Thanks for your message. I've been trying to implement, but still having trouble.

Right now, I've tried to do this:

1) Credit Vendor using clearing account

2) Journal Entry: Credit AP, Debit Clearing Account

3) Apply Credit to this Journal Entry Bill

4) Journal Entry: Debit Clearing Account, Credit Expense Account

5) Pay Bills from Vendor with Clearing Account. With enough vendor payments with clearing account, the clear account will be zero.

Question: Second Journal Entry from step 4 shows open balance.

How do I reduce this second entry to zero?

Is this a correct workflow for credit a vendor, without affecting my Account Payable?

Thank you.

I appreciate you for getting back, @mikeshick.

I can see that you're using journal entries (JE) to track the vendor credit in QuickBooks Desktop. JE involves specific accounts which you might need to consult with an accountant to record the transactions accordingly. He or she can share more options in tracking the credit and give you details on what specific account to use to reduce the balance from your second entry.

On the other hand, you may want to consider checking out the resources from this link for more tips about recording refunds from a vendor: Record a vendor refund in QuickBooks Desktop.

Aside from vendor credit, you can also get more hints while handling your other vendor transactions from here: Enter expenses, pay bills, write checks, and manage suppliers.

If you have any other follow-up questions about vendor credits, let me know by adding a comment below. I'm more than happy to help. Have a good one!

@Angelyn_T , Thanks for the hints. They are good. But, I would love if someone, possibly @MadelynC could answer with a specific answer/solution. I've explained the workflow I attempted in response @MadelynC post, but either I misunderstood the application, or I have an unexplained general entry open balance that still needs to be addressed with another step.

Thank you all for your kind support in trying to identify the answer.

@Angelyn_T I read the article you sent here.

This scenario is different than the original post and follow-up questions, so this is a sideways question. However, when I followed Scenario 1 and linked the deposit with the credit, my deposit still shows open balance. Why?

https://www.dropbox.com/s/dxd5sy2be91lsaj/2022-02-03_13-28-15.png?dl=0

@MaryLandT Maryland, any chance you can follow up on this thread. You're answer was helpful...but I'm still missing a thing or so. Thanks,

If you issue a vendor credit, (Enter Bills>Credit), it will always reduce A/P in QB.

Your original post mentions you "loaned" money to a vendor. Are you trying to apply this loan credit against future bills from this vendor? If so, the check you originally wrote to the vendor can be assigned to an asset account (Vendor Receivable or something similar). Then, whenever you receive a bill from the vendor, you can enter it as usual but add a line on the expense tab, choose the Vendor Receivable asset account and enter the amount of the loan credit you want applied to the bill as a negative amount. This will reduce the amount due on the bill while also reducing the Vendor Receivable account.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here