Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a client that uses Wells Fargo's Bill Payment system. QBO is the software that they use.

Steps used to pay their bills in QBO:

1. +New

2. Pay Bills

3. They select the bills (different vendors)

4. On Wells Fargo's website the enter the bills to be paid (could have different pay dates)

5. Clicks Save and Close

6. Vendors bills are showing paid

7. Wells Fargo shows a lump sum as a deduction

8. Check register show "Bill Payment" for the type of transaction

9. Reconcile > Shows "Bill Payment" as type and "Accounts Payable" as Account, Wells Fargo statement shows Lump sum

10. How do I reconcile this bank statement?

Thanks for providing the detailed steps you've performed, @change master admin.

Let me help you reconcile your account to make sure your books are accurate before you close it.

Once the bill payment you made in Well Fargo is downloaded in the Banking register, you'll match it with the transaction you enter in QBO. This way, they are categorized and cleared which avoids duplicates.

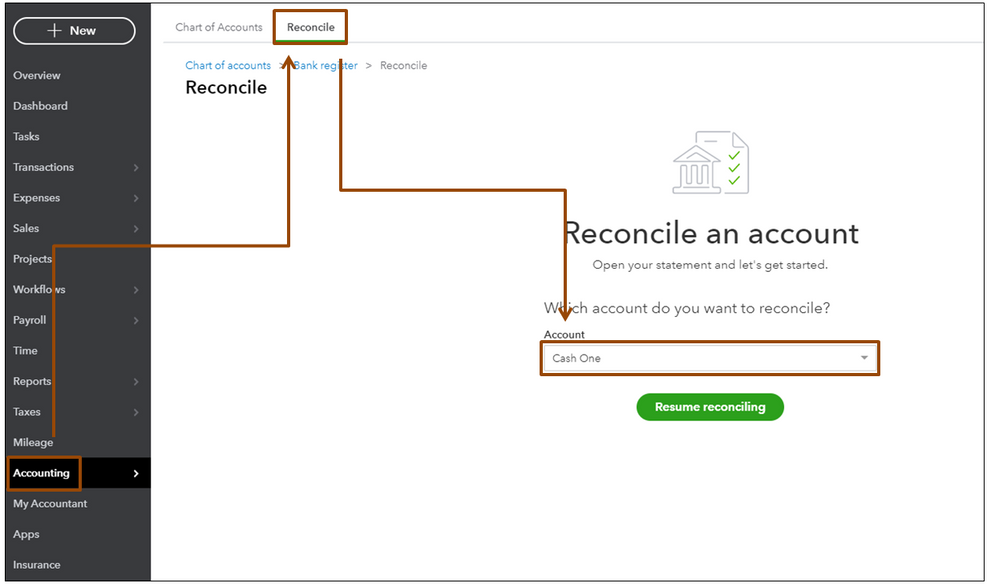

After the transaction are matched, proceed to these steps to reconcile your bank account. Here's how:

To reconcile, compare the list of transactions on your bank statement with what's in QuickBooks. If they match, make sure there's a checkmark next to the amount in QuickBooks.

When you reach the end, the difference between your statement and QuickBooks should be $0.00. If it is, select Finish now and then select Done.

In case the difference isn't $0.00, or you can't find a transaction that should be in QuickBooks, don't worry. Here's how to review and fix everything.

Additionally, you can run a Reconciliation report to view your previous reconciliations. This report is useful if you have trouble reconciling the following month and when you meet with your accountant.

If you need further assistance in reconciling your account in QBO, click the Reply button below so I can further assist you. Have a great day.

My problem is that Wells Fargo only listed the aggregate amount, not the individual paid amount, even if the payments are scheduled for different days.

I have requested that the client send me the printout from Wells Fargo so that I can match the withdrawals with the Bill Payments.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here