Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello.

I'll help you get your contractors shown on your 1099 report.

You mentioned that you tried everything suggested online; could you tell us what you did so far? Any information can assist us in determining the best course of action to resolve this issue.

There are certain requirements so that contractors will be included in the 1099 Transaction report. These are the following:

I've got this article to guide you with 1099s in QuickBooks Online: Fix missing contractors or wrong amounts on 1099s.

Let's run some troubleshooting steps to fix it If everything is fine and they still aren't showing. You can start by accessing your account using an incognito window. Use these shortcut keys below:

If it fixed the issue, you can clear the cache on your web browser. This will refresh the system and remove out-of-date internet data causing this unexpected behavior. Alternatively, you can use different supported browsers.

In addition, you can review the resources below to assist you in preparing and filing your 1099s. This guarantees that you can file them on time:

I'm only a post away if you need further assistance with the 1099's report. It's always my pleasure to help you out again.

None of the items you provided helped me. These are the same resources I found online and none of them worked. After hours of researching I discovered that the 1099-NEC threshold for Contractors who are categorized under Direct Sales is $5,000, not $600 like you website says. The $600 threshold is only for employee 1099 contractors. I wanted to my vendors to non-employee so they aren't categorized as Direct Sales and couldn't figure it out how to do it, so I called in and just spent 2 hours on the phone with a Quickbooks rep that couldn't help me figure out how to change it either.

I am checking with my tax guy to verify the correct status that we should be listing employee independent contracted sales reps under to verify if they should be categorized as Direct Sales (box 2 on 1099-NEC form) or employee (box 1 1099-NEC form). At that point if I have to change all contractors from Direct Sales category I will take another stab at recategorizing all of their commissions to a different transaction category.

same issue- some non-employee comp. is showing as Direct sales and won't generate a 1099. I don't know how to remove the direct sales classification.?

Thank you for joining this thread, MKNA.

There are a few reasons a contractor won't appear on the report, and we'll go through them to see which one applies to your scenario, so we can resolve it.

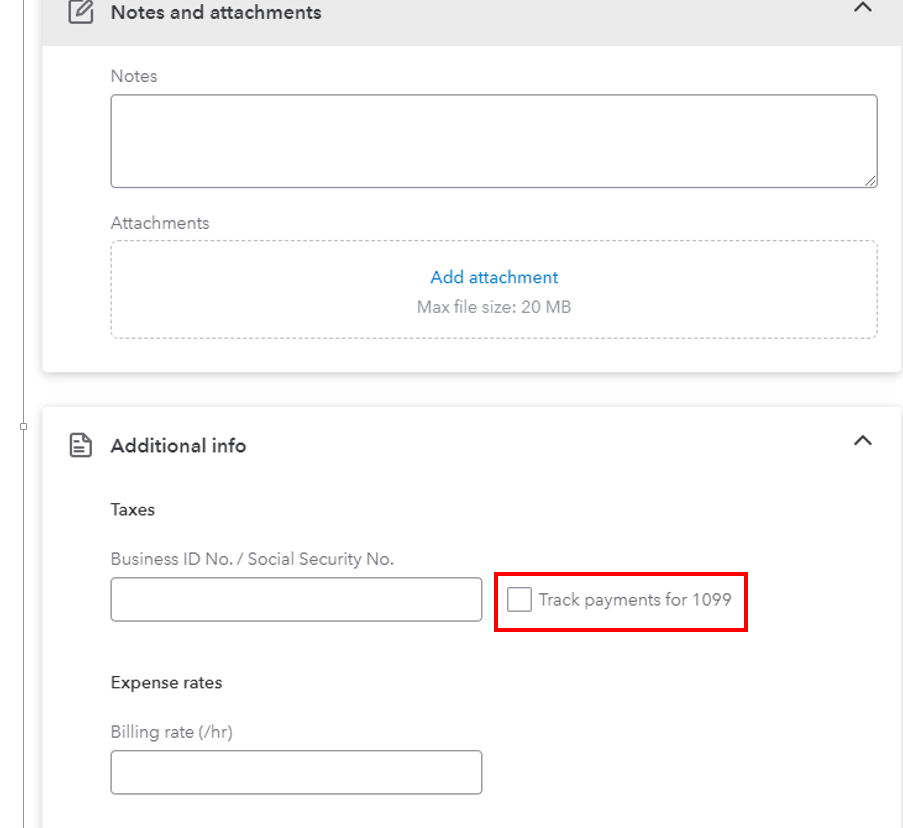

First, you'll want to check if the Track payments for 1099 box is ticked in their profile.

Secondly, if you paid your contractors with a credit card, debit card, gift card, or via PayPal, they'll be excluded from the 1099 calculations. The financial institution reports these payments, so you don't have to.

To find the payment information, run the Excluded Payments by Vendor. Here are the steps you can follow.

Note the column titled Excluded. You can select the total in this column to see an Excluded Payments by Vendor report, which shows transaction details. This will help you double-check if payments should indeed be excluded.

Lastly, if the accounts you used on your vendor transactions are not mapped for 1099, then the transactions won't show on the report. This includes the accounts you used on your items.

You can correct the accounts by mapping it while creating 1099s in QuickBooks.

For other troubleshooting solutions, please use this article: Fix missing contractors or wrong amounts on 1099s.

I'm just around if you still have other concerns. Thank you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here