Good day, lisach.

Helping you manage your keep the change transactions in QuickBooks Online is my priority.

To answer your question, yes, the system will create a second transaction in QuickBooks Online since you've set up different rules for each account.

To isolate this issue, as an initial step, I'd suggest deleting the rules for your savings account marking the transactions as deposit and transfer.

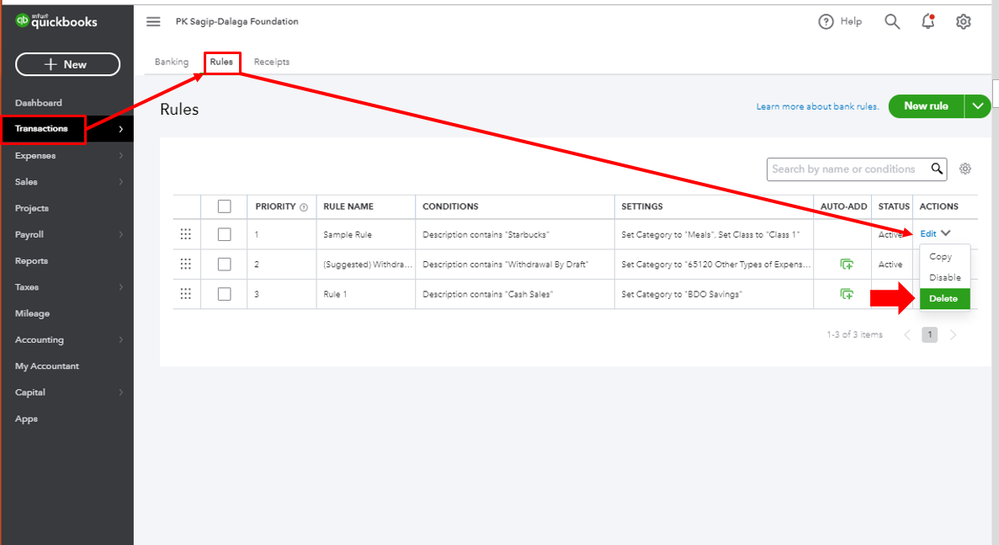

Below are the steps to delete a bank rule:

- Click Transactions in the left panel.

- Choose Rules.

- Select the Rule and click the drop-down arrow beside Edit.

- Hit Delete.

This way your transfer will be allocated accurately and to avoid the system in creating a second transaction in QuickBooks.

Also, regarding the option to mass change the existing transaction from deposit to transfer is currently unavailable. You'll need to delete those deposits and record them via the transfer feature in QuickBooks Online. For the outlined steps in recording a transfer, check out this article: Transfer funds between accounts.

I recommend editing, assigning, and categorizing your transactions. Also, you can match them to the existing entries in the software. Just go to the For Review tab from the Banking menu. Doing so will help you ensure the accuracy of your financial records.

Let me know if you need further help with this topic. You can connect with me again by clicking the Reply button below. Have a wonderful day!