Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI want to delete old credit card and bank transactions without affecting the balances on both accounts for reconciling purposes.

Hi, Donalm. Deleting financial transactions will affect account balances, so let me clarify everything first to avoid miscalculations. I'll provide the details below.

Removing transactions can compromise your financial data integrity and lead to discrepancies in your accounts and reports.

Since you are looking to prevent changes to the balance, are you considering deleting these transactions due to performance issues with QBDT? If so, the Condense Data Utility can help by reducing the size of your company file while preserving financial integrity.

Here's how:

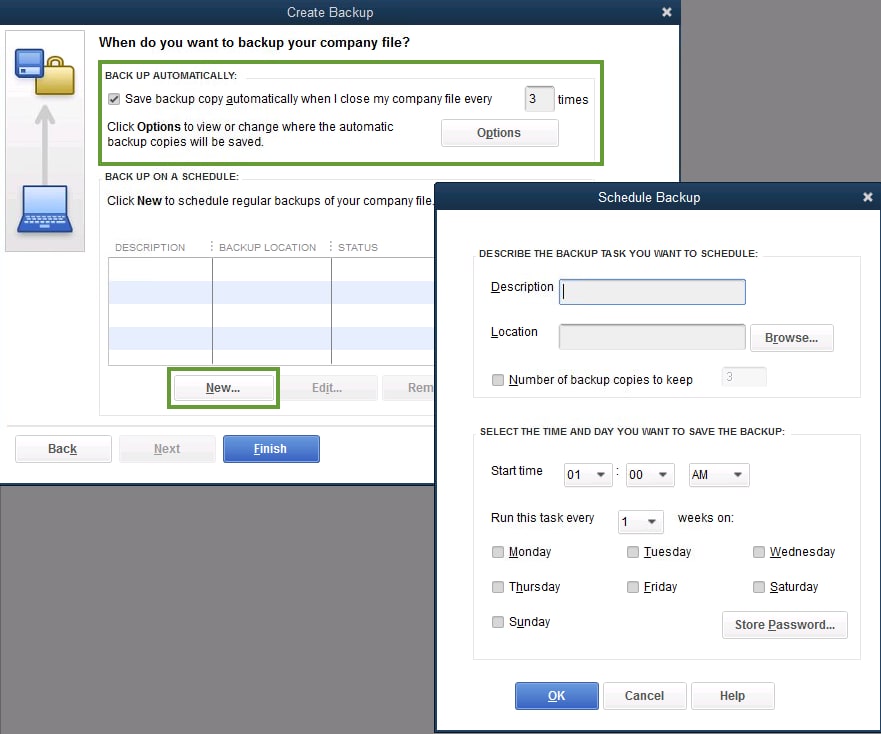

Before proceeding, create a backup of your QuickBooks company file to ensure a secure copy of your data.

Here's how:

If you meant to delete transactions entered by mistake or those that do not match your bank statement, please confirm which transactions you are referring to, how they were entered, and the period they belong to. Providing these details will help us offer a targeted solution.

Providing these details will help us offer a targeted solution before you proceed with the deletion of your account.

Refer to these articles for detailed guidance:

Furthermore, visit this article to automatically categorize and streamline bank feed transactions, ensuring better organization and accuracy in your financial records.

If you have other reasons for wanting to delete transactions, please let us know so we can provide tailored guidance. Either way, we are here to assist you with any questions or further assistance.

Thanks for the information. That seemed to work.

My colleague and I are glad to hear that the recommendations for deleting old bank and credit card transactions in QuickBooks Online helped address your concerns, Donalm.

Please remember that the QuickBooks Community is always here to assist you with any QBO-related tasks whenever you need guidance.

You can also refer to this article to learn how to reconcile your accounts in QuickBooks. This process involves matching your QuickBooks entries with your actual bank and credit card statements to ensure accuracy: Reconcile an account in QuickBooks Desktop.

If you have any further questions, feel free to post them here at any time. We hope you have a great day ahead, and please take care and stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here