Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

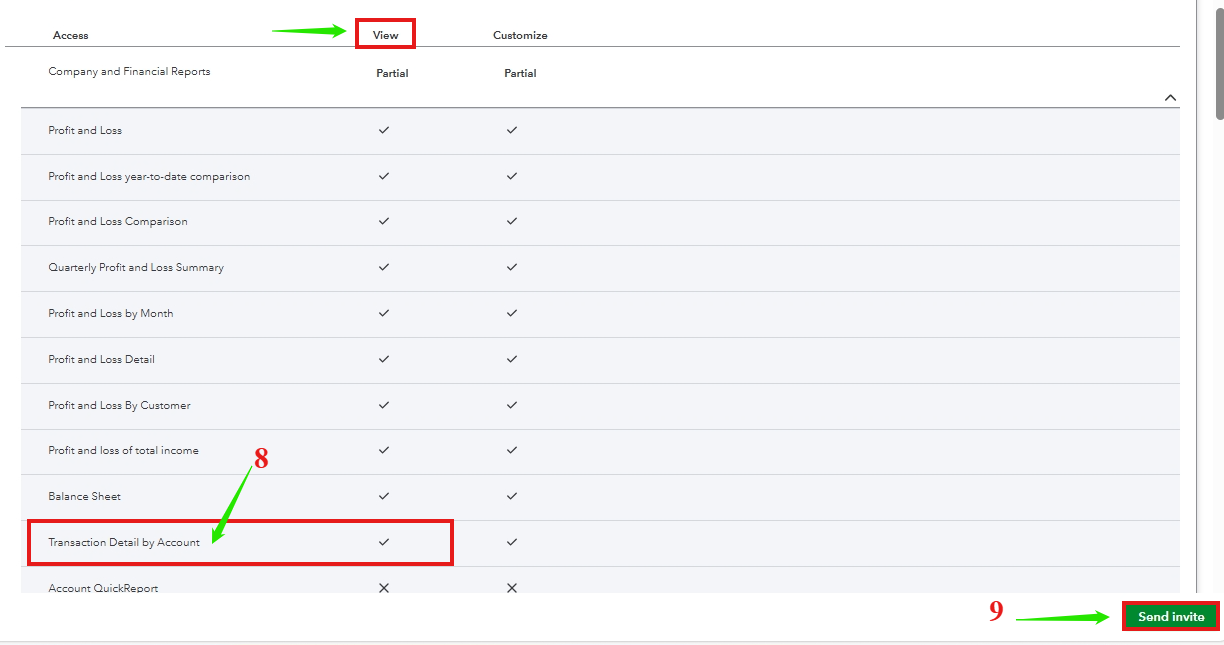

Buy nowTo allow your auditor to view the transactions detail by account report, we need to use the view company reports, GWNWUPDF. This will prevent them from making any altering to the transactions. Here are the steps to do this:

Moreover, if you want to configure and save a report for easy future access. You can check this article as your guidelines: Memorized reports in QuickBooks Online.

If you have any questions regarding reports or need further assistance, feel free to hit the Reply button. I'm always here to help!

Does the auditor need to have Quickbooks to view?

How does the auditor access the view only quickbooks

what software does the auditor need to access view only on quickbooks

this is not answering my question

Good morning, @FPSD .

Thanks for following along with the thread and sharing your concerns.

Before I begin, I wanted to clarify if you're using QuickBooks Online Advanced or QuickBooks Desktop. If you're using QuickBooks Online, then the Auditor will not need QuickBooks. You can add them as a user and assign them view-reports access. This way, they can not alter any transactions, etc.

To add them as a user, you can use the detailed steps my colleague has provided above. Once the user accepts the invite, they can sign into your QuickBooks using the role you assigned them.

For more information about user roles, check out: User roles and access rights in QuickBooks Online.

Please don't hesitate to let me know if you have any additional questions or concerns. I'm happy to help out. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here